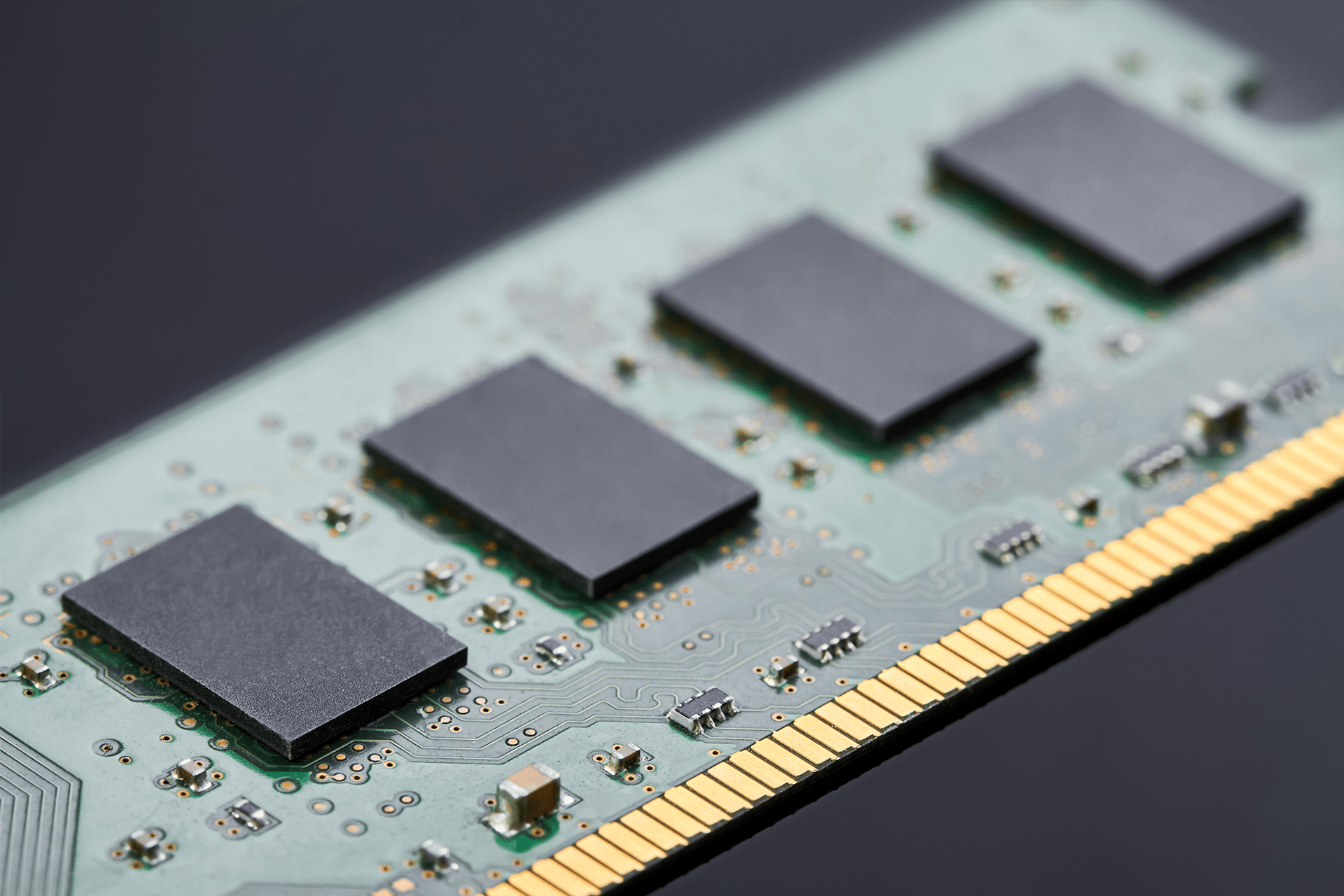

Global memory chip prices and supply are on the move — and that movement could reach all the way into Mac production in early 2026. Memory chips like DRAM and NAND flash are essential for iPhones, iPads, Macs, and nearly every modern electronic device. But with rising demand from artificial intelligence infrastructure and a reallocation of manufacturing capacity toward high-bandwidth memory for data centers, memory supply for traditional consumer products has tightened, driving costs upward.

Prices for memory chips surged sharply in late 2025 and are expected to climb further in 2026, with analysts forecasting increases of 40–50% in the first quarter alone. That price jump follows a 50% rise at the end of last year, reflecting how demand from AI build-outs — led by companies such as OpenAI, Google, and Microsoft — is outpacing the ability of chipmakers to produce enough conventional memory for smartphones, personal computers, and gaming consoles.

For Apple, the memory chip situation is mixed. The company reportedly locked in NAND flash supply for its products through early 2026, giving it some stability on one front. But rising DRAM prices and approaching expiry of long-term supplier contracts could still push up memory costs for Macs and other devices as the year progresses.

