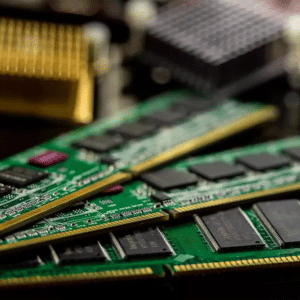

Apple is continuing to rely heavily on Samsung for memory components as RAM prices rise across the global semiconductor market. The renewed increase in memory costs follows tightening supply conditions and growing demand from smartphones, personal computers, data centers, and artificial intelligence infrastructure, placing RAM back at the center of hardware cost discussions.

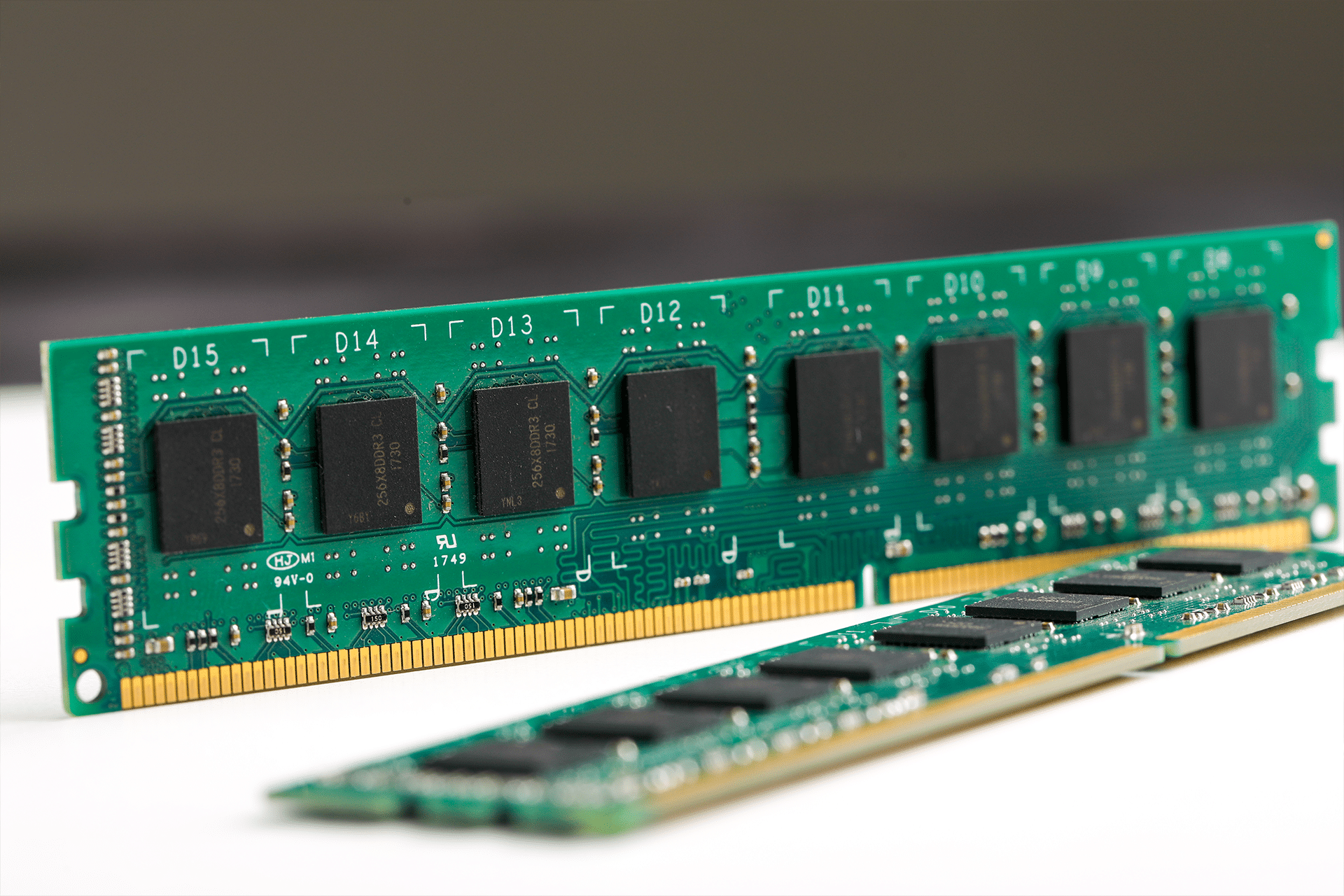

Memory is one of the most widely used components across Apple’s product lineup. iPhone, iPad, and Mac models all depend on high-performance mobile and desktop RAM, making Apple especially exposed to shifts in the DRAM and LPDDR markets. As prices move upward, Apple’s decision to stick with Samsung highlights how supply stability now outweighs short-term cost flexibility.

Why RAM Prices Are Rising Again

The memory market has entered a new tightening phase after a prolonged period of oversupply. During earlier downturns, manufacturers reduced production and delayed fab expansion to stabilize margins. As demand rebounded—driven by AI servers, cloud computing, and new consumer hardware cycles—available capacity tightened faster than suppliers expected.

Samsung, SK Hynix, and Micron control the majority of global DRAM output, and all three have faced strong demand for both conventional memory and newer high-density formats. Mobile LPDDR memory, widely used in Apple devices, has seen especially strong pressure as smartphone and tablet makers prioritize faster, more efficient memory configurations.

With limited near-term capacity expansion, pricing momentum has shifted in favor of suppliers. This has pushed RAM costs higher across consumer and enterprise segments simultaneously.

Why Samsung Remains Apple’s Primary Memory Partner

Apple’s supply chain prioritizes consistency, yield reliability, and long-term volume commitments. Samsung’s manufacturing scale and technical maturity make it one of the few suppliers capable of meeting Apple’s global demand without disruption.

Changing memory suppliers during a tightening cycle introduces risks tied to quality variation, delivery timing, and qualification delays. Maintaining a stable relationship allows Apple to plan inventory and production schedules with greater confidence, even as component costs fluctuate.

