Apple quarter results 2026 arrived with a rare mix of scale, speed, and consistency. For the fiscal first quarter ended December 27, 2025, Apple posted $143.8 billion in revenue, up 16 percent year over year, and diluted earnings per share of $2.84, up 19 percent. These numbers not only exceeded expectations, they marked new all-time records for the company. The results reflect a business operating at full momentum across products, services, and regions, supported by a rapidly expanding installed base that now exceeds 2.5 billion active devices worldwide.

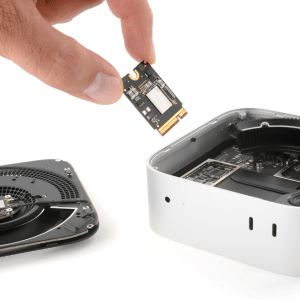

Behind the headline figures is a company benefiting from long-term investments in ecosystem depth, global reach, and operational efficiency. iPhone and Services both reached new revenue highs during the quarter, reinforcing Apple’s two-engine growth model: hardware that anchors users, and services that extend lifetime value.

iPhone and Services Drive a Record Quarter

iPhone delivered its best quarter in Apple’s history, setting all-time records across every geographic segment. This performance underscores the strength of Apple’s product cycle and the global appeal of its latest models, which continue to attract both first-time buyers and upgraders.

At the same time, Services revenue reached an all-time high, growing 14 percent year over year. This category now plays a central role in Apple’s financial profile, offering recurring revenue streams from subscriptions, payments, content, and cloud services. As hardware sales bring new users into the ecosystem, Services expand the value of each device over time.

The combination of record iPhone demand and sustained Services growth shows how Apple has evolved beyond a traditional hardware company into a platform business with predictable, scalable revenue.

Margins, Cash Flow, and Shareholder Returns

Strong operating margins supported Apple’s earnings growth, translating revenue gains into record profitability. During the quarter, Apple generated nearly $54 billion in operating cash flow, demonstrating the efficiency of its business model even at massive scale.

This cash position enabled the company to return almost $32 billion to shareholders through dividends and share repurchases. The board also declared a quarterly cash dividend of $0.26 per share, reinforcing Apple’s commitment to consistent capital returns while maintaining flexibility for future investments.

For investors, these figures highlight Apple’s ability to balance growth with financial discipline, funding innovation while continuing to reward long-term shareholders.

