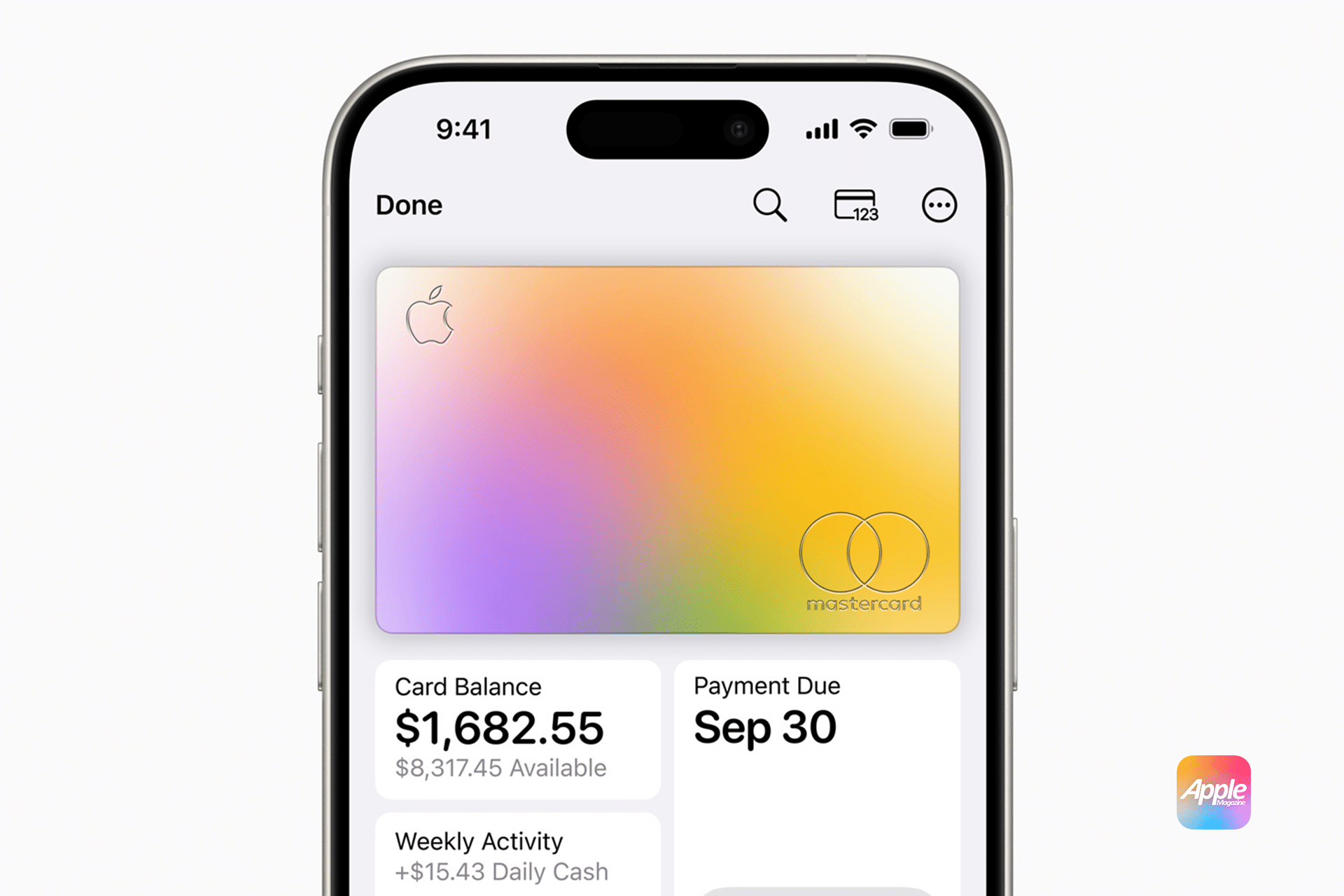

The partnership between Apple and Goldman Sachs introduced a new era in consumer finance. The Apple Card offered users innovative features like daily cashback, seamless integration with the Wallet app, and a focus on transparency. However, the collaboration was as much about Goldman Sachs entering consumer banking as it was about enhancing Apple’s ecosystem.

Despite its innovative features, the Apple Card future has not been without challenges. Goldman Sachs faced criticism for its financial losses in the consumer banking segment, and regulatory investigations into discriminatory lending practices have added further strain.

The Leadership Question at Goldman Sachs

As the driving force behind Goldman Sachs’ consumer banking initiatives, Solomon played a pivotal role in the Apple Card’s launch. His potential exit raises concerns about continuity and commitment to Apple’s financial services vision.

Industry experts suggest that a new CEO could lead to a strategic pivot, potentially deprioritizing consumer banking ventures. Such a shift might leave the Apple Card in an uncertain position, potentially prompting Apple to seek alternative partners or strategies.

The Impact on Apple’s Financial Services Strategy

The Apple Card was Apple’s first major step into financial services, followed by ventures like Apple Pay Later and Apple Savings. The Apple Card future could shape the trajectory of these services, given their interdependence.

If Goldman Sachs scales back its involvement, Apple could explore partnerships with other financial institutions or even consider developing an in-house financial solution. Both scenarios present opportunities and challenges for maintaining the Apple Card’s growth and innovation.

User Reactions and Expectations

Apple Card users have expressed concerns about how potential changes could affect their experience. Apple has historically focused on maintaining customer trust, suggesting it will prioritize transparency during this transitional phase.

Speculation abounds about whether Apple might introduce new features or benefits to reassure users and strengthen the card’s value proposition amidst uncertainty.

Apple Card’s Role in Apple’s Ecosystem

The Apple Card future remains tied to its unique integration with the iPhone and Wallet app. This seamless experience is a key differentiator from traditional credit cards, and Apple will likely continue to build on this foundation.

Apple’s commitment to data privacy has been a hallmark of the Apple Card. Regardless of potential changes in financial partnerships, maintaining this focus will be critical to ensuring user confidence.

Competitive Landscape in Consumer Finance

While the Apple Card has carved a niche for itself, competitors like Chase, Citi, and American Express are continuously innovating their offerings. Apple must remain vigilant to stay ahead in this competitive landscape.

The Apple Card’s simplicity, lack of fees, and cashback rewards have been central to its appeal. Enhancing these features could further solidify its position in the market.

The Bigger Picture: Apple’s Service Strategy

Services like the Apple Card represent Apple’s efforts to diversify its revenue streams beyond hardware sales. This strategy has become increasingly critical in ensuring sustained growth in a competitive market.

Apple’s recent moves, including Apple Savings and Apple Pay Later, signal its commitment to financial services. The Apple Card future will play a significant role in defining the success of this strategy.

The Road Ahead: Challenges and Opportunities

Apple must navigate potential disruptions arising from Goldman Sachs’ leadership changes while ensuring minimal impact on users. Clear communication and a proactive approach will be essential.

The current uncertainty also presents an opportunity for Apple to reimagine the Apple Card, introducing innovative features that reinforce its leadership in consumer finance.

The Apple Card future is at a crossroads, with Goldman Sachs’ leadership changes posing potential challenges and opportunities. As Apple navigates this period of uncertainty, its commitment to innovation and user experience will likely shape the next chapter of its financial services journey. With the right strategies, the Apple Card could continue to thrive as a pivotal component of Apple’s broader ecosystem.