Goldman Sachs and Wells Fargo have raised their price targets for Apple ahead of the company’s next earnings report, signaling renewed optimism in the iPhone maker’s growth trajectory. The upgrades come as investors look to the iPhone 17 cycle and Apple’s expanding ecosystem of services to sustain revenue momentum through the year’s final quarter.

Goldman Sachs increased its 12-month target to $279 per share, citing continued strength in iPhone demand and early signs of recovery in global device sales. Wells Fargo lifted its target to $290, pointing to Apple’s deepening integration of on-device artificial intelligence as a key driver of future margins and differentiation. Both firms maintained positive ratings on the stock.

Hardware Momentum and Services Strength

Analysts anticipate that the upcoming earnings report will highlight strong performance from Apple’s latest iPhone lineup, bolstered by the early success of the iPhone 17 series. Higher average selling prices and robust preorders are expected to support year-over-year growth in hardware revenue, despite broader market headwinds.

Meanwhile, Apple’s services business — including App Store, Music, and iCloud — continues to outpace hardware in profitability, contributing a growing share of total earnings. Analysts also pointed to increased user retention and ecosystem spending as signs of long-term stability.

AI Integration Boosts Market Confidence

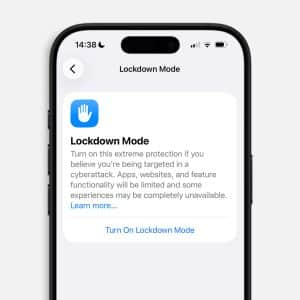

The adoption of Apple Intelligence across devices has become a major theme in recent analyst coverage. Both Goldman Sachs and Wells Fargo emphasized that Apple’s focus on on-device AI, rather than cloud-based processing, strengthens its privacy advantage and technical control over the user experience.

This strategy, combined with the rollout of new AI-optimized hardware such as the M5-powered MacBook Pro and iPad Pro, has helped position Apple as a leader in personalized computing. Market watchers believe these developments will drive incremental demand and extend the company’s competitive lead heading into 2026.

Investor Outlook Ahead of Earnings

With higher targets from major financial institutions, investor sentiment toward Apple has improved after a period of cautious trading earlier in the year. The upcoming earnings announcement will provide the first full look at how early iPhone 17 sales and new AI features are translating into financial performance.

If results align with the upgraded projections, Apple could enter its next fiscal year with record-level service revenue and a stronger average selling price across devices — reinforcing Wall Street’s view that the company remains one of the market’s most resilient and profitable brands.