Well, this is where Apple Pay comes in. This is not just an app, but an entire financial ecosystem, that has solved much of this dilemma with its tap-and-go system. Obviously, the introduction of the Apple Pay virtual card pushes digital payments into a whole new level.

We are not talking about replacing plastic but redefining what it means to pay securely in the digital age.

Let’s explore the future of virtual payments and find out are we really secured tapping our phone everywhere we go.

What a Virtual Card Really Means

If you are a Millennial or older, the first thing that comes to mind when you hear a “card” is that small piece of plastic (or metal if you are coming from a rich family). But in the digital world, that definition is shifting.

A virtual card isn’t a piece of plastic anymore. It’s a digital version of your debit or credit card that lives inside your device. Yes, Apple has made some incredible innovations, and this is definitely one of them. It goes even further generating unique numbers and one-time codes every time you buy something, which means that they are also focused on security.

So, forgetting your wallet isn’t an issue anymore, as long as you have your phone.

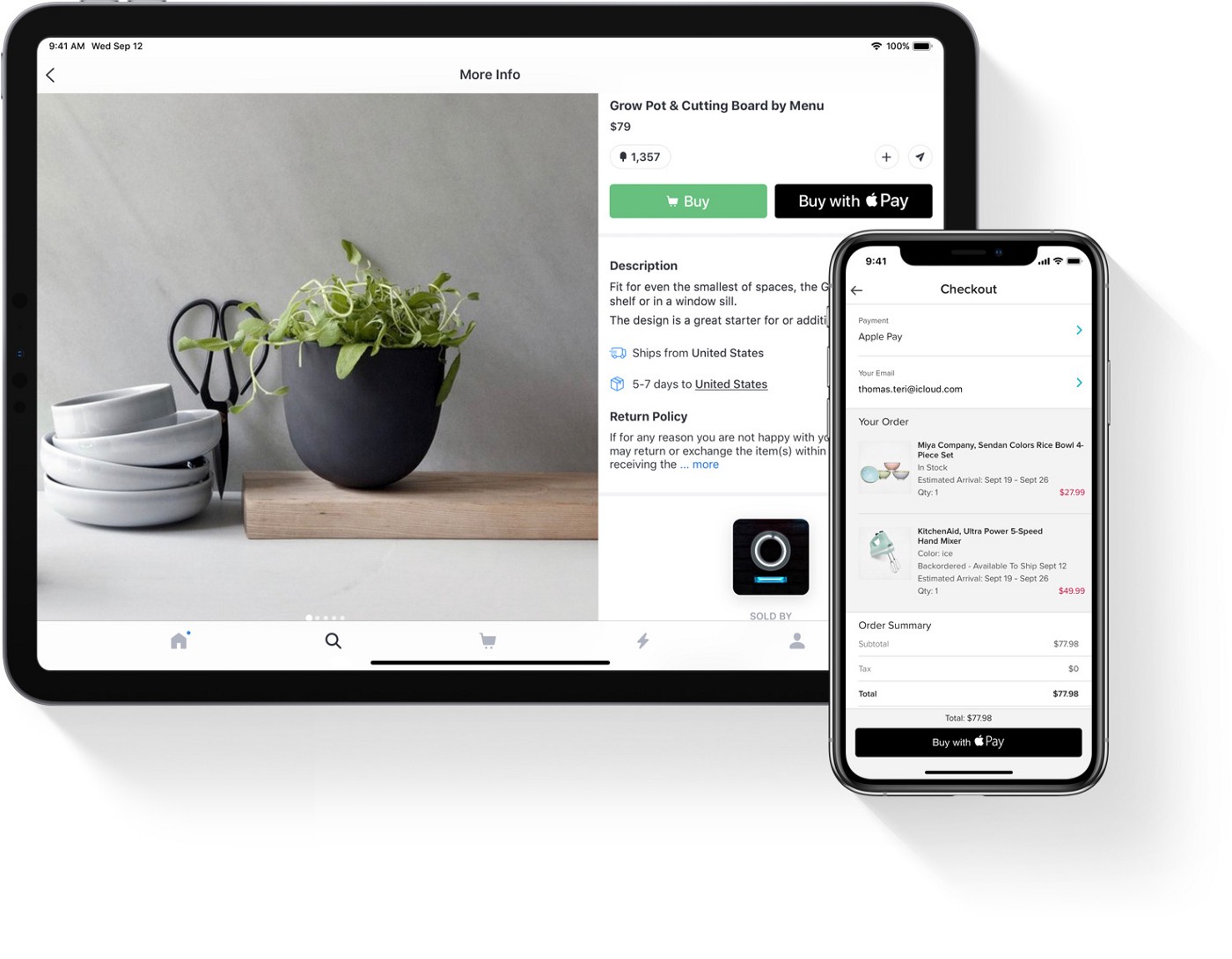

This has changed the way we purchase things in person or online, and to be honest, the simple process has probably led to some impulsive purchases. Instead of handing over your actual 16-digit card number, Apple Pay sends a completely different identifier, or if you do it with your phone where your virtual card is stored, it only requires your face ID.

Why This Feels Like a Game-Changer

To be honest, for most consumers, the biggest advantage is simplicity and convenience. No more typing in card details, carrying a huge wallet that pumps up your pans. With Apple Pay, you just tap or use Face ID and boom.

On top of that, virtual cards are usually safer than the original plastic cards in many different ways. First of all, every transaction requires its own dynamic code, making it impossible for criminals to reuse your information.

Then there is control. If a physical card is lost or stolen, you need to cancel it, wait for a replacement, and update all your subscriptions. With virtual cards, you just suspend it, generate a new one, and keep life moving without disruption.

Plus, you don’t need to call your bank in most cases, since many platforms that offer Apple Pay virtual cards have an option to suspend or cancel your card right away. So, they are safer for sure.

The Bigger Shift in How We Pay

