Dan Ives, Wedbush Securities’ managing director, has highlighted a positive outlook for Apple, based on recent supply chain analyses and the company’s strategic advancements in artificial intelligence (AI).

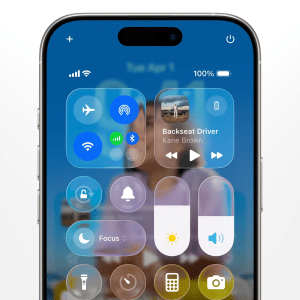

In a note to investors released on February 4, Wedbush hinted at a potential “product renaissance” for Apple, a sentiment Ives elaborated on during a CNBC appearance, citing “Super Bowl moment” shifts towards AI, including the creation of an AI App Store and enhancements in device memory to support on-device AI processing.

Apple’s supply chain checks reveal fewer order cuts than anticipated, suggesting a robust demand for iPhones, particularly in China. This stability, coupled with the anticipation of AI-driven growth, has contributed to an uptick in Apple’s stock value, with Wall Street acknowledging the impending AI revolution headed to Cupertino.

Ives predicts this revolution will not only boost Apple’s hardware, but will also significantly enhance its Services unit by attracting developers keen on integrating AI into their applications.

The introduction of the Apple Vision Pro stands as a testament to Apple’s AI ambitions, with early indicators suggesting strong consumer interest. Originally forecasting 300,000 units sold in its debut year, Wedbush has now doubled its estimate to 600,000, based on impressive conversion rates from demonstrations.

This optimism extends to Apple’s overall market trajectory, with Ives reasserting a belief in Apple reaching a $4 trillion market cap within the next year, supported by a $250 price target and an “Outperform” rating for Apple stock.

In essence, Apple’s sustained innovation, particularly in AI, alongside a resilient iPhone market, positions the company for unprecedented growth.

As it edges closer to a $4 trillion valuation, Apple’s strategic focus on AI and robust supply chain performance underline its potential for continued dominance in the tech industry.