In contrast to its global performance, Apple’s U.S. Mac sales remained flat in Q2 2025, reflecting a cautious market. IDC analysts attribute this stagnation to vendors accelerating shipments earlier in the year to avoid tariff-related disruptions. The U.S. PC market saw minimal growth, with total shipments reaching 16.9 million units, a 1.3% increase from last year. Apple’s U.S. market share held steady at 16%, trailing Lenovo (24.9%) and HP (22.8%). This front-loading strategy, while strategic, risks oversupply, as consumer demand may not match the elevated inventory levels later in 2025.

Ryan Reith, IDC’s group vice president, noted that the industry is navigating a delicate balance. Vendors are pushing shipments to mitigate tariff impacts, but weakening consumer sentiment could lead to excess stock. “Price increases will likely be dispersed over time and geography depending on vendor strategy,” Reith said, hinting at potential clearance promotions in Q3 to address inventory backups.

M4 Chip Fuels Enterprise Appeal

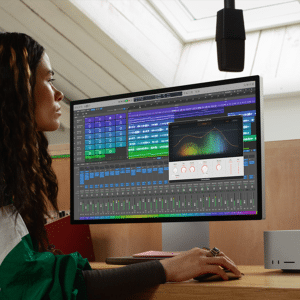

Apple’s M4 chip has been a key driver of its shipment growth, particularly in the enterprise sector. The chip’s advanced neural engine enhances AI-driven tasks, positioning Macs as attractive options for businesses upgrading hardware before Microsoft ends support for Windows 10 in October 2025. IDC forecasts a 20% increase in Mac sales to enterprise users through 2024, driven by this transition. The M4 MacBook Air, with its lightweight design and robust performance, has resonated with professionals seeking reliable, high-performing devices for hybrid work environments.

Beyond hardware, Apple’s ecosystem integration—combining macOS, iCloud, and seamless device connectivity—continues to differentiate its offerings. Businesses increasingly value this cohesion, especially as competitors like Microsoft struggle to maintain a foothold in mobile and hybrid computing spaces.

Tariff Clouds Loom Over Future Growth

The specter of U.S. tariffs, particularly on electronics imported from China, casts uncertainty over the PC market’s trajectory. IDC projects global PC shipments to reach 273 million units in 2025, a 3.7% increase, but growth could slow if tariffs drive price hikes. Apple, which assembles most Macs in China, faces potential cost increases that could be passed to consumers. This dynamic may temper demand, particularly in price-sensitive markets, despite Apple’s premium brand positioning.

Canalys offers a slightly more conservative outlook, projecting U.S. PC shipments to grow by 2% in 2025, reaching 70.4 million units, with a stronger 4% uptick in 2026. Apple’s ability to maintain growth will hinge on its pricing strategy and ability to innovate amid these pressures. The company’s focus on diversifying its supply chain, with moves to expand manufacturing in countries like India and Vietnam, may mitigate some tariff-related risks.

Consumer Trends and Market Dynamics

While Apple’s shipment gains are impressive, they don’t fully reflect consumer demand. IDC notes that much of the Q2 surge stems from channel inventory buildup rather than direct sales to end users. This disconnect suggests cautious optimism, as actual consumer uptake remains uncertain. In China, a critical market for Apple, Mac shipments faced headwinds due to weak demand, though the company saw a rebound in iPhone sales driven by aggressive discounