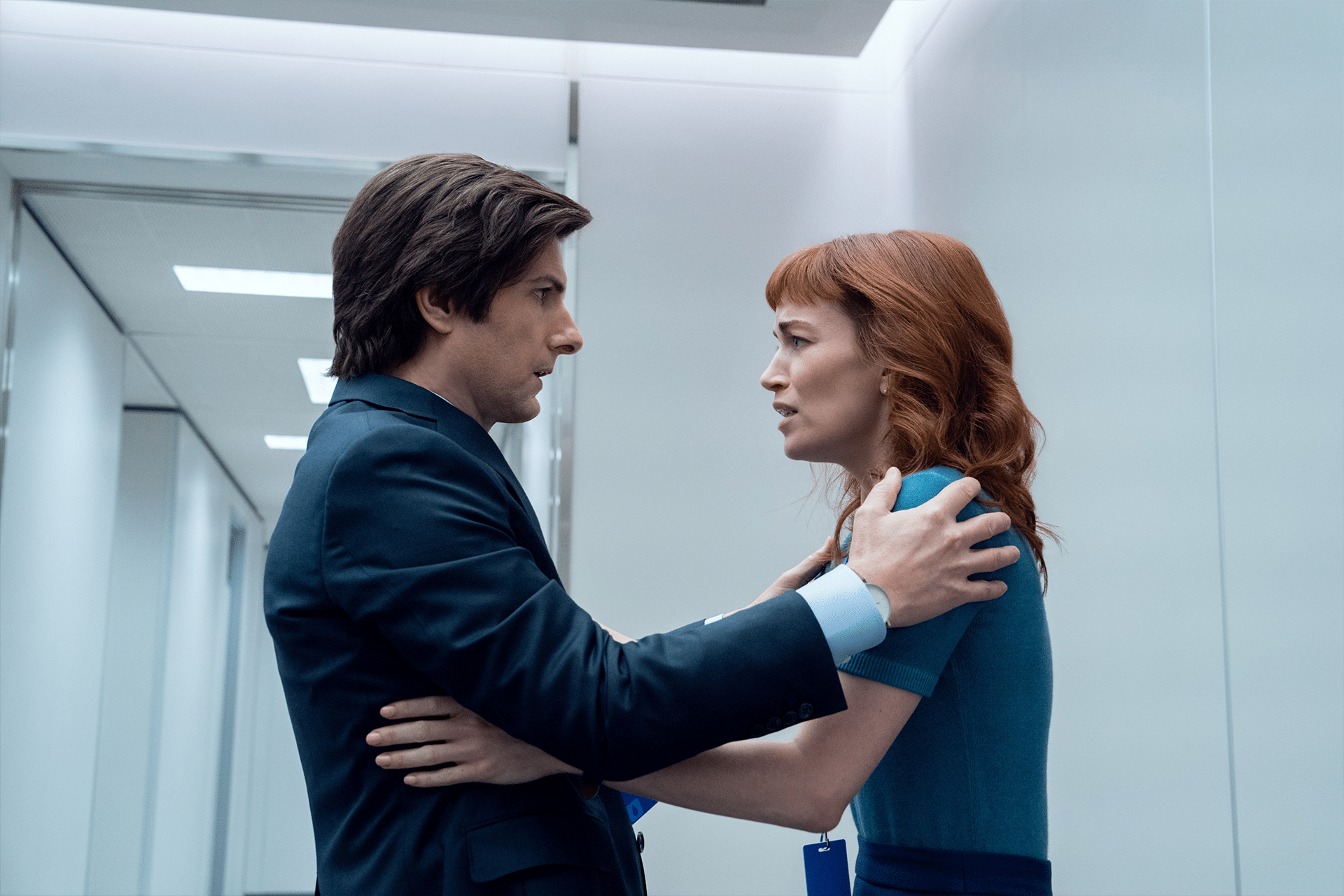

The numbers speak volumes. Severance has smashed viewership records for Apple TV+, fueled by a three-year gap that turned anticipation into a fever pitch. Apple saw it coming—announcing the season two premiere six months early, a rare move for the company, per 9to5Mac. Critics and fans alike have lauded the show’s eerie take on work-life balance, cementing its status as a cultural juggernaut. But here’s the rub: Apple’s lineup from March to June sticks to its usual pace, not a flood of new releases to capitalize on the buzz. Instead, it’s banking on a handful of tentpole series to carry the torch.

The HBO Playbook in Action

Apple’s strategy mirrors HBO’s golden era—think The Sopranos or Game of Thrones—where one standout show keeps viewers subscribed. Unlike Netflix’s binge-heavy, volume-driven model, Apple TV+ opts for quality over quantity, rolling out all-original content with a steady drip of prestige. It’s earned the “new HBO” label at times, and Severance fits the mold perfectly. Yet, even HBO today leans on the broader Max bundle to stay afloat, blending its classics with Warner Bros.’ vast catalog. Apple, meanwhile, doubles down on its lean, originals-only bet.

That gamble is about to hit a proving ground. Post-Severance, Apple’s slate includes Dope Thief, a crime thriller debuting this month, and The Studio, already pegged as a 2025 standout by early buzz. April brings Your Friends & Neighbors with Jon Hamm, followed by Murderbot in May, a sci-fi epic starring Alexander Skarsgård. June caps it with Stick, a golf comedy featuring Owen Wilson. These aren’t small swings—each has the makings of a hit. But can they collectively match Severance’s pull? Apple’s betting they’ll keep viewers from churning.

