A $5 trillion valuation is not a product launch, a single quarter, or one headline feature. It’s the sum of compounding drivers that investors decide to price in at once: durable demand across Apple’s core devices, expanding high-margin Services, confidence in cash returns, and a believable path to the next wave of upgrades.

Apple has already shown it can grow revenue while keeping margins resilient, and it continues to return enormous capital to shareholders through repurchases authorized by its board. The question for 2026 is whether those ingredients line up at the same time, with enough momentum to push valuation expectations into the next bracket.

Apple 5 Trillion Market Cap Drivers

The simplest path to a higher market cap is a stronger earnings story, because the stock market doesn’t price Apple on unit shipments alone. In Apple’s latest fiscal-year reporting, the company emphasized record results, including revenue and EPS growth, while pointing to Services as a standout performer. Services revenue also reached a new all-time high in that release, which matters because Services typically carry higher margins and smoother seasonality than hardware. A valuation push becomes easier when investors believe Apple’s profit mix is shifting toward recurring revenue without slowing device demand.

The installed base is the other lever. Apple has highlighted a record active device installed base across product categories and regions, and that detail influences valuation because it sets the ceiling for Services attachment. If the installed base keeps expanding and monetization per user rises even modestly through subscriptions, payments, cloud storage, and media bundles, the earnings math can scale without requiring an iPhone “supercycle” every year.

Services, Subscriptions, and Higher-Margin Growth

Services is often framed as the quiet engine under Apple’s headline devices. Investors watch it for two reasons: how much it grows, and whether the company can sustain pricing power while expanding the bundle of value Apple users rely on daily. Apple’s own reporting has underscored Services as a record-setting segment, and the company has repeatedly tied that performance to subscription growth and ecosystem engagement.

The Services story also intersects with regulatory risk in a way that can cut both directions. If Apple navigates platform rules while maintaining the App Store’s economics, Services remains a margin stabilizer. If rules significantly compress fees or force broader changes to payments and distribution, investors may demand a different valuation multiple. That’s part of why Apple’s narrative around trust, privacy, security, and user experience is not just branding, but a defense of the business model that supports high-margin Services growth.

Cash Returns and the Buyback Effect

Apple’s capital return program is a major piece of the valuation puzzle because it can amplify earnings per share over time. In recent filings and financial disclosures, Apple disclosed board authorization for very large repurchase programs, including a $110 billion program and an additional $100 billion authorization, with clear language that the program does not obligate a minimum amount of shares. The scale of those authorizations matters because sustained repurchases reduce share count and can lift EPS even when revenue growth is moderate.

That dynamic becomes especially relevant when a company is already enormous. At multi-trillion-dollar scale, it’s difficult to grow revenue at the rate of smaller businesses, so the market pays closer attention to consistency, margins, and capital allocation. If Apple maintains the ability to generate cash at scale and continues returning it aggressively, the company can support valuation expansion when investors believe the underlying earnings base remains durable.

AI Execution and the Next Upgrade Logic

A $5 trillion conversation in 2026 is likely to involve AI whether Apple wants it to or not, because investor expectations for consumer platforms are increasingly framed around what AI features do to retention, upgrades, and new revenue streams. Apple’s approach emphasizes on-device processing, privacy, and system-level integration, which tends to deliver improvements that feel subtle rather than theatrical. That can be a strength for daily usage, but a challenge for market storytelling if investors reward flashier demonstrations from competitors.

The key question is whether Apple’s AI work becomes a meaningful upgrade reason. If next-generation Siri and Apple Intelligence features translate into faster workflows, better personalization, and more reliable automation across apps, that can change how users perceive the value of updating hardware. Investors don’t need AI to be a separate product category for it to matter. They need it to move behavior at scale, increasing the likelihood of upgrades and raising Services engagement across Apple’s installed base.

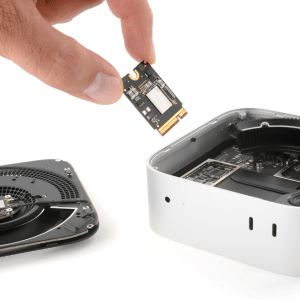

Hardware Cycles That Still Move the Needle

Even in an era where Services is the margin star, hardware remains the volume engine. Apple’s valuation tends to respond when a hardware cycle combines better devices with a clear reason to upgrade. Display changes, camera improvements, battery gains, and tighter device-to-service integration can all push an upgrade cycle, particularly when paired with software features that feel materially better on newer chips.

Mac also plays a role in the 2026 story when its chip roadmap and product cadence reinforce confidence in Apple’s long-term platform control. When Apple hardware and Apple silicon move in sync, it supports the narrative that Apple can deliver performance gains without depending on external roadmaps, and that can influence investor confidence in sustained differentiation.

The path to $5 trillion is ultimately about whether these forces stack, not whether any single one dominates. If Services continues to post record performance, buybacks keep shrinking the share count, and Apple’s AI and hardware roadmap produces a convincing upgrade narrative, the market has a clear set of levers to reprice Apple higher. A major catalyst would not need to be a new category; it could simply be a year when Apple’s next software wave lands cleanly and pulls the rest of the ecosystem forward with it.