First of all, Apple’s virtual card isn’t a new product; it’s a larger shift that has been happening over the last couple of years. We’ve been tied to physical objects for decades, but it seems that we are finally going away from that system.

This shift matters just because it breaks down a lot of traditional barriers. For example, think about how easy traveling can be. Instead of worrying about carrying different cards or currencies, or getting your wallet stolen in Barcelona, you can carry your phone with your digital wallet, and everything is there.

With virtual cards, you also have more control over your spending, so you can manage renewals, set limits, and even generate temporary card numbers just for those services.

So, it’s not only about making payments easier; it is more about giving people more control, security, and flexibility.

The Challenges No One Talks About

Of course, the story isn’t perfect. Some banks still rely on outdated methods, like SMS codes, to verify transactions (although they still work). These can be intercepted or exploited by scammers. There’s also the issue of adoption. While millions of retailers now accept Apple Pay, there are still plenty of places where you’ll be asked to pull out the old-fashioned card.

Another challenge is trust. For many people, the idea of not having a physical card feels uncomfortable. There’s still a generational gap here; older users often feel safer with something they can hold in their hands. It may take time before virtual-only cards become the norm.

What Does The Future Look Like?

If we zoom out, it’s easy to see where this is heading. Apple Pay isn’t stopping at payments. The technology already hints at a future where your phone or watch could replace everything in your wallet, loyalty cards, IDs, boarding passes, and even keys to your car or house. The virtual card is just one piece of this bigger puzzle.

It’s also likely that virtual cards will come with more built-in features. Imagine cards that let you set spending rules for yourself, like “only $200 for restaurants this month” or generate temporary cards for one-time purchases. Some of these features already exist in fintech apps, but Apple has the power to bring them into the mainstream.

And then there’s global expansion. As more countries embrace contactless payments, Apple Pay and its virtual card could become a universal standard. That could mean traveling without ever thinking about foreign transaction fees, carrying extra cards, or worrying about theft.

The future of payments won’t be about cards at all – it will be about trust, security, and simplicity.