By merging cutting-edge tech and user-friendly perks, Apple Pay transcends mere payment choice—it underpins the burgeoning contactless economy.

Here, we unravel Apple Pay’s mechanics and strategies for piloting global digital transaction pathways.

The Evolution of Apple Pay

Since its 2014 debut, Apple Pay has evolved from an innovative concept to widely available for countless folks. Its trajectory includes continuous tech upgrades, global adoption, and steadfast security primacy, positioning Apple Pay not just as current but as spearheading digital wallet progress.

Tracing its timeline reveals Apple Pay revolutionizing transactions – making secure purchases via phone touch or arm wave seamless.

This payment ease, sleekly device-integrated, prompts myriads to embrace Apple Pay for routine financial exchanges, including newer venues like a crypto casino, where users seek both convenience and security in their transactions.

Birth of a New Payment Era

Apple Pay ushered in a transformative payment period. Launching this service transformed iPhones and Apple Watches into more than communication tools. They became secure mobile payment information repositories, facilitating smooth money receipt.

Digital payments through NFC (Near Field Communication) have transformed transactions with a vision of a cashless, digitally convenient future. Physical wallets may become unnecessary.

Constant Evolution

Apple aimed beyond simple payments with Apple Cash and Apple Card. They enabled effortless person-to-person money transfers and expanded shopping options.

The Wallet app pioneered innovations like scheduled preauthorizations, money transfers, and Apple Pay Later’s flexible payment solutions meeting modern consumer demands.

The Wallet app consistently led digital payment advancements, incorporating timely features aligning with evolving consumer preferences.

International Reach

Since its 2015 launch, Apple Pay has spread internationally, covering nations like the UK, Australia, and Canada. Its widespread adoption highlights Apple’s market dominance. It catalyzed NFC technology integration within global retail.

Countries like Australia and the UK witnessed a surge in contactless payments due to Apple Pay’s pivotal influence driving this transition.

Ecosystem Integration

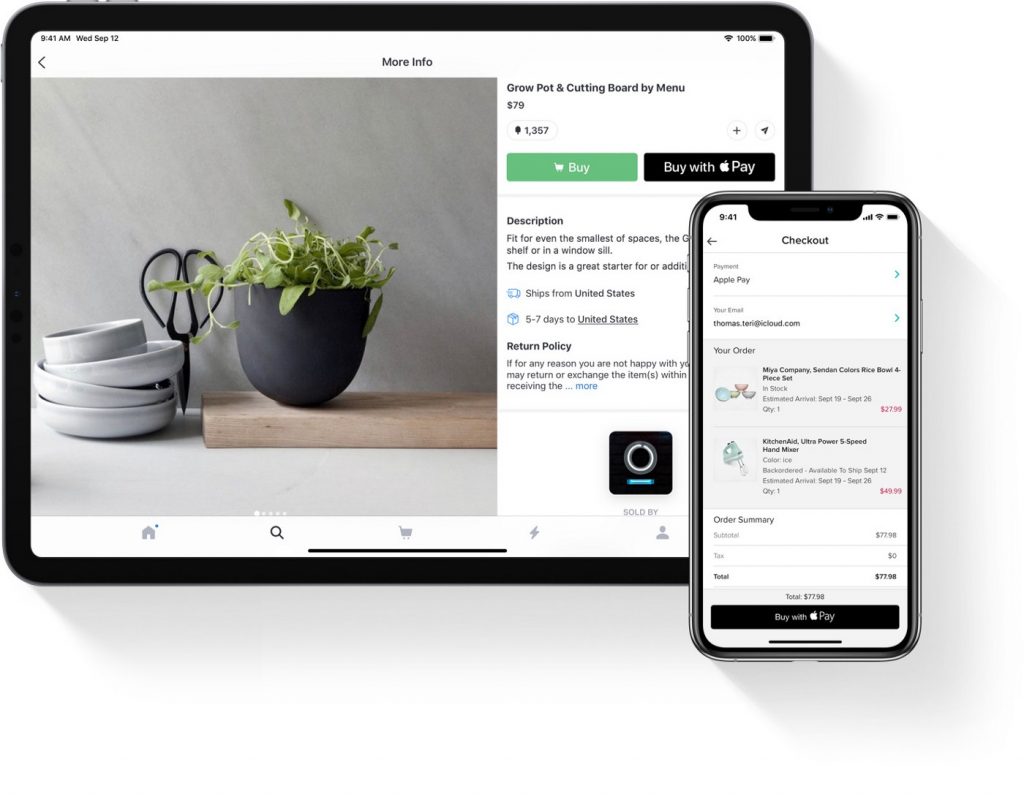

Apple Pay seamlessly integrates across Apple’s ecosystem, reflecting their commitment to frictionless user experiences. Transactions span from iPhones and double-tapping Apple Watches to online Mac payments.

