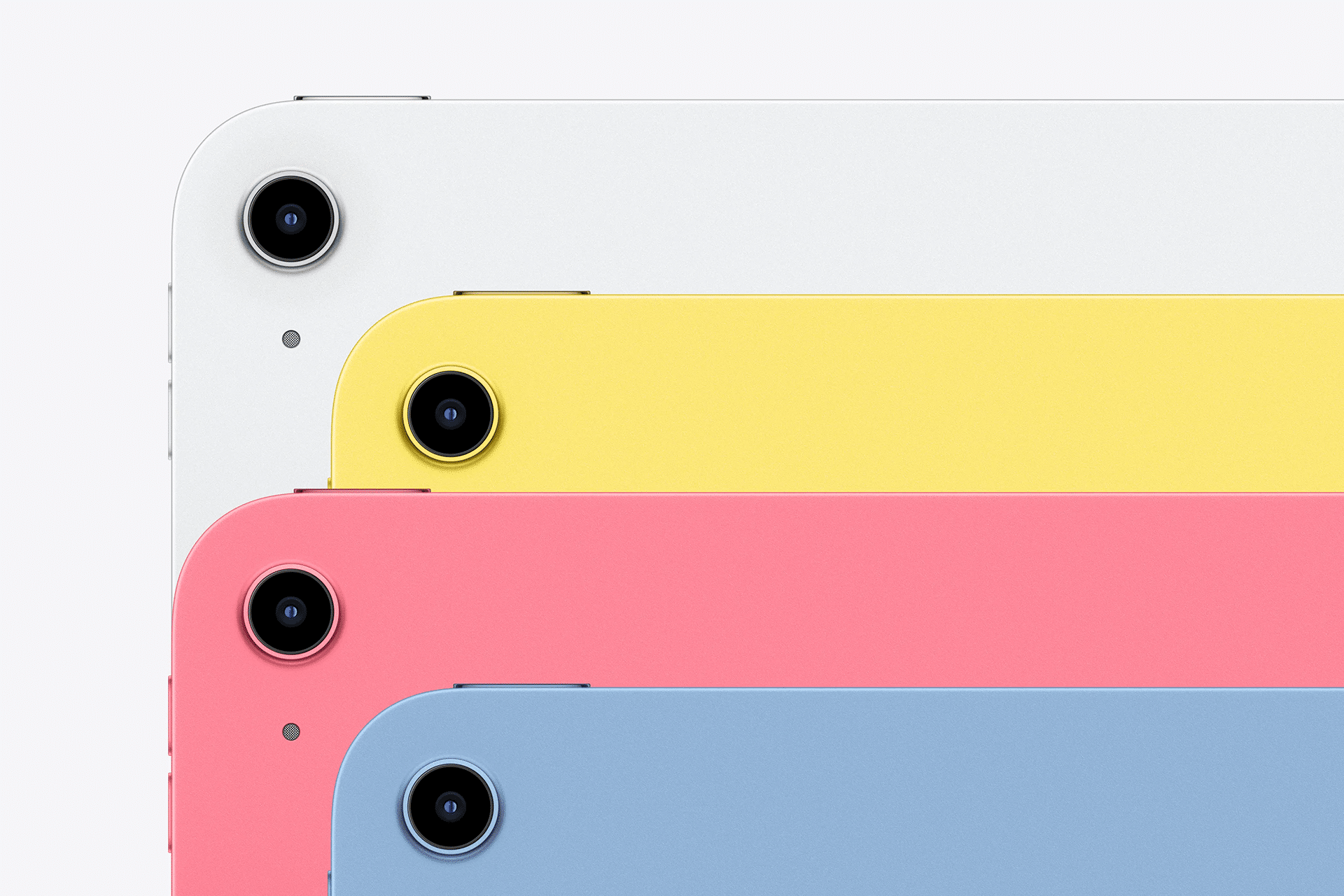

The 11th-generation iPad, released this month, sports the A16 chip—first seen in the iPhone 14 Pro back in 2022—and doubles its base storage to 128GB, all while holding steady at $349. Compared to its predecessor’s A14 chip, the A16 offers a respectable 30% performance boost, according to Apple. Yet, it falls short of the minimum requirements for Apple Intelligence, which demands at least 8GB of RAM and a more robust Neural Engine, found in the A17 Pro or M-series chips. For context, the new iPad mini packs an A17 Pro, enabling AI features like Writing Tools and an enhanced Siri, while the base iPad sticks to 6GB of RAM and misses out.