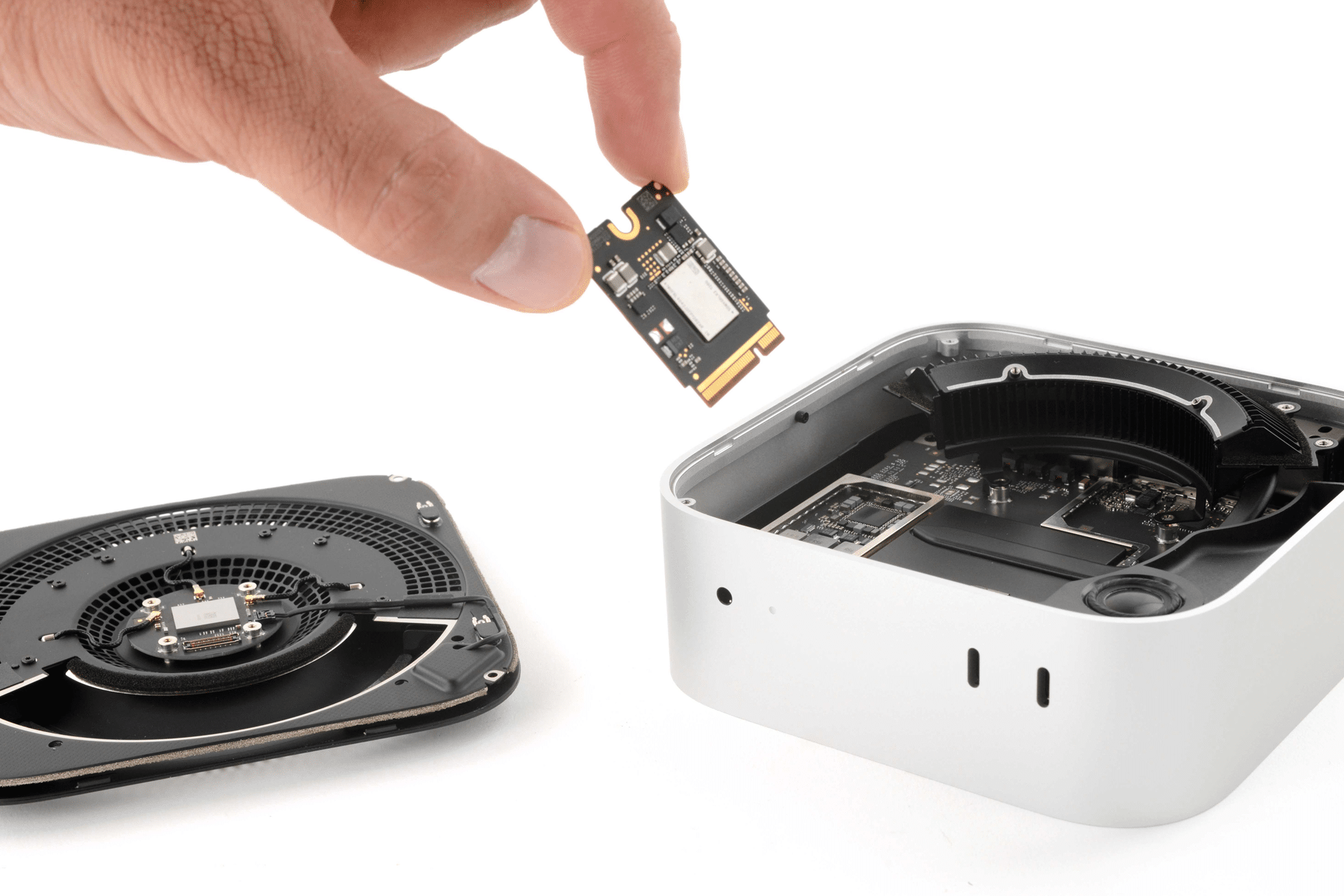

Samsung’s leadership in advanced LPDDR memory also aligns with Apple’s performance goals. Faster memory speeds and improved efficiency are increasingly important as Apple silicon relies on unified memory architectures across CPU, GPU, and machine learning workloads.

How Rising RAM Costs Shape Apple Hardware Decisions

Higher RAM prices rarely translate directly into visible price changes, but they influence how devices are configured and segmented. Memory tiers, upgrade pricing, and base specifications are all areas where cost pressure is absorbed.

On Macs, unified memory makes RAM capacity a critical performance factor. Decisions around 8 GB, 16 GB, or higher configurations affect multitasking, creative workflows, and long-term software support. Rising memory costs can slow aggressive increases in base configurations or make higher tiers more expensive relative to previous generations.

In mobile devices, memory pricing can shape how Apple differentiates standard and Pro models. Balancing performance expectations with cost discipline becomes more complex as RAM prices climb across the board.

Broader Implications for the Memory Market

The current pricing environment suggests that RAM costs may remain elevated longer than in past cycles. AI infrastructure continues to absorb large portions of global memory output, while suppliers remain cautious about adding capacity too quickly due to high capital costs.

This dynamic favors companies with predictable, long-term purchasing power. Apple’s scale allows it to secure supply even during tight markets, but it does not eliminate exposure to broader industry trends.

As memory technology advances toward higher bandwidth and efficiency, competition for cutting-edge capacity is expected to intensify. Supplier relationships established during this cycle will likely shape access to future generations of memory.

Apple’s Memory Strategy

Apple’s continued reliance on Samsung reflects a broader strategy focused on stability during periods of component volatility. Memory remains a foundational element of performance, influencing everything from everyday responsiveness to professional workloads.

Rather than abrupt pricing changes, the effects of rising RAM costs are more likely to appear through configuration strategies and upgrade paths across future devices. As the semiconductor market continues adjusting to AI-driven demand, memory pricing will remain a quiet but persistent factor shaping Apple’s hardware roadmap.