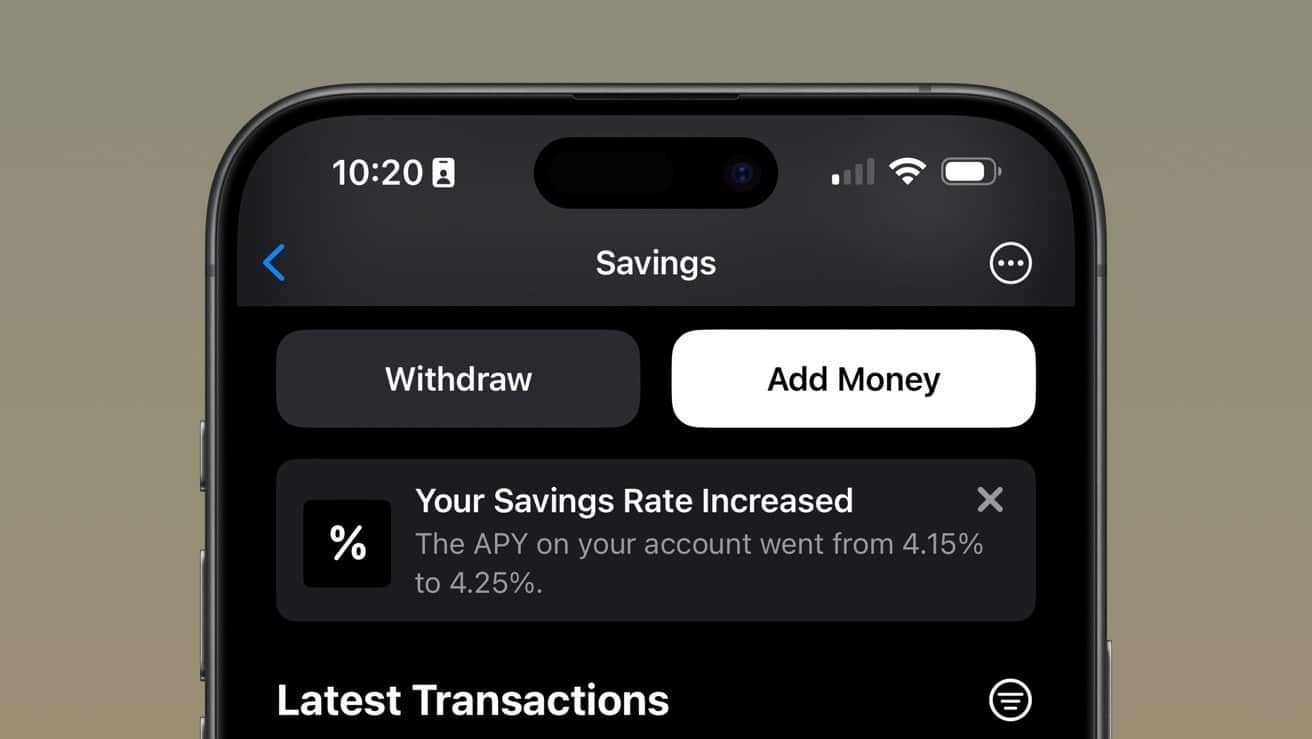

In a recent development, Apple Card holders have received a boost in their savings growth, with the Apple Savings account’s annual percentage yield (APY) climbing from 4.15% to 4.25%. This change marks the account’s first APY increase since its launch eight months ago. Despite this improvement, Apple’s offering still lags behind some competitors in the financial market.

The announcement of this increase was made to account holders on Wednesday, signaling a positive change, albeit modest in comparison to industry rivals.

Leading the competition, Goldman Sachs’ consumer-oriented Marcus brand boasts a 4.5% APY, slightly ahead of its previous rate. Other financial institutions like UFB and PNC offer even more attractive rates at 5.25% and 4.65% respectively, demonstrating a more dynamic approach in APY adjustments.

Interestingly, this incremental adjustment in Apple Savings’ APY coincides with ongoing discussions about the future of Apple’s financial partnerships. Goldman Sachs, currently collaborating with Apple on the Cupertino firm’s financial products, has expressed interest in concluding the partnership.

This intention might be influencing the limited changes observed in both the Apple Savings and Apple Card benefits.

As Apple considers potential replacements for Goldman Sachs, rumors point to names like American Express and Synchrony Financial. However, for a new partnership to materialize, there might be a need for Apple to revise its requirements and expectations in the banking sector.

The future of Apple’s financial services, therefore, hangs in the balance as these negotiations and market comparisons continue to evolve.