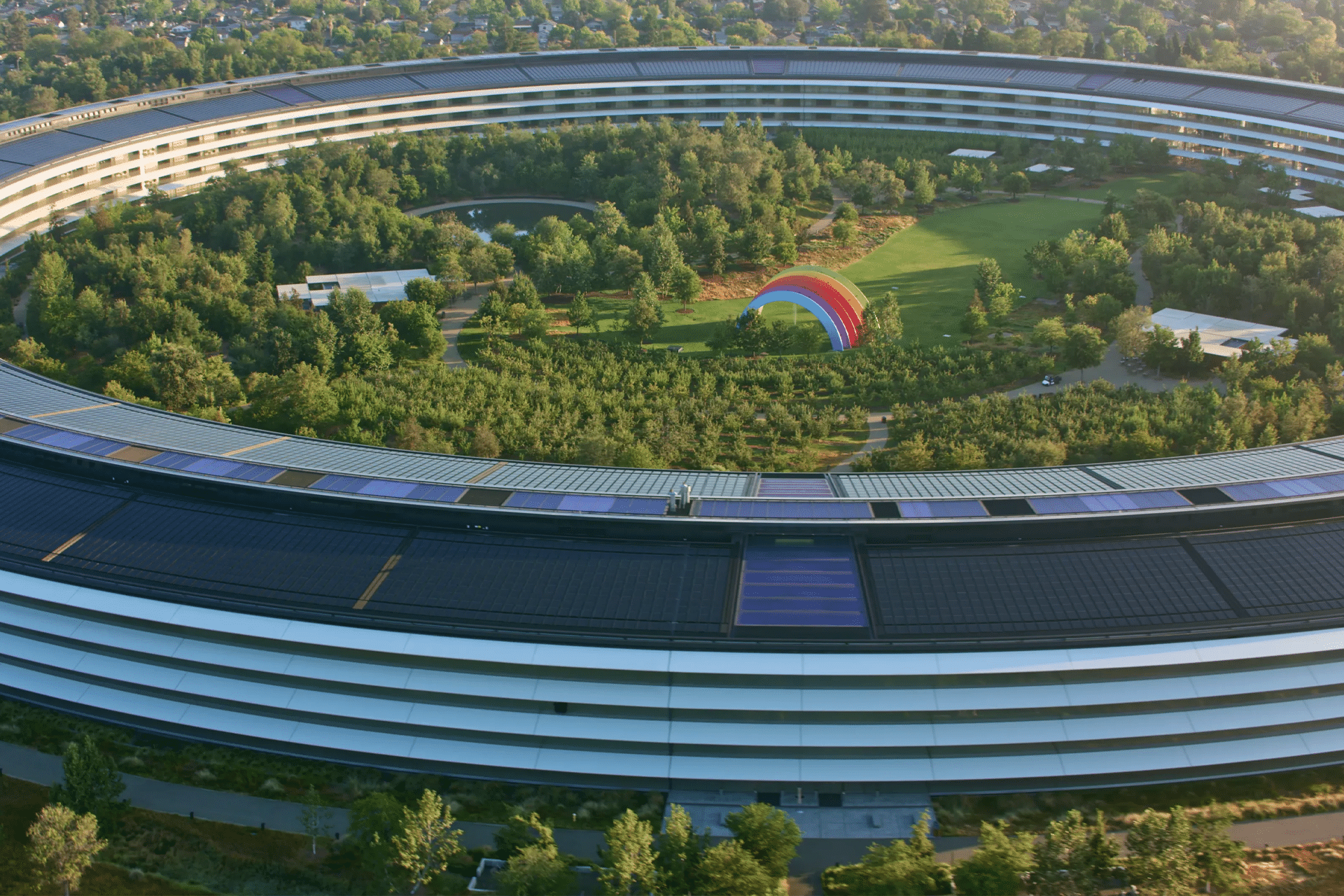

A Growing Global Installed Base

One of the most significant milestones in the quarter was the expansion of Apple’s installed base to more than 2.5 billion active devices. This metric represents the true engine of Apple’s long-term growth. Each active device is a gateway to services, upgrades, and ecosystem engagement.

The scale of this installed base creates network effects that competitors struggle to match. As more users rely on Apple devices for communication, entertainment, work, and payments, switching costs increase and loyalty deepens. This foundation gives Apple a durable advantage, even in volatile economic conditions.

The installed base also provides Apple with a massive audience for new services, features, and business models, ensuring that future product launches can scale quickly.

Regional Momentum and Market Position

Apple’s record quarter was not driven by a single market. Growth was broad-based, with strong performance across the Americas, Europe, Greater China, Japan, and the rest of Asia Pacific. This geographic balance reduces dependence on any one region and positions Apple to benefit from global economic recovery and rising consumer demand.

In emerging markets, expanding middle-class populations and improving digital infrastructure continue to open new opportunities. In mature markets, Apple’s focus on premium experiences and ecosystem integration sustains demand even as device cycles lengthen.

This global reach allows Apple to offset localized slowdowns with strength elsewhere, stabilizing revenue and supporting long-term growth.

The Strategic Importance of Services

Services now function as Apple’s financial stabilizer. While hardware cycles can fluctuate, recurring service revenue provides consistency and margin expansion. As more users subscribe to Apple’s digital offerings, the company’s revenue mix becomes more resilient to macroeconomic shifts.

Services also deepen user engagement. Features tied to iCloud, payments, media, and productivity make Apple devices more central to daily life, strengthening retention and increasing lifetime value. This strategy transforms each hardware sale into a long-term relationship rather than a one-time transaction.

Looking Ahead to 2026

The Apple quarter results 2026 set a strong tone for the year. Record revenue, earnings growth, and an expanding global footprint show a company operating with both scale and agility. With a massive installed base, growing services ecosystem, and continued product innovation, Apple enters the rest of 2026 positioned to sustain momentum across both consumer and enterprise markets.