Apple opened an entirely new dimension of connectivity with the iPhone, and now the tech giant is gearing up to challenge established payment providers and take the mantle of leadership on the fintech scene.

The latest announcement of a new set of features for the iPhone Wallet app confirms Apple is going forward with its project Breakout, which aims to bring the company’s financial services in-house.

This is a clear signal that the IT company is transitioning to a fintech role.

Experts have had doubts about Apple branching out into the financial sector, and the apprehension is reflected in the recent stock price. However, not every industry insider is pessimistic. Some think it’s a logical move for the trillion-dollar entity working on creating a comprehensive ecosystem.

Fintech investor David Kezerashvili discusses Apple’s desire to compete with established providers

The boom in online retail has redefined the financial lexicon, and many businesses are implementing new technologies to remain competitive. The fintech sector has emerged as a facilitator of eCommerce, allowing any size business to be relevant.

As with every new technology, there is much uncertainty. We asked venture capitalist David Kezerashvili of InfinityVC to clarify the meaning of the fintech concept and the intentions of Apple. “Fintech is a term that refers to mobile applications and other software products, any technologies that automate and improve the delivery of financial services for customers and businesses. It’s one of the three most promising industries and a vibrant field with numerous companies creating cutting-edge technologies that expedite payments and transactions. But at the same time, it’s a term constantly expanding its meaning with each new tech breakthrough”, explains Kezerashvili.

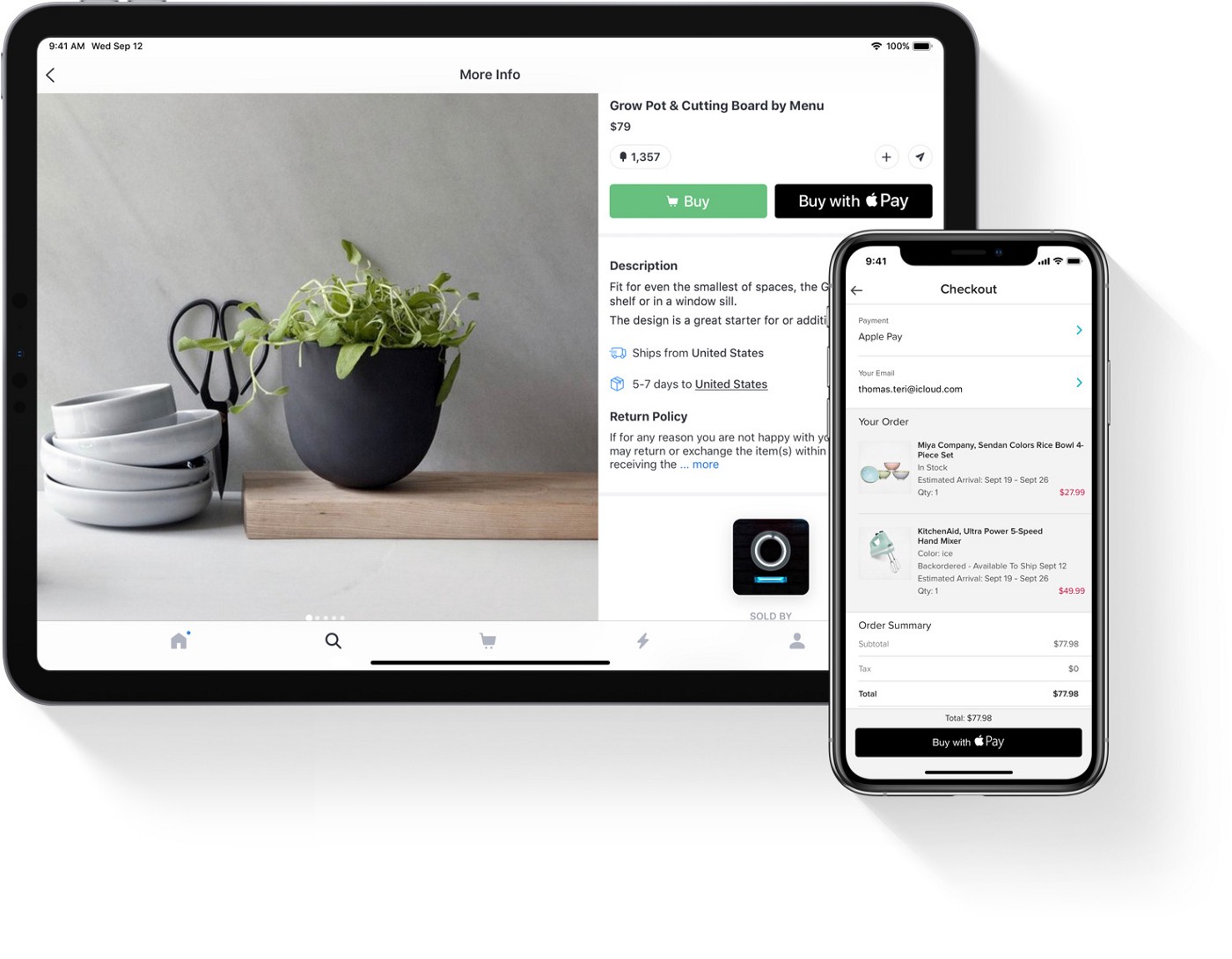

Apple Pay was only the first phase of a larger strategy built upon with the latest Apple Pay Later. This option allows users to split the purchase cost into four equal payments, which can get settled over six weeks without any extra fees – in effect, providing a rival service to the one offered by PayPal and Klarna.

The new pay feature transforms the utility of iPhones and iPads.

Potential to dominate the market

The Cupertino company is constantly reinvigorating the tech scene. The thing is that the financial sector may seem like a big bite, considering the well-established banks and payment providers with decades of experience. However, in the opinion of Kezerashvili, Apple’s strategy to steer its efforts in providing financial services is soundly based.

“The fintech landscape initially got populated by startups with the speed and adaptability to develop solutions that covered the gaps larger industry players refused to tackle. However, recent global market trends have shown the necessity for continuous innovation. And that is a trait Apple is well versed in.”

“The company possesses the expertise and infrastructure to implement new methods. Those qualities, coupled with the brand recognition that inspires consumer confidence, means Apple is on solid footing to carve out a significant market share in the financial sector”, explains Kezerashvili.

Apple is not hiding its plans for the digital Wallet, which company executives envision as a replacement for a physical wallet. There is even an option in the Wallet to incorporate a driver’s license.

Yet it’s not implemented widely and is currently available only in a few US states. But, with billions of devices with the Apple logo in daily use, the fintech role is not such a far-fetched idea as some perceive it to be.

The next frontier for Apple

The buy now, pay later service is just one of several features coming online with iOS16 this fall. It represents a huge leap because Apple Pay Later is a lending service, which the company manages via its subsidiary Apple Financing LLC. The provider performs the credit check and authorizes the loan for the purchase.

However, the transaction will be processed through the MasterCard network, which is also used for the Apple Card. This is one technical obstacle Apple needs to overcome if it hopes to realize its vision for the autonomy of its financial services.

The Apple Pay Later will build on the momentum gained in February with the Tap to Pay functionality. This option replaces the need for a payment terminal and uses the iPhone’s NCF chip to verify a transaction, meaning users only have to tap the screen to make a payment.

Apple’s Wallet app is not focused only on replacing credit and debit cards. The company is working on new proprietary payment processing technology that will provide transaction approval, fraud analysis, lending risk assessment, credit checks, increasing credit limits, and reporting data to credit bureaus. Apple is moving forward and entrenching its position as a fintech company.