This all-encompassing strategy streamlines payment options. Secure transactions employ various authentication methods, cementing Apple Pay’s essential role within Apple’s suite of services.

Unified Experience on iOS and watchOS

Apple excels at seamless connections between its devices. A great example is how Apple Pay works with iPhones and Apple Watches. You can easily add cards from your iPhone to the Wallet app on your Apple Watch.

This lets you have a digital wallet on your wrist. The process is identical on both devices: use Face ID to verify on iPhone, or double-click to authorizeapple Watch. Secure payments feel smooth and unified.

Expanding to the Mac and Beyond

But Apple Pay isn’t just for iPhones and Watches anymore. It’s making online payments more straightforward, too.

Many big websites and apps now support Apple Pay checkout, and major e-commerce platforms and payment companies have adopted it. Businesses realize how important Apple Pay is becoming for digital transactions.

For developers, Apple provides tools to add Apple Pay to websites and apps. The Apple Pay Web Merchant Registration API helps with integration. Built-in Apple Pay lets websites streamline their checkout flow. This improves the customer’s experience when buying things online.

Apple’s Security Prowess in Digital Payments

Security has been a core focus for Apple Pay since day one. It uses advanced encryption, tokenization, and biometrics, and every transaction is firmly secured. Apple cares deeply about protecting user data.

Card details are encrypted from setup in Wallet through storage on Apple’s servers. You can trust that your financial information is shielded.

Security rules prevent unauthorized use of Apple Pay and maintain the privacy levels customers expect from Apple’s brand.

Authentication Methods

Apple Pay includes advanced ways to confirm your identity. Face ID and Touch ID work together with Apple’s Secure Enclave to ensure only you can authorize payments. This gives peace of mind for transactions.

Verifying who you are is crucial whether shopping in stores or purchasing via apps. It keeps Apple Pay payments secure and straightforward.

Unique Codes for Transactions

Device Account Numbers and dynamic security codes make Apple Pay very secure. Advanced encryption and protected hardware mean Apple devices use safe payment processes. Each transaction has robust security measures.

Apple Pay’s Ecosystem Aids Daily Life

Apple Pay isn’t just for buying things. The Wallet app houses Apple Pay, yes, but also loyalty program details, membership info, and order tracking capabilities. It’s a hub enriching various life areas.

Apple Pay revolutionizes payments. It offers immense convenience. Customers love using it daily.

Wallet App Innovations

Apple Wallet stores event tickets, boarding passes, loyalty cards. It automates updating membership details. Transactions become frictionless. Individual experiences are personalized.

Apple Wallet excels at contactless check-in point redemptions for loyalty programs. It leads to innovation in digital wallets.

Apple Pay in Everyday Life

Apple Pay integrates into daily commutes worldwide. Tapping on London buses, using Japan’s Suica transit card—millions appreciate the effortless convenience. Smoother public transit exemplifies how Apple Pay seamlessly fits everyday life.

The Apple Pay Effect on Retail and Banking

Apple Pay profoundly impacts the banking and retail industries. It transforms customer payment methods and transaction handling by merchants and banks.

Consumer satisfaction rises. Transaction costs reduce. Tailored marketing avenues open. Financial exchanges undergo a revolution.

Merchant Adoption and POS Upgrades

Apple Pay’s increased use has led stores to upgrade checkout systems so shoppers can tap to pay. Consumer demand pushes better retail checkout tech to make payments easier. This change shows how people want simple payments, leading stores to improve the tech.

Shifting Bank Strategies

Digital wallets like Apple Pay change how people manage money and what they expect. This shift forces banks to rethink strategies and modernize as finance goes digital.

Apple values privacy and wants lower fees, challenging banks. To attract customers, banks must constantly enhance offerings.

Contactless payments aren’t a fad – they’re the future of transactions. The contactless payment market will multiply as tap-to-pay becomes standard. Looking ahead, consider tech like better near-field communication and greater QR code adoption for payments.

Domination without Contact

Contactless payment ways like secure magnetic transmission are forecast to grow their market presence considerably. They’ll become more common for consumer credit and debit cards. It’s not just about ease of use. It shows a larger trend.

Transactions will be faster, more reliable, and safer for buyers and sellers. The whole experience with credit card and debit card payments will improve.

Possible Features and Technologies

In the changing digital transactions landscape, Apple Pay may soon use biometric authentication and blockchain tech. These potential enhancements aim to better the user experience.

They’ll provide not only simple payment processes. But also greater assurance for users navigating the increasingly complex digital realm.