For Paraguayan consumers, Apple Pay launch in Paraguay introduces a new level of convenience in day-to-day transactions. Users with Apple devices, such as iPhones, Apple Watches, iPads, and Macs, can now complete purchases without the need for physical cash or cards. Apple Pay allows users to store their credit or debit card information in the Wallet app, making it easy to tap and pay at compatible terminals or use the service for online shopping.

Increased Security for Transactions

One of the standout features of Apple Pay is its commitment to security. Unlike traditional payment methods, Apple Pay employs tokenization, which replaces sensitive card information with a unique digital identifier, or token. This system means that merchants never actually receive the user’s card number, reducing the risk of data breaches or fraud. Additionally, Apple Pay relies on biometric authentication, such as Face ID or Touch ID, to verify transactions, ensuring that only authorized users can complete purchases.

For consumers in Paraguay, this added layer of security is a valuable asset. In an age where digital payment fraud is a concern, Apple Pay provides peace of mind, allowing users to feel confident in their transactions.

Convenience Across a Wide Range of Merchants

With Apple Pay, users in Paraguay can make purchases with just a tap of their device. This convenience extends to a growing number of merchants who support contactless payments, from grocery stores and restaurants to retail shops and public transport. For users, the simplicity of making purchases without needing to handle cash or cards enhances the overall shopping experience, especially in busy urban areas.

For Paraguayan businesses, supporting Apple Pay not only caters to the demand for digital payments but also enhances the customer experience. As more merchants adopt contactless payments, the availability of Apple Pay will likely encourage more users to embrace the technology, further driving the shift toward a cashless society.

How Apple Pay Enhances the Financial Landscape in Paraguay

The Apple Pay launch in Paraguay comes at a pivotal time when digital payments are growing rapidly across Latin America. As consumers become more familiar with cashless transactions, Apple Pay’s presence in Paraguay is set to promote financial inclusion, making it easier for people to manage their money digitally. This shift aligns with a broader movement toward accessible and user-friendly financial services in the region.

One of the significant benefits of digital wallets like Apple Pay is their potential to improve financial inclusion. For individuals who may not have access to traditional banking, digital wallets offer a secure and accessible alternative for managing funds. In Paraguay, where mobile penetration is high, Apple Pay could empower a broader segment of the population to participate in digital commerce, regardless of their access to conventional financial institutions.

For younger generations and tech-savvy users, Apple Pay’s intuitive interface offers an easy way to make purchases without relying on physical currency. This ease of use and accessibility play a critical role in encouraging a more inclusive financial environment, where users can benefit from secure, cashless transactions.

Supporting Small and Medium-Sized Businesses

The introduction of Apple Pay in Paraguay could also benefit small and medium-sized businesses (SMBs) by modernizing their payment options. Many SMBs may have been limited to cash transactions or basic credit card support, but with Apple Pay, they can offer a modern, convenient payment option that appeals to a wider range of customers. For small businesses, adopting Apple Pay can also enhance the overall customer experience, providing a seamless and efficient transaction process that encourages repeat visits.

Additionally, as Apple Pay doesn’t require complex hardware or POS systems to get started, it’s a cost-effective solution for businesses seeking to meet consumer demand for digital payments without significant upfront expenses.

The Broader Impact of Apple Pay on Paraguay’s Economy

The Apple Pay launch in Paraguay represents more than just a new payment option—it’s a step toward fostering a digital economy. By encouraging cashless transactions, Apple Pay is helping Paraguay transition to a more digitally inclusive and financially secure environment. This shift aligns with global economic trends that emphasize the importance of digital literacy and technological adoption in driving economic growth.

As more consumers adopt Apple Pay and other digital wallets, Paraguay could move closer to a cashless economy. The benefits of cashless transactions include reduced costs associated with cash handling, increased efficiency in transaction processing, and the ability to track spending more effectively. For Paraguay, transitioning to a cashless society could lead to a more transparent economy where digital records make financial transactions easier to monitor, track, and regulate.

