Apple partnered with Goldman Sachs to bring the card to market, leveraging the bank’s expertise in consumer lending. However, the relationship hasn’t been without friction. Customer service issues, particularly around disputed transactions and delays in savings account withdrawals, drew scrutiny. The U.S. Consumer Financial Protection Bureau investigated Goldman Sachs, resulting in a combined $90 million fine for both companies due to what the agency called “customer service breakdowns” and “misrepresentations.” Apple, while disagreeing with the characterization, worked with Goldman Sachs to address these issues swiftly, emphasizing their commitment to fair and transparent financial products.

Now, Apple is preparing to part ways with Goldman Sachs in 2025, as the bank exits consumer lending. This shift marks a significant turning point for the Apple Card. Finding a new financial partner will be critical to maintaining the card’s seamless experience, especially as Apple explores expanding the card to markets like India, where talks with local banks are underway. The challenge lies in navigating diverse regulatory landscapes while preserving the card’s core promise of simplicity and value.

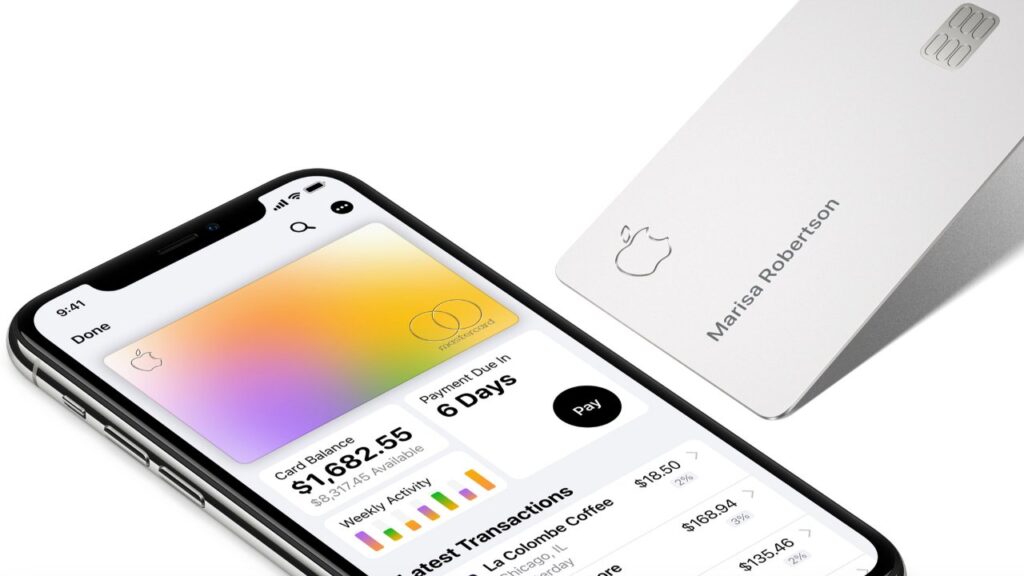

User Experiences and Trade-Offs

The Apple Card has sparked varied reactions among users. For some, it’s a standout product. The integration with the Wallet app makes tracking spending intuitive, and the lack of fees aligns with Apple’s user-first ethos. The high-yield savings account has been a particular draw, with users appreciating the ability to earn competitive interest without the complexity of traditional banking products. However, others find the rewards less compelling. One user remarked that the Daily Cash percentages have dwindled over time, making the card’s rewards less competitive compared to alternatives like American Express or Amazon’s credit card, which offer more robust cashback systems. Customer support, while functional, doesn’t always match the gold standard set by competitors like Amex.

The card’s U.S.-only availability remains a point of contention. Despite early promises from Apple’s CEO to expand globally, regulatory hurdles have kept the card stateside. Trademark filings in Europe, Hong Kong, and Canada hinted at broader ambitions, but no concrete deals have materialized. The impending end of the Goldman Sachs partnership adds further uncertainty to international expansion.

Promotions and Perks

Apple has kept the card attractive with targeted promotions. For instance, cardholders recently received a six-month free trial of Uber One, and through mid-September, 5% Daily Cash back is available on gas purchases at Exxon and Mobil stations via Apple Pay. Another promotion offers 6% back on Nike purchases up to $500, doubling the usual 3% for that merchant. These incentives, while appealing, are carefully capped—$30 back on the Nike deal, for example—to balance Apple’s costs with user benefits. Such offers show Apple’s knack for aligning the card with lifestyle brands, reinforcing its place in users’ daily routines.

What Lies Ahead

As Apple Card enters its seventh year, the search for a new banking partner will shape its future. The card’s strengths—its intuitive design, fee-free structure, and integration with Apple’s ecosystem—position it well to remain a favorite among tech-savvy consumers. Yet, the transition away from Goldman Sachs introduces risks. A new partner must match the card’s operational smoothness while addressing past customer service pain points. Apple’s reported discussions with banks in India suggest a cautious step toward global markets, but success will depend on adapting to local regulations without diluting the card’s appeal.

The broader financial landscape is also evolving. As competitors like Amazon and Chase offer compelling rewards programs, Apple may need to rethink its Daily Cash structure to stay competitive. The high-yield savings account remains a strong draw, but its long-term viability depends on market rates and Apple’s ability to maintain attractive yields. For now, the Apple Card continues to resonate with users who value simplicity and integration, but its next chapter will test Apple’s ability to innovate in a crowded financial services market.

A Broader Vision

Apple’s financial ambitions extend beyond the card. The company has integrated digital car keys into the Wallet app, allowing users to lock and unlock compatible vehicles with their iPhone or Apple Watch. This move hints at a future where the Wallet app becomes a central hub for financial and lifestyle services. With Apple exploring smart home devices and new operating systems like “Charismatic” for home hubs, the Apple Card could play a role in a broader ecosystem, tying financial services to smart living. For users, this means a more cohesive experience, but it also raises questions about privacy and data security—areas where Apple has historically taken a strong stance.