NEW YORK — There is more than meets the eye in the smartphone market – prospects are actually quite different from what investors are being told, once growth considerations and revenue strategy are accounted for. The result, is opportunity where you least expect it.

NEW YORK — There is more than meets the eye in the smartphone market – prospects are actually quite different from what investors are being told, once growth considerations and revenue strategy are accounted for. The result, is opportunity where you least expect it.

The race is on and competition is heating up as Apple Inc. (NASDAQ: AAPL) [Full Research Report] and Research In Motion Limited (NASDAQ: RIMM) [Free Research Report] look to defend their positions in the marketplace. Apple’s primary focus remains on the consumer, with enterprise and government market share gains growing as a result of RIM’s aging platform. RIM is looking to reverse this trend and build new momentum with the launch of BB10, BlackBerry’s first major revamp since the dawn of the iPhone circa 2007.

Opportunity is abound as RIM opens the door to OEM licensing of its Blackberry 10 Platform, a move which could drive increased user- adoption. The struggling image of Blackberry may be a thing of the past as RIM fast approaches its January 30, 2013 launch date, already securing U.S. government security clearance for its new BB10 platform. RIM will look to defend its current market share from further erosion and springboard this excitement to regain lost ground. If RIM can successfully execute its launch this January, the cash-rich company could soon discover a different kind of momentum. This could allow ramp-ups in advertising, bringing the Blackberry back into the forefront of consumer’s minds.

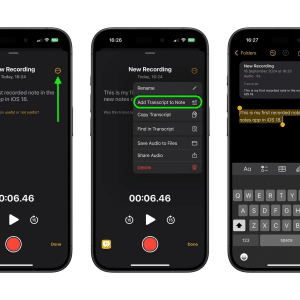

Despite a lower market-share than Android, Apple continues to leverage device sales and complementary offerings (AppStore, iCloud, iTunes) to capture high-margin revenues from its current smartphone market-share. This is ultimately where Apple’s strategy succeeds, ensuring every sale counts with wide margins. Apple’s ability to build an ecosystem surrounding its mobile devices has fostered an entire economy all its own, establishing reoccurring revenue streams from user purchases.

More importantly however, something its competitors are only starting to realize, the secondary ecosystem available to users is what drives device purchases in the first place. Apple stacks its profits upfront with its pricing of the device itself, while delivering its famous user experience with AppStore, iTunes and iCloud in order to build user retention and drive demand for the next generation of device purchases.

Google Inc. (NASDAQ: GOOG) [Full Research Report] is unique in its approach to the mobile market. Android is a hedge for Google, not a dependent revenue stream. The search giant drives revenue no matter what happens in the mobile arena as they are focused on content and ad delivery. Profits directly related to its Android platform are insignificant when considering the big picture.

Google’s strategy is to deliver mobile-ads on iOS, Android and other mobile platforms and is independent of which platform holds the greatest market-share. Google’s interest in Android is to protect its mobile ad revenue stream by controlling the platform itself, just in case any competitors try to “cut-off” Google ads. Therefore, despite Google’s counter-intuitive approach of giving Android away for free, it rather works to improve the overall smartphone market – ultimately increasing user adoption of mobile browsing and allowing the company to serve more ads and drive more revenue. This allows Google to focus on long-term, user-beneficial developments and enables its partners the flexibility to offer low- cost devices.

Microsoft Corporation (NASDAQ: MSFT)’s [Free Research Report] Windows Phone 8 could recover market share with a unified approach across all platforms. It’s partnership with Nokia cements its position in the mobile race as a top 4 competitor, just behind Blackberry in user adoption.

The success of Windows Phone will rely heavily on the overall success of Windows 8 on tablet and desktop form factors. A familiar user-experience across a family of devices may prove to be a rather distinct advantage. Employees who use Windows at work prefer to have a Windows OS at home. If Microsoft can realize its goal and turn advertising dollars into active Windows 8 users, a growing market share of Windows Phone 8 may soon follow.

Hindsight Delivers Insight into Future Trends

The year is 2006. Nokia dominates the smartphone market and Google is developing an Android platform as insurance against any potential lock-out of Google’s mobile search revenue, with particular concern toward Microsoft’s mobile platform. Apple is developing its iOS platform in preparation for its upcoming iPhone release and RIM’s Blackberry remains focused on security, still relatively unchanged since its debut.

Fast forward to 2013 and innovation is now king. Google and Apple have emerged as the major players because consumers rewarded companies which were thinking on their behalf. An entirely new segment of the population became smartphone adopters, thanks to the disruptive innovations brought forth delivering a user-experience the average consumer could relate to.

Moving forward, how will innovation and technology change? Where are the next major trends in the marketplace forming? If you would like to read full research reports on the mobile handset industry, including price targets for Apple, RIM, Google and Microsoft, use these free links below.

National Traders Association/PRNewsiwre

(c) 2013 PRNewswire. Provided by ProQuest LLC. All rights Reserved.