Apple phone case profit entered a global economic conversation this week after the head of the International Air Transport Association said the margin from a single iPhone cover can exceed what airlines earn per passenger. The comparison, highlighted during a briefing on the aviation sector’s latest financial outlook, underscored how sharply profit structures differ between consumer technology and the airline business. According to IATA’s projections, airlines expect to generate an average net profit of about US$7.90 per passenger next year, a figure unchanged from prior forecasts. The executive used the example of an Apple phone case to illustrate how thin that number is relative to everyday consumer purchases.

The remark drew widespread attention because it frames Apple’s accessory economics as an example of how certain technology products can generate significant margin with comparatively low operational burden. Accessories like phone cases require design, manufacturing, marketing and distribution, but they lack the heavy infrastructure, regulatory requirements and variable costs that airlines must absorb. This disconnect between cost structure and profit potential highlights how different industries approach scale, resilience and financial sustainability.

IATA’s latest figures reflect an environment where airlines continue to handle rising expenses across fuel, staffing, maintenance, airport fees and safety compliance. Despite steady travel demand, those pressures limit margins and leave airlines with little profit cushion. By contrast, Apple’s accessory ecosystem operates on high-volume sales of relatively low-complexity items that benefit from established supply chains and predictable production cycles. A phone case’s retail price incorporates substantial markup, allowing even a single unit to surpass the per-passenger net profit airlines expect to record.

Why the Contrast Resonates Across Consumer and Travel Sectors

The comparison between an everyday accessory and a global transportation industry resonates because it illustrates broader economic trends. Consumer electronics companies increasingly rely on accessory revenue as part of diversified earnings, with products like cases, cables and chargers contributing meaningfully to profitability. For Apple, accessories complement device sales and support recurring revenue beyond its major hardware lines. Their margins often reflect efficiencies in mass production and consistent demand from users replacing or upgrading their items.

Airlines, meanwhile, manage extensive infrastructure and carry high fixed costs regardless of passenger volumes. Revenue per ticket faces competition, regulatory constraints and operational volatility influenced by fuel markets, weather disruptions and geopolitical shifts. In such an environment, achieving substantial profit per passenger remains difficult. The IATA forecast for a flat US$7.90 margin per traveler reflects those realities, even as global flight volumes climb.

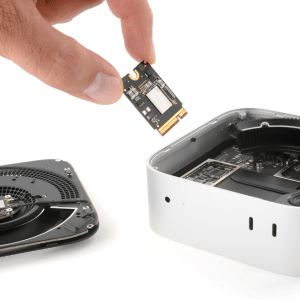

The Structure Behind Accessory Margins

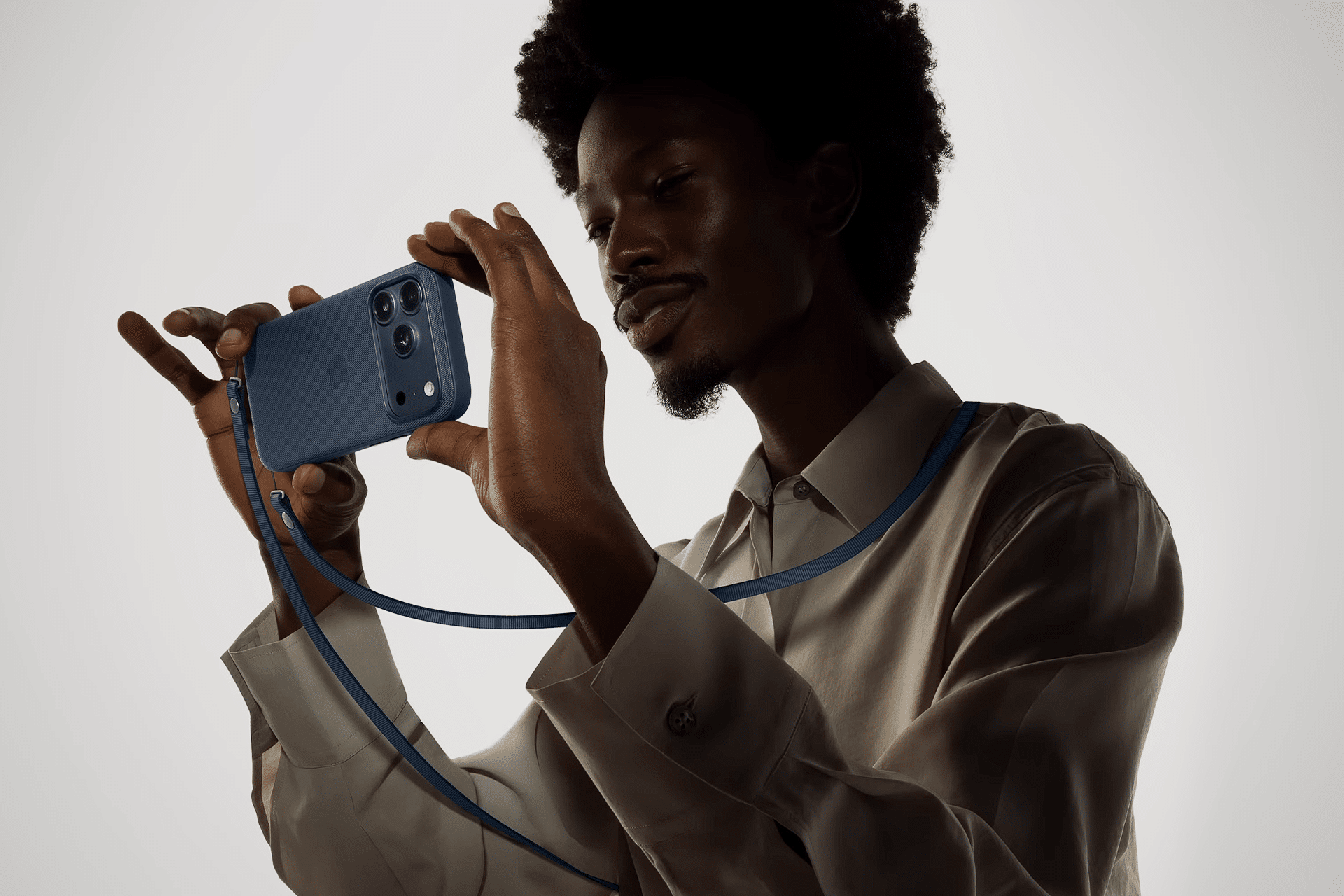

Apple’s phone case business illustrates a model built around steady demand, brand influence and streamlined production. Cases serve as a low-entry purchase for users of new iPhones or for those seeking protection or personalization. Production efficiencies reduce costs, while distribution through Apple Stores and online channels keeps logistics straightforward. Because device owners often buy cases shortly after purchase, the accessory market benefits from predictable cycles linked to annual smartphone releases.

As a result, the margins produced by a case can appear outsized when viewed next to industries that must deploy fleets, maintain infrastructure, and meet stringent safety requirements. Airlines generate substantial total revenue by transporting hundreds of millions of passengers, yet these dollars distribute across an immense cost base. Accessories, by contrast, concentrate profitability in each transaction.

How the Comparison Reflects Changing Global Economics

The comment from the aviation sector’s leadership highlights how economic conditions differ for companies built around physical infrastructure versus those built around digital ecosystems and consumer hardware. As more industries face pressure to modernize and streamline, the gap between high-margin consumer products and low-margin service industries continues to gain attention. For travelers, the remark does not suggest airlines are undercharging but rather illustrates the financial constraints that shape pricing, service quality and investment decisions across the aviation sector.

For technology companies, accessory sales remain an important component of revenue diversification. While not comparable in scale to core device categories, accessories help stabilize earnings and maintain engagement with users throughout the lifespan of a device. The ongoing demand for cases underscores how supplementary hardware can influence broader market economics, especially when those items carry strong margins.

The comparison also invites reflection on how industries adapt to shifting consumer expectations. As airlines navigate economic headwinds and evolving travel habits, tech companies continue refining products that deliver high return on manufacturing and distribution. Understanding these dynamics offers a window into the challenges and strengths that define each sector’s financial trajectory in the years ahead.