Apple India iPhone supply chain growth is reshaping the country’s role in global technology manufacturing. According to recent reports, Apple’s suppliers in India have created around 350,000 jobs tied directly to iPhone production. The milestone reflects both Apple’s push to diversify away from China and India’s ambitions to become a hub for advanced electronics. The scale of job creation underscores the impact of Apple’s investment in India, not just in factories but across a wider ecosystem of suppliers, logistics, and retail.

How Apple’s Supply Chain Shifted to India

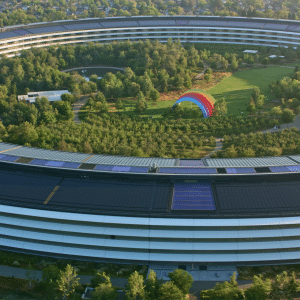

For years, iPhones were almost exclusively assembled in China, with Foxconn, Pegatron, and Wistron leading production. Geopolitical tensions, pandemic disruptions, and rising costs pushed Apple to rethink its supply chain. India emerged as the most significant alternative, backed by government incentives under the “Make in India” initiative. Over the past several years, major suppliers have expanded operations in states like Tamil Nadu and Karnataka. Foxconn now operates large facilities employing tens of thousands of workers, Pegatron has scaled up assembly lines near Chennai, and Wistron, whose operations were acquired by Tata Group, has become another critical partner. Together, these factories produce iPhones for both the domestic Indian market and for export, marking a historic shift in global manufacturing.

350,000 Jobs and Counting

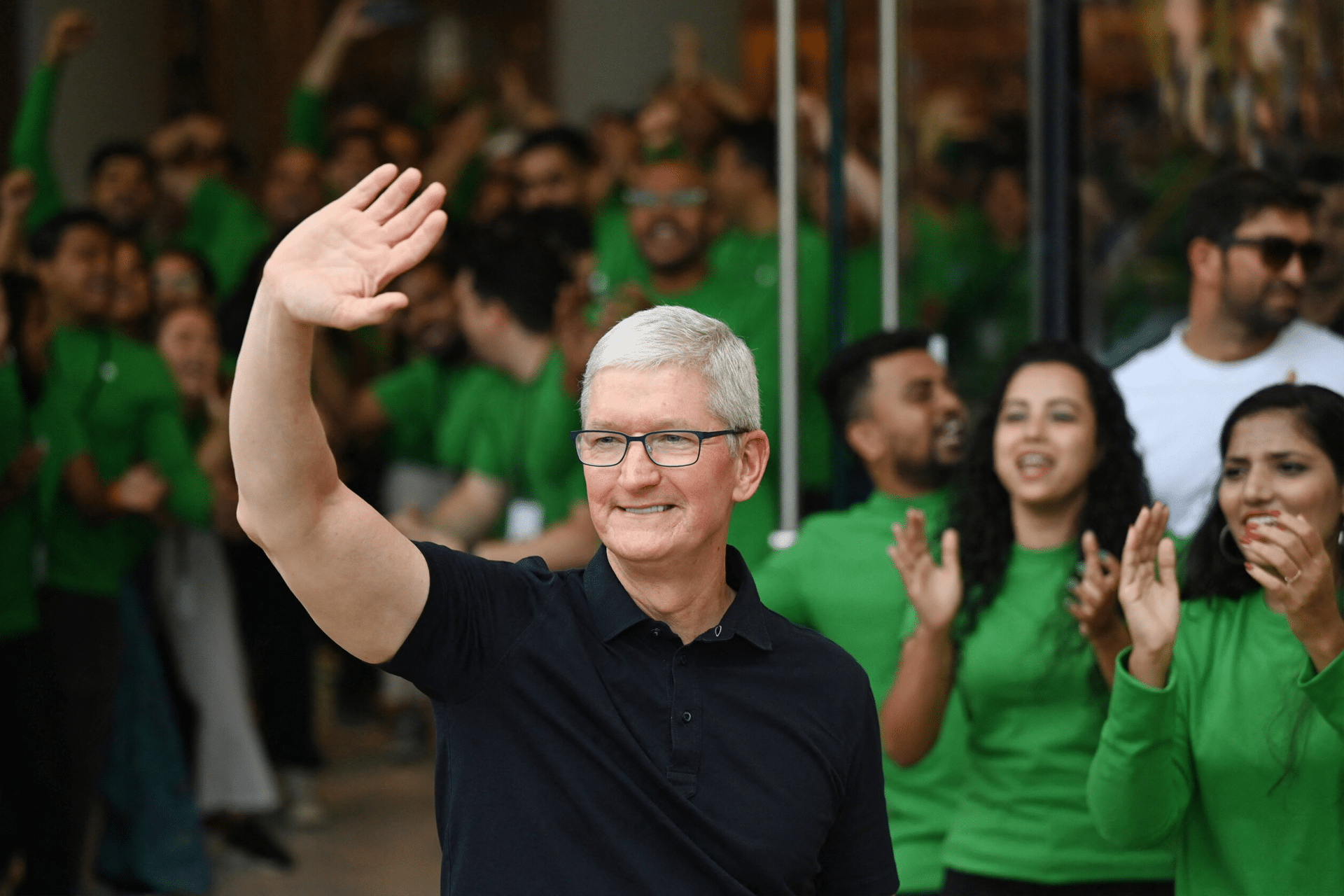

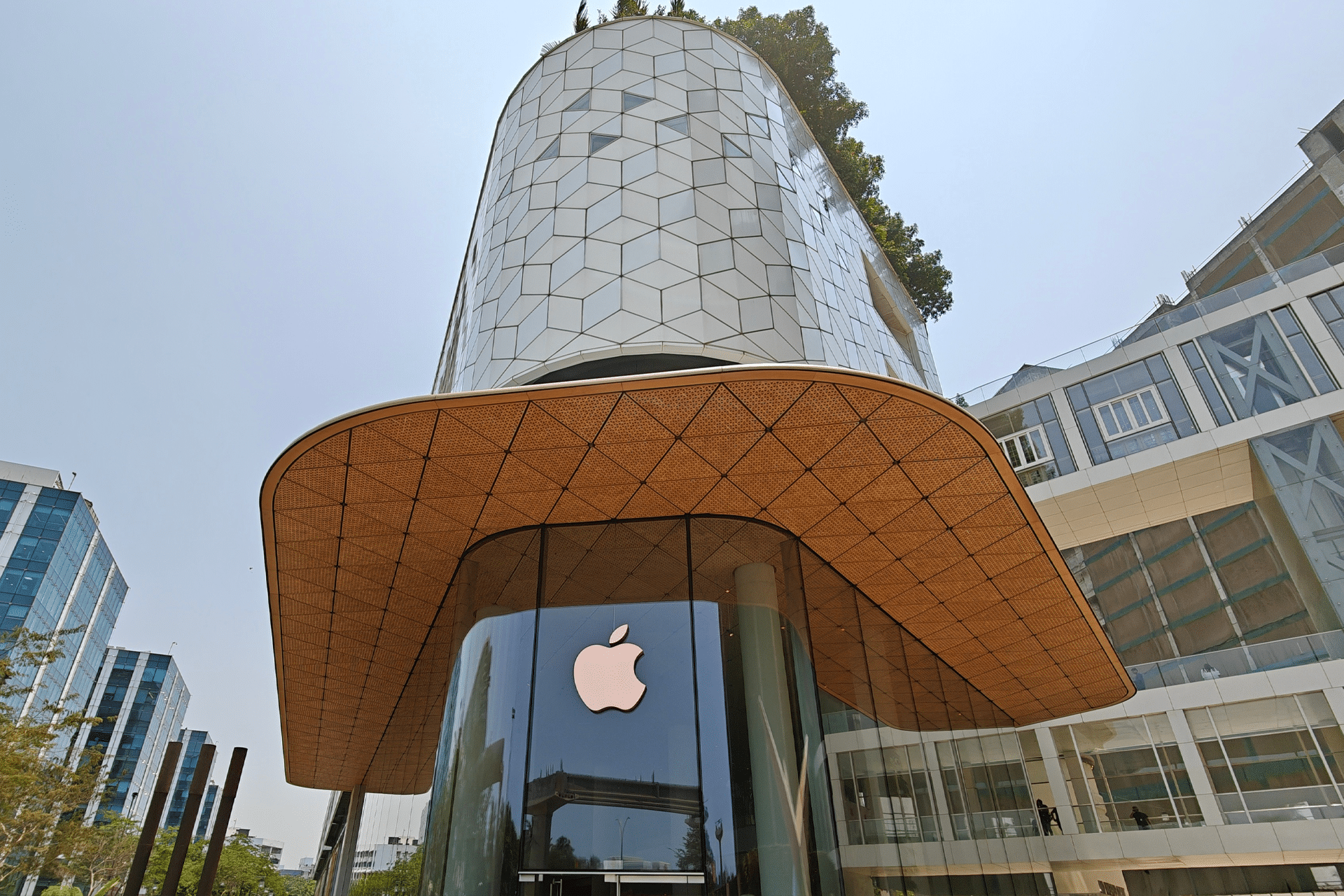

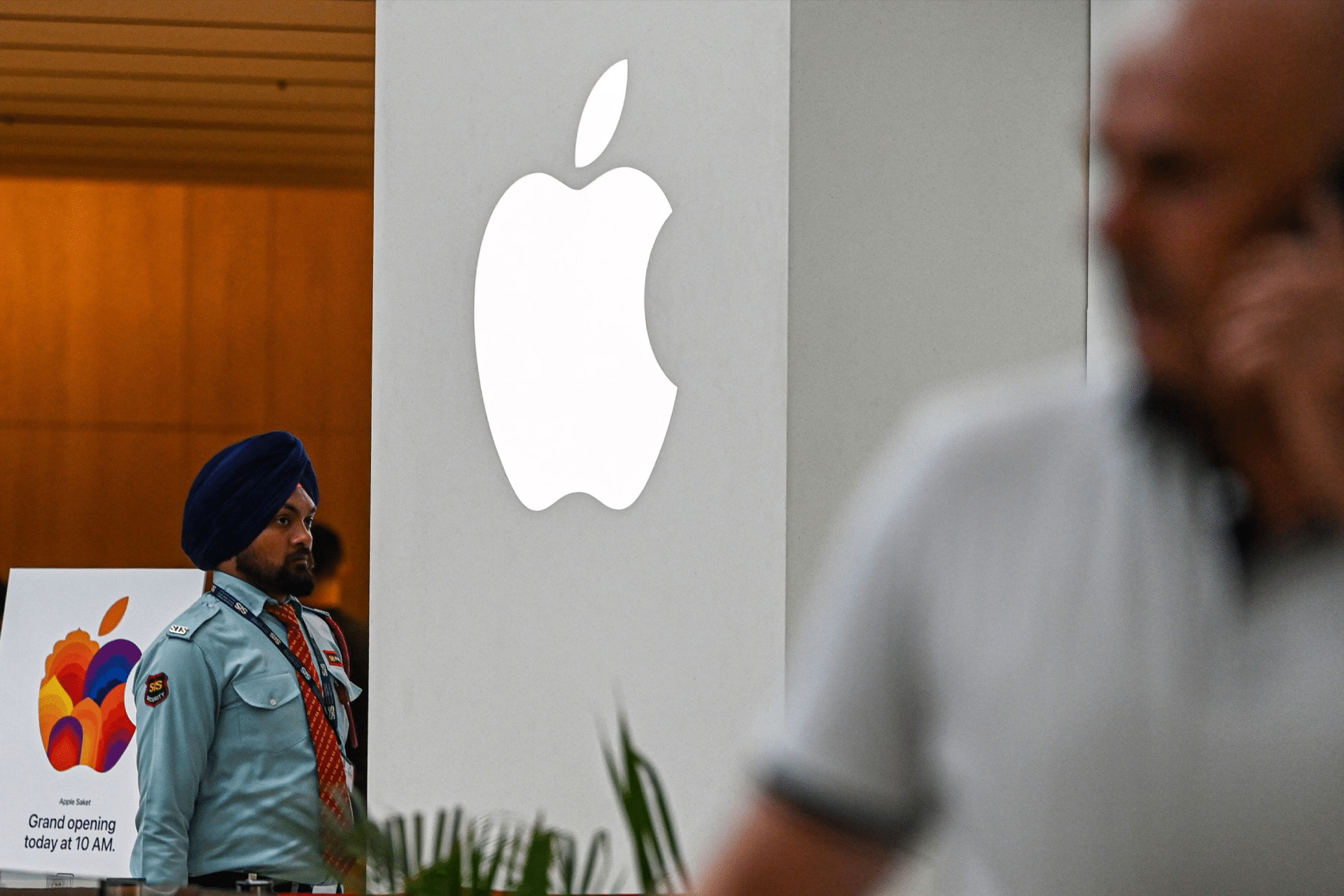

The reported 350,000 jobs created by Apple’s supply chain in India represent more than just factory roles. Tens of thousands of employees now work at Foxconn, Pegatron, and Tata-owned Wistron facilities, but the ripple effects extend much further. Additional employment has been generated in logistics, packaging, repair, and support services that orbit around iPhone production. Retail expansion, including Apple’s flagship stores in Mumbai and Delhi, has further increased demand for sales and customer service roles. Even in software, app development, and after-sales services, the growth of Apple in India has stimulated new career paths. For India, this represents one of the largest technology-sector job creation waves in recent memory. For Apple, it is evidence that scaling outside China is not only possible but sustainable.

Why India Matters for Apple

India offers a unique mix of advantages that make it a compelling manufacturing base for Apple. The country’s massive workforce brings both scale and skill, and government incentive programs such as the Production-Linked Incentive scheme have created strong financial reasons to expand production locally. India also represents an enormous