Why This Moment Matters

For users, Apple TV+ at $9.99 a month is a premium play—sleek integration with Apple devices, 4K streaming, and a curated vibe. Severance has been the anchor, drawing in subscribers who might otherwise skip a service with just 270 titles. Compare that to Netflix’s thousands or Max’s deep bench, and Apple’s approach feels bold, even risky. The payoff hinges on keeping at least one must-watch show in rotation. If the handoff from Severance to these newcomers stumbles, cancellations could spike—especially with rivals like Disney+ and Amazon Prime bulking up their own lineups.

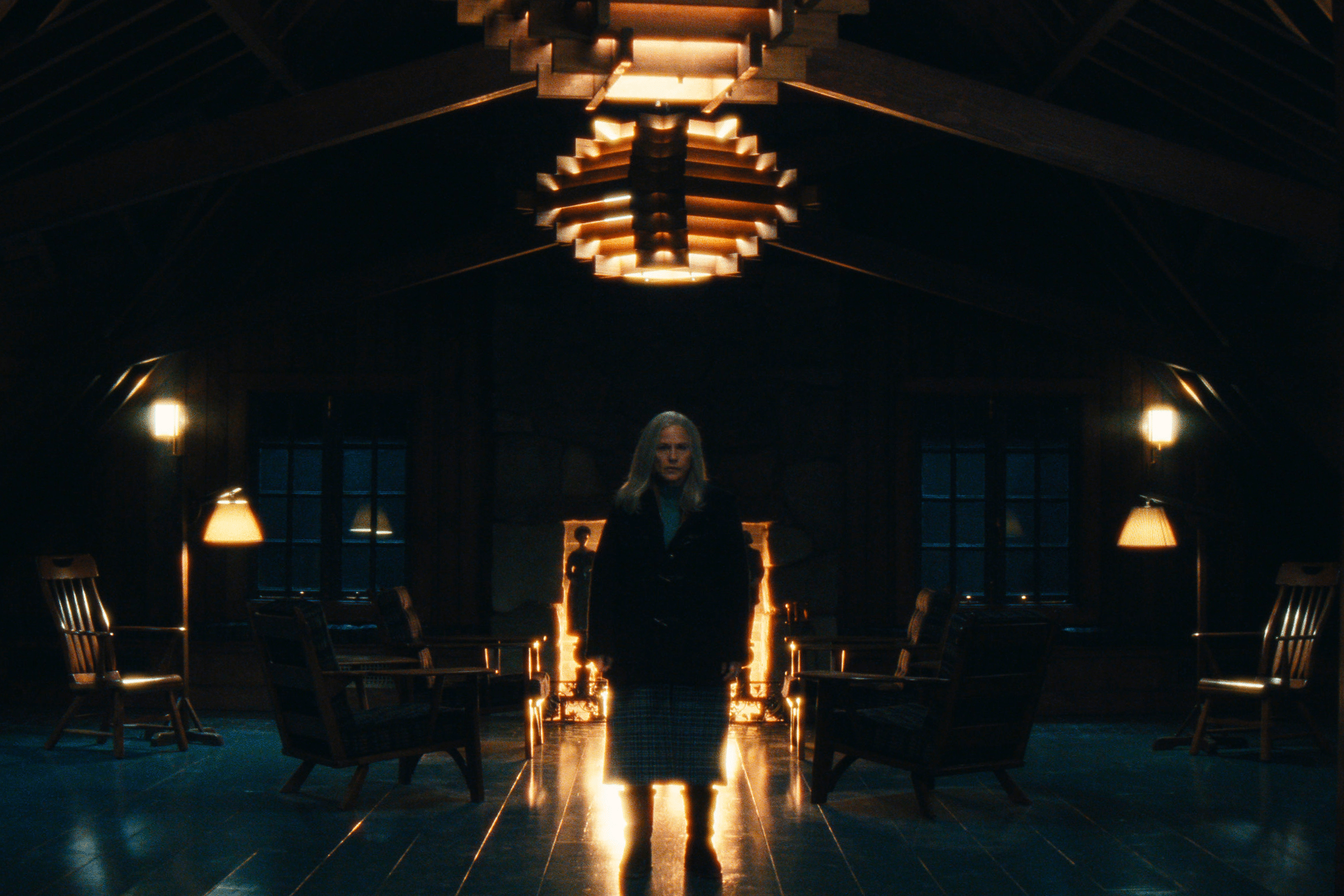

Apple’s had hints of this test before. Films like The Gorge scored big on streaming after a pivot from theatrical flops like Argylle, showing the company can adapt. Severance’s success—built on a modest season one that exploded with season two—proves the HBO model can work. But it’s a tightrope. Posts on X reflect a mix of excitement for what’s next and worry that Apple’s pace might not sustain the hype. The company’s clearly aware, spacing out releases to avoid dead zones, but the pressure’s on.

What’s at Stake—and What’s Next

If Dope Thief or Murderbot falters, Apple TV+ risks losing momentum in a crowded market. TSMC’s U.S. factories are churning out chips to power Apple’s hardware (Reuters confirms supply’s up), but software like TV+ needs to match that muscle. A dip in subscribers could dent Apple’s broader ecosystem play, where services bolster device loyalty. The iPhone 16e’s Bluetooth woes and Apple Intelligence’s rocky start already have analysts like Ming-Chi Kuo cautious—TV+ can’t afford to join the missteps.

Apple’s not blind to this. The upcoming shows pack star power and genre diversity—crime, comedy, sci-fi—aiming to hook different tastes. The Studio could be a sleeper hit, blending satire with Seth Rogen’s draw, while Murderbot taps the sci-fi surge Skarsgård fans will chase. Success here could cement Apple TV+ as a lean, mean prestige machine. Fail, and the “new HBO” tag might fade fast. For now, all eyes are on the post-Severance playbook—Apple’s future in streaming hangs in the balance.