Apple Pay’s secure infrastructure can encourage even reluctant users to consider cashless transactions, paving the way for widespread acceptance of digital payments across all demographics. In countries where digital wallets are prevalent, the convenience and accessibility of services like Apple Pay have shown to increase consumer spending, which could have a positive impact on Paraguay’s economy.

Creating Opportunities for Future Financial Technologies

The successful integration of Apple Pay in Paraguay could also open doors for additional financial technologies, as consumers become more comfortable with digital payments. Apple Pay can act as a gateway for other services, such as mobile banking, personal finance apps, and even blockchain-based payment solutions. As users in Paraguay become accustomed to digital payments, their acceptance of more advanced technologies may grow, facilitating an environment of innovation in the financial sector.

This shift could attract fintech companies to Paraguay, creating a vibrant financial technology market that benefits from consumer demand for convenient, secure, and modern payment options.

The Competitive Advantage of Apple Pay Over Other Payment Options

Apple Pay stands out among digital wallets and payment solutions for several reasons, including its high level of security, ease of use, and brand trust. The Apple Pay launch in Paraguay brings these benefits to a new audience, positioning it as a preferred option for users looking for a streamlined and secure payment experience.

Apple Pay’s use of tokenization and biometric verification sets it apart from other digital payment methods. Tokenization replaces sensitive card information with a unique identifier, meaning merchants don’t receive actual card details, which reduces the likelihood of fraud. Additionally, Face ID and Touch ID add a layer of security that ensures only the authorized user can make a transaction, making Apple Pay one of the most secure options available.

These security features are particularly relevant in today’s digital landscape, where cybersecurity threats are a growing concern. For users in Paraguay, Apple Pay offers a level of protection that is highly trusted, creating a safe environment for cashless transactions.

Seamless Integration with Apple’s Product Network

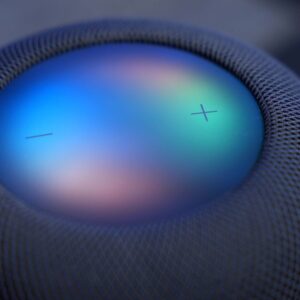

Apple Pay integrates seamlessly with other Apple products, including iPhone, Apple Watch, iPad, and Mac, enabling users to make purchases from any of their devices. This integration provides a consistent and reliable experience, allowing users to complete transactions without needing additional hardware. The ability to use Apple Pay across Apple’s network of products simplifies the user experience, especially for those who already rely on Apple devices in their daily lives.

For Apple users in Paraguay, this integration means that Apple Pay becomes a natural extension of their existing device network, supporting daily tasks, shopping, and even managing finances through an intuitive interface.

What the Future Holds for Apple Pay in Paraguay

With the Apple Pay launch in Paraguay, the future looks promising for digital payments in the region. As the service gains traction, more merchants are likely to adopt Apple Pay, and consumers will become increasingly familiar with the convenience of digital wallets. This shift could pave the way for Apple to introduce additional services in Paraguay, enhancing the user experience with tools that promote financial literacy, spending insights, and broader financial management.

The successful adoption of Apple Pay in Paraguay could lead to the introduction of other Apple financial services, such as Apple Card or Apple Cash. These services, which provide unique features like daily cashback and peer-to-peer payments, could offer Paraguayan users even greater flexibility and financial control. Apple’s commitment to innovation in the financial space means that Paraguay’s digital payment landscape could continue to evolve with new Apple offerings tailored to the local market.

As Paraguay embraces digital payment solutions like Apple Pay, the country is better positioned to compete in the global digital economy. By adopting modern payment technology, Paraguay not only supports its residents with accessible financial services but also builds a foundation for future innovations in digital finance. Apple Pay’s launch is a step toward a more connected, technologically advanced society where consumers and businesses alike can thrive.

Apple Pay Launch in Paraguay Ushers in a New Era of Digital Payments

The Apple Pay launch in Paraguay marks a significant milestone in the country’s journey toward embracing digital transformation. With Apple Pay, users gain access to a secure, convenient, and modern payment option that supports cashless transactions across a variety of merchants and platforms. As Paraguay adapts to this new payment method, both consumers and businesses stand to benefit from the increased efficiency, security, and inclusivity that Apple Pay offers.