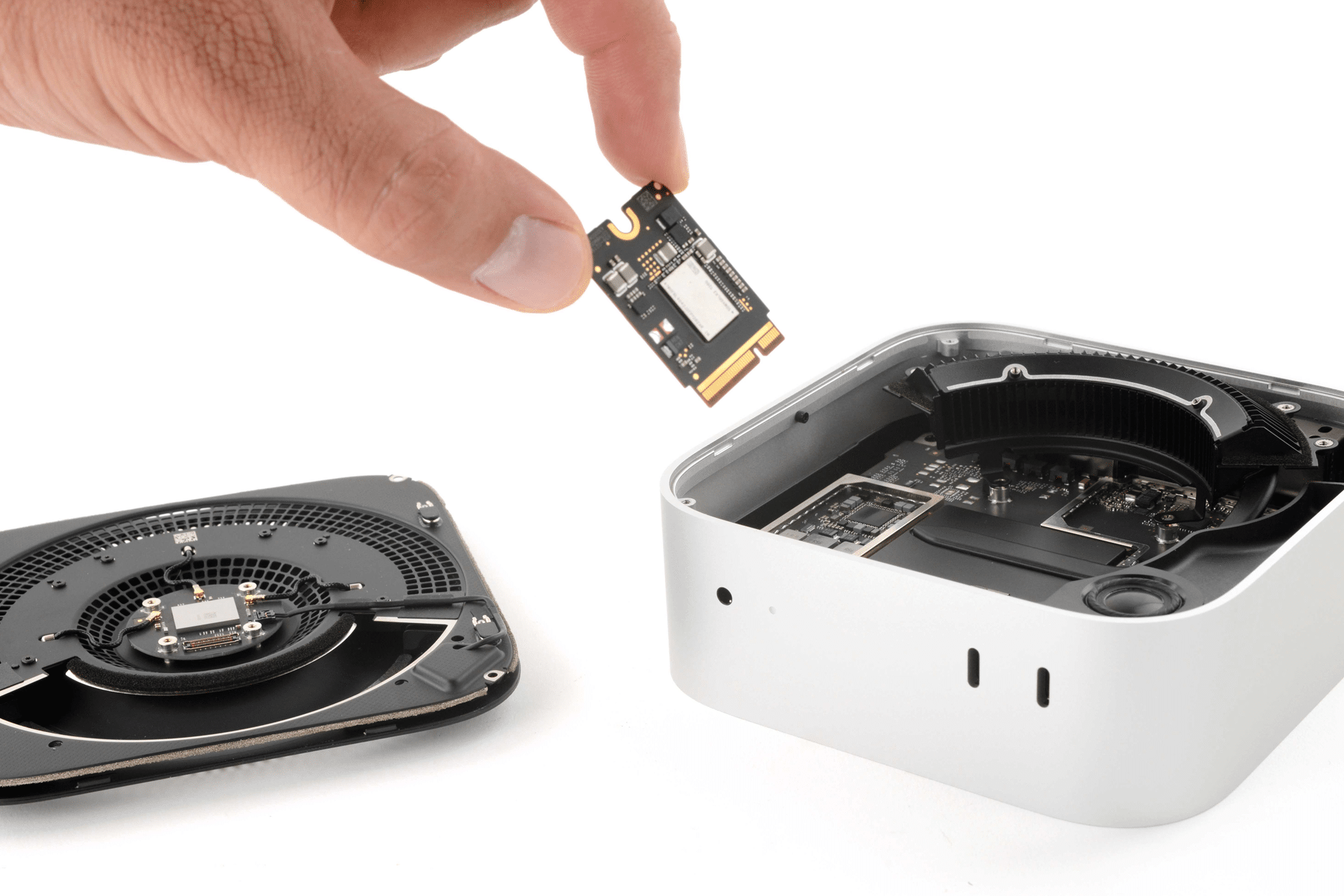

DRAM and NAND Components

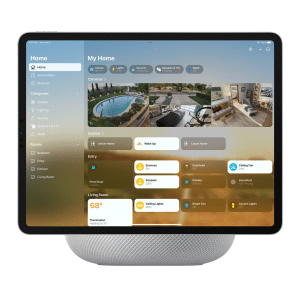

Macs rely on memory that is integrated directly into Apple silicon, which is different from traditional PC models. However, this unified memory architecture still depends on raw DRAM and NAND components from the broader market. When prices for those components spike, the cost of producing Macs rises as well. Higher memory costs can reduce margins or force price increases for consumer pricing — a delicate decision for Apple in a competitive landscape.

The memory shortage and price inflation are driven in part by structural changes in the semiconductor industry. As data centers and AI workloads consume more of the available DRAM supply — with some forecasts suggesting up to 70% of high-end memory chips could go to AI infrastructure in 2026 — fewer chips are left for traditional consumer products.

This reallocation is not just a short-term blip. Analysts warn that supply growth for DRAM and NAND could be below historical norms through 2026, leaving manufacturers with less flexibility. Rumors of global smartphone and PC sales slowing due to memory inflation underscore how widespread the issue could be.

What This Means for Mac

For consumers eyeing a new Mac in early 2026, the memory chip situation could show up in a few ways:

• Higher prices for memory-heavy configurations: Memory chips are among the pricier components in modern Macs, especially for models with larger RAM or storage. As DRAM and NAND costs rise, Apple may pass some of those costs on to customers via higher configuration pricing.

• Longer wait times for high-end models: With supply constrained and demand still strong for Apple silicon Macs, configurations with more memory could see longer production windows or lead times.

• Pressure on competitors: Smaller PC makers without long-term memory contracts may need to raise base prices or trim specs, giving Apple some relative advantage — though even Apple is not immune to memory inflation.

The Bigger Picture

This memory crunch reflects a broader shift in technology markets. AI infrastructure and data centers are absorbing more and more of the world’s memory production, often at the expense of consumer electronics supply chains. That shift highlights a long-term tension in the semiconductor ecosystem: balancing demands for cutting-edge AI workloads with the components that power everyday devices.

For 2026, memory price volatility and constrained supply are likely to remain central themes for manufacturers from Apple to PC brands. How companies adapt — through supply contracts, production adjustments, or pricing strategies — will shape how consumers experience the next wave of hardware releases.