Their influence is seen in industries from retail stores to online casinos. Apple Payments are a fast, safe, and convenient way to pay for goods and services, and they are becoming more noticeable by the day. When you start using this tech, it will add another dimension to the checkout process as it enhances the customer experience regardless of the industry where it is applied.

It was only a matter of time before Apple expanded into different sectors and hit the jackpot with Apple Pay. Payment technology adapts and grows daily, and Apple is at the forefront of it. It managed to get to new customers by providing an app that reduces fraud and increases trust through security features such as Face ID and Touch ID. The story of Apple and Apple Pay is broad, so in this article, we will focus only on its influence in industries such as retail, hospitality, online casinos, and e-commerce.

Impact on Retail

Retail is expected to be influenced the most. After all, when you simplify in-store transactions, both the customer and the industry will notice. Today, it is possible to tap your iPhone or an Apple watch and make a transaction at a contactless terminal. With no need for fiat currencies or card payments and no waits in line at the registers, the entire industry blossomed.

Retailers are more than eager to see faster operation at checkouts; a seamless payment experience brings precisely this. Furthermore, an option to create loyalty programs and digital receipts opened up. Further, they aided in creating a smooth and efficient system for both the sellers and, most of all – the buyers.

Apple Payments in Hospitality

Hospitality embraced Apple Pay with open arms as it made it even more of what it should be – efficient and enjoyable. Most parts of hospitality are elevated to a higher level, starting with booking and ending with checkout. It all was made possible thanks to a simplified payment process.

Simplified Hotel and Restaurant Payments

Today, hotel guests can pay for their rooms and other services using Apple Pay. Nowadays, it can be done both at the reception area and online, making the whole process of checking in and out more streamlined. The same system also applies to restaurants, where it’s possible to pay for meals via mobile devices.

Transactions in this domain require less manual input, reducing the chances of payment errors. With no friction tied to transactions, restaurants and coffee shops can provide better service during busy hours, making the dining experience more efficient and pleasant.

Boosting Customer Experience

At the end of the day, in hospitality, convenience is the key to success. The moment Apple Payments made the integration of room keys and mobile apps a thing, guests started experiencing smoother service. When you can use your iPhone to unlock a room or pay for a spay day, you know you’ve come to a modern hospitality establishment. A seamless experience mixing hospitality and technology is one of the keys to customer satisfaction and encourages your guests to return.

Apple Payments in Online Casinos

Online casinos have embraced all forms of new technology in the name of progress, which paid dividends for them. When you look at how Apple Payments have made deposits and withdrawals simpler than ever, you get why online casinos and this new form of payment tech get along so well. A secure and fast way to manage funds was always on the wish list of online casinos and casino game aggregators such as Hub88 and customers.

Simplifying Payments for Players

People who gamble and bet online require one thing for complete satisfaction: the option of instant deposits. The moment card details became irrelevant, biometric authentication and second-fast transaction completion became the norm, and things changed for online businesses such as casinos.

When you have a setup in place that handles transactions instantly, the number of customers increases, and their eagerness for further engagement increases. Online gamblers want no downtime between rounds of playing games, and with faster payments Apple Pay provides, they receive what they asked for. When overall user experience is increased, the customers are satisfied, and revenues grow.

Seamless Integration with Gaming Platforms

With the addition of Apple Payments to their catalog, many online casinos have added a new weapon in attracting new customers and retaining old ones. This payment platform is easily integrated with every online business, and online casinos are no exception. The best part is that it provides a consistently good payment experience on mobile and desktop devices. Players can switch between devices without worrying about payment methods and details.

For casinos, introducing Apple Payments was like a small revolution. The moment they introduced increased speed of cash flow and vastly reduced the number of failed transactions, the benefits became immeasurable. For casinos, it also brought another benefit. Once the trust was built, loyalty sneaked in, which is essential for both casinos and players. Apple payments were for seamless integration for all platforms that required fast, safe, and secure transactions without fault. As it turned out, online casinos were the ideal testing ground.

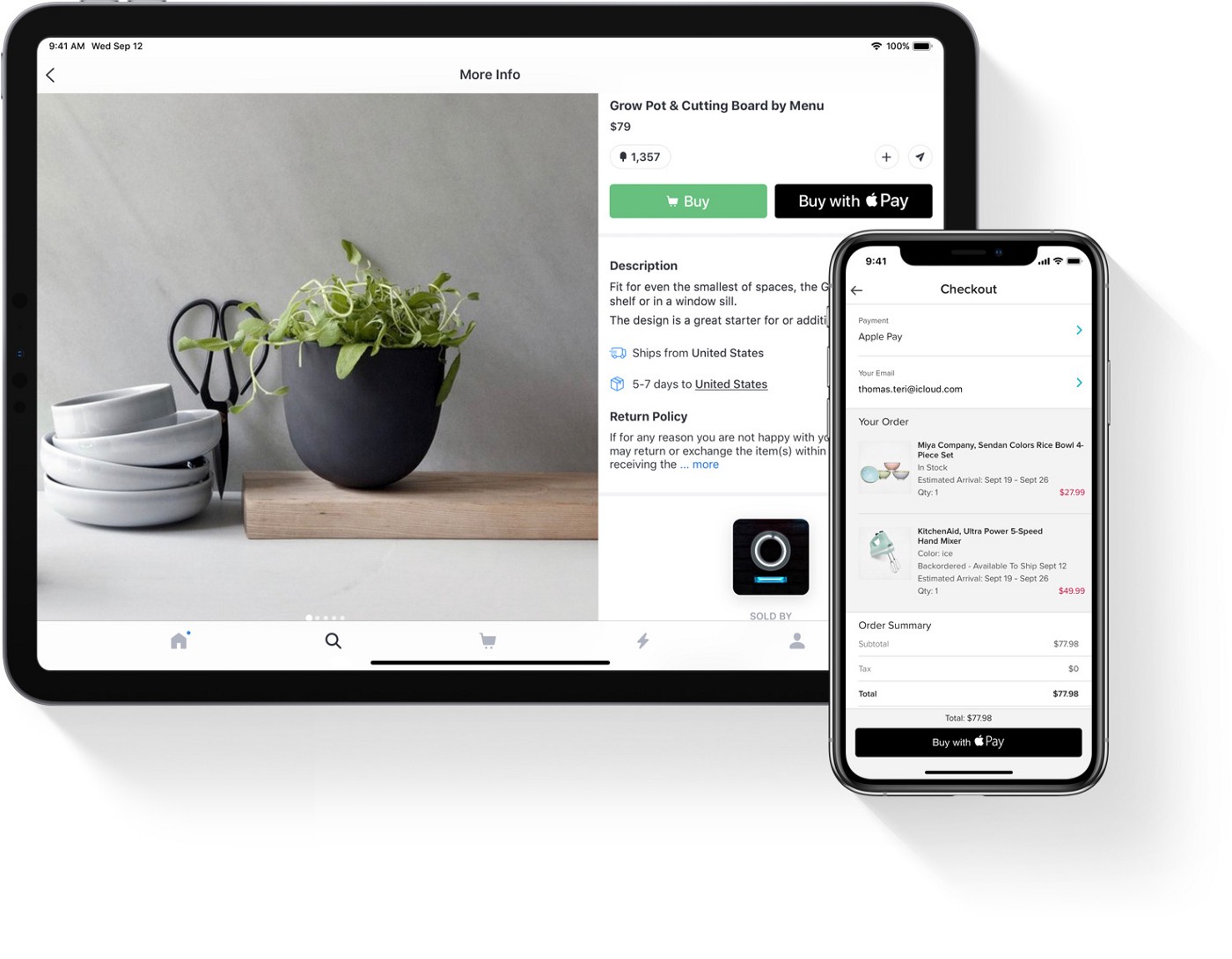

Apple Payments in E-Commerce

If you’re even remotely into e-commerce, you know that Apple Payments became a massive leverage that simplified all online purchases. The e-commerce platforms might be the first establishments to notice how good Apple Payments’ introduction would be for their domain. For customers, it was a drastic change in the way they shop.

Easy Online Checkout

If you have tried Apple Pay, you know that it enables a one-click purchase of any item. By offering this perk, Apple streamlines the checkout process. Users who have the Apple Pay app installed authenticate their payments using Face ID or Touch ID, which in return reduces the rates of cart abandonment.

Fewer errors during transactions, when paired with higher conversion rates, are good for business. Both are made possible by the introduction of Apple Pay. Thus, it is appealing for both e-commerce services to offer this type of payment and for customers to start using it. With its priorities being speed and security, both parties have an interest in starting to use it if they haven’t already.

Integration with Online Platforms

Integration is the key to Apple Pay’s success. Its integration with platforms such as Shopify and WooCommerce was as smooth as it gets. Because of its ease of integration, Apple Pay proved to be an ideal payment option for both small and large companies and customers alike.

Its integration process is straightforward. It allows merchants to accept Apple Payments without any deep technical work. As a solution for digital payments, Apple Pay is as good as it gets, and its broadened accessibility is what businesses online find more than useful.

Security and Privacy

Apple Pay places a huge emphasis on protecting user data. Their entire operation is based on minimizing fraud and protecting sensitive data, and all of the features they offer are created with these issues in mind.

Strong Encryption and Privacy Protection

What makes Apple Payments unique in this domain is the use of unique codes during transactions based on tokenization. They do not require card details for payments. Because of this approach, they ensure that sensitive information is never shared with the merchant and that it is even less likely to be accessible to a third party.

Face ID and Touch ID enable extra layers of protection with Apple Pay that are not available with some other providers. With these features, even if your device is stolen, there is a very slim chance that an unauthorized transaction could occur.

Future Outlook

For the people behind Apple Pay, the work is not over; it has only just begun. In the future, we can expect that the safety measures they have in power will evolve the same way the current threats do. Apple’s payment ecosystem is as strong as it gets at the moment. In the future, they will surely follow the trends, enhance their encryption protocols, and share new privacy features with users, further strengthening their product.

Innovations and Growth Potential

With the current online financial system’s state, Apple Pay is scheduled for continuing growth. If you look around you, you will see that it is already used by entertainment businesses, public transportation providers, and healthcare companies. It has the potential to expand to many more businesses, too.

The work on making Apple Pay a global payment system is already underway, and Apple is already working on broadening its system to partnerships with international financial institutions. The future of payment is already here, and its role is only getting bigger by the day.

Conclusion

Apple Payments are a transformative force in the world of financial transactions, making them faster, safer, more convenient, and more accessible to a broad spectrum of industries. Retail, hospitality, e-commerce, and online casinos are just some of the industries that were the first to adopt this payment system and have greatly benefited from it.

As technology continues to advance, we are sure that Apple Pay will be a leader in adapting and improving the existing financial system and that more industries will benefit from its presence in the future.