consumer market, with rising demand for premium smartphones even as midrange models dominate. Building iPhones in India not only reduces Apple’s reliance on China but also allows the company to sell more devices in India at competitive prices. This dual strategy—diversification and local market penetration—makes India central to Apple’s long-term growth.

The Ripple Effects on India’s Economy

Apple’s presence is not confined to factory gates. By increasing exports, India has gained a stronger position in global trade for consumer electronics. Workers receive training in advanced assembly techniques and quality control, raising the overall skill level of the workforce. Suppliers of parts, packaging materials, and logistics services benefit from contracts tied to Apple’s operations, creating a broader ecosystem of opportunity. Local communities near Apple’s supplier plants, particularly in Tamil Nadu, have seen boosts in infrastructure development, housing demand, and service industries that support workers and their families. The economic multiplier effect is clear, and economists argue that Apple’s continued expansion will encourage further foreign direct investment in India’s technology sector.

Challenges Ahead

The rapid growth of Apple’s supply chain in India has not been without difficulties. Workforce conditions have occasionally come under scrutiny, with strikes and protests at supplier facilities drawing attention to pay, safety, and treatment of workers. Infrastructure remains another challenge. While India has invested heavily in logistics and manufacturing zones, bottlenecks in transportation, power reliability, and regulatory complexity continue to create friction compared to China’s more mature ecosystem. Despite these hurdles, Apple and its partners have continued to scale, and evidence suggests the company is managing these issues effectively as it deepens its presence.

Looking to 2026 and Beyond

Industry analysts expect Apple to expand iPhone manufacturing in India significantly over the next two years. Some forecasts predict that by 2026, up to a quarter of global iPhone production could originate from Indian facilities. Such a shift would mark one of the most dramatic reconfigurations in consumer electronics supply chains. For Apple, it represents a hedge against geopolitical risks and a stronger foothold in a critical growth market. For India, it solidifies the country’s status as a leading destination for high-value manufacturing. For users worldwide, the change may be invisible—an iPhone built in Chennai looks identical to one assembled in Shenzhen—but behind the scenes, it is one of the most important industrial transitions in Apple’s history.