Apple Pay has reached a point where it rarely needs explanation. It works, it’s trusted, and it shows up at the exact moment it’s needed. In 2025, that quiet reliability translated into real scale. Apple Pay became available in 89 markets, supported by more than 11,000 banks and network partners worldwide, including over 20 local payment networks.

Behind the scenes, its impact has been measurable. Over the past year, Apple Pay helped eliminate well over $1 billion in fraud globally while generating more than $100 billion in incremental merchant sales. During peak holiday shopping, transactions made through Apple Pay grew faster than overall consumer spending, reinforcing its role as a preferred checkout method rather than a convenience add-on.

Payments That Adapt to How People Shop

With iOS 26, Apple Pay expanded how users pay in everyday situations. Banks and lenders can now enable installment options and rewards directly at checkout, both online and in stores. This shifts flexible payments away from third-party apps and into a familiar, secure flow.

For merchants, Apple Pay continues to reduce friction at the point of sale. For users, it removes decisions and steps. Payment becomes a moment, not a process.

Apple Wallet Becomes an Identity and Travel Companion

Apple Wallet grew far beyond payments in 2025. Internationally, Apple introduced support for Japan’s My Number Card on iPhone, marking the first time a government-issued ID outside the U.S. became available in Wallet. This allows millions of users to present identity information in person, in apps, and online for age and identity verification.

In the United States, Digital ID launched using passport-based identity, enabling secure presentation at TSA airport security checkpoints for domestic travel. This builds on the continued rollout of state IDs and driver’s licenses in Wallet, now available across 13 states and Puerto Rico.

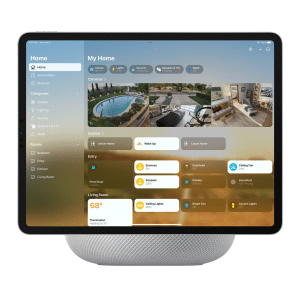

Travel itself became more streamlined. A refreshed boarding pass experience brought Live Activities, Maps, Find My, and flight updates into a single view. Apple Wallet also began using Apple Intelligence to automatically detect and summarize order tracking details from merchant and carrier emails, turning scattered information into something immediately useful.

Everyday Money, Made Social

Apple Pay’s influence extended into daily interactions as well. Apple Cash became more social with integration into group chats, allowing users to request, send, and receive money directly within Messages. Splitting bills, sharing expenses, or organizing group plans became part of the conversation rather than a separate task.

At the same time, Tap to Pay on iPhone continued its global expansion, reaching 50 markets and enabling more than 15 million merchants to accept contactless payments using only an iPhone. This shift lowered barriers for small businesses while reinforcing Apple Pay as an infrastructure, not just a feature.

A System Built on Trust and Scale

Apple Pay’s progress in 2025 reflects a broader strategy. Growth did not come from flashy changes, but from steady expansion, security improvements, and deeper integration into moments that matter. Payments, identity, travel, and everyday transactions now live side by side in Apple Wallet.

What once started as a way to leave a physical wallet at home has quietly become a system that supports how people move, shop, verify, and connect across the world.