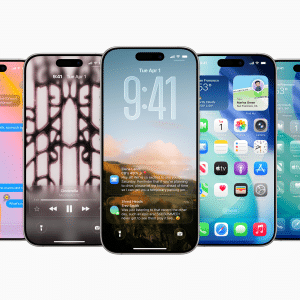

This isn’t just a technical oversight. The base iPad’s update feels deliberately restrained—no major design changes, no Apple Pencil Pro support, and certainly no AI bells and whistles. Meanwhile, the rest of Apple’s tablet lineup has been showered with attention: the M4 iPad Pro flaunts a stunning tandem OLED display, the iPad Air got two updates in a year with M3 power, and the iPad mini leapt into the AI era. So why did Apple hold back on its cheapest tablet?

The Chart That Tells the Story

CIRP’s latest data offers a clear explanation: the base iPad has been eating into the market share of Apple’s pricier models. The chart shows a steady rise in the entry-level iPad’s sales relative to the Air, mini, and Pro lines over recent years. Shoppers, it seems, increasingly find the base model “good enough” for their needs—web browsing, streaming, light productivity—without splurging on premium options. This trend poses a problem for Apple, a company that thrives on upselling customers to higher-margin products like the $799 iPad Pro or $599 iPad Air.

Faced with this shift, Apple appears to have adopted a calculated approach. First, it delayed the base iPad’s update longer than usual—over two years compared to the typical annual cycle. Then, when the refresh arrived, it delivered just enough to keep the device competitive (better chip, more storage) but stopped short of adding premium features like Apple Intelligence. The result? A base iPad that’s still appealing to budget-conscious buyers but lacks the cutting-edge allure that might tempt users toward pricier models.

A Strategic Play, Not a Snub

This isn’t about neglecting the base iPad—it’s about nudging consumers up the ladder. By reserving AI capabilities for devices with A17 Pro or M-series chips, Apple creates a clear incentive to upgrade. Want Genmoji or a smarter Siri? You’ll need at least an iPad mini ($499) or an iPad Air ($599). The base iPad remains a solid value proposition for students, casual users, and families, but it’s no longer a jack-of-all-trades threatening to cannibalize sales of its siblings.

The strategy aligns with Apple’s broader playbook. Historically, the company has used feature differentiation to segment its product lines—think Stage Manager multitasking exclusive to M-series iPads or ProMotion displays limited to the Pro tier. Skipping Apple Intelligence on the base iPad reinforces this pattern, ensuring the entry-level model doesn’t steal too much thunder from the premium lineup where Apple’s profits shine brightest.

What It Means for Users

For tech enthusiasts eyeing AI-driven tools, the base iPad’s update is a letdown. Its A16 chip handles everyday tasks with ease and even outperforms many Android tablets, but it’s a step behind the AI-powered future Apple is pushing. Casual users, however, might not care—$349 still buys a sleek, reliable tablet with a vibrant 10.9-inch display, USB-C charging, and access to iPadOS 18’s core features. It’s a practical choice for note-taking, video calls, or keeping kids entertained, just without the futuristic flair.

Looking ahead, Apple’s decision could spark debate. As AI becomes table stakes in tech, will buyers forgive the base iPad’s exclusion, or will they turn to rivals offering more for less? For now, the CIRP chart makes one thing clear: Apple’s holding back wasn’t an accident—it’s a deliberate move to protect its bottom line while keeping the base iPad relevant. Whether that gamble pays off will depend on how much users value AI over affordability.