Apple’s latest quarterly report showed savvy investors two things clearly.

The first is that the entity run by CEO Tim Cook essentially has been transformed from Apple, the company, into Apple, the bank.

The vault of that bank is now wide open, and Cook is sharing Apple’s massive cash hoard — worth $68 billion (and climbing) at the end of June — with its shareholders in the form of fat quarterly dividends and even larger share repurchases.

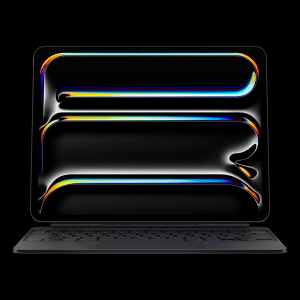

The quarterly results also showed, however, that while no income investor should be without Apple stock in a portfolio, no growth investor should be anywhere near it.

By every measure of operations, the company’s fiscal third quarter was a disaster. Operating income dropped 20% from the same period a year ago, while its net income fell by 14.5%, even as sales were flat.

The company’s gross margin — a key measure of profitability — fell for the fifth-straight quarter, to 36.8% of sales, down from 42.8% a year earlier. Fifteen months ago, as sales of iPads and iPhones were surging, gross margin topped out at 47.4% of sales.

Meanwhile, Apple’s sales growth has evaporated, shrinking from 27% to 17.6% to 11% to less than 1% during the past four quarters.

Apple’s fiscal fourth-quarter revenue forecast suggested little change, as the company sees sales in a range between $34 billion and $37 billion, compared with $36 billion a year earlier. Gross margin, meanwhile, was forecast to be unchanged from the quarter ended in June.

One reason for Apple’s quarterly performance was a 16% drop in iPad sales, even as iPhone sales climbed 20%. Another is the challenge Apple faces in China, an area of expected growth that has failed to materialize.

As this column warned in January, Apple faces stiff price competition in less-developed smartphone markets, including China, where consumers are less willing to pay a premium to own the company’s products.

Apple’s sales and profit momentum in the world’s most populous country haven’t only slowed; they’re in reverse. Sales in China dropped 14% in the fiscal third quarter, to $4.6 billion from $5.4 billion a year earlier, according to the company’s latest filing made to securities regulators.

That’s a dramatic reversal from the first six months of Apple’s fiscal year, when sales in China rose 28% year over year. The company’s operating profit margin there plunged almost a third, to 31% of sales from 46% a year earlier. By comparison, Apple’s sales in its Americas region rose 12.5% year over year, to $14.4 billion.

While its operating margin here fell, the drop was less severe, declining to 36% of sales from 40% year over year.

Yet, Cook and the board recognize that Apple is in a mature, slow-growth phase right now, and has wisely decided to share the past fruits of the company’s success with common shareholders.

For starters, it has paid an aggregate of $7.5 billion in cash dividends this fiscal year, and Apple boosted that dividend to $3.05 a share in its most recent quarter, from $2.65 a share paid in the prior two quarters.

What’s more, Apple’s board in April increased to $60 billion the amount allotted for share repurchases, according to the filing, up from the $10 billion the company first announced last year. As of June 29, Apple had spent $18 billion of that money buying back its own stock.

For good measure, the Bank of Apple in May issued $17 billion in bonds, according to its filing, padding its balance sheet to a degree that would make any Federal Reserve banker smile. That means even more money, not just for hiring employees and marketing products, but for still more dividends and share repurchases in the future.

Borrowing to pay investors a dividend makes Apple’s financial accounting look a lot more like a Wall Street bank than a Silicon Valley tech company. It’s why income investors helped send shares higher in the past three months, after the stock fell 40% between September and April as growth investors bailed out.

In summary: Retail growth investors who think Cook is about to reignite sales and profit growth with a great new Apple product may want to think twice, because the company’s results and forecast simply don’t support that belief.

But for income investors, there’s now even more to love about the Bank of Apple.

John Shinal has covered tech and financial markets for 15 years at Bloomberg, BusinessWeek, the San Francisco Chronicle, Dow Jones MarketWatch, Wall Street Journal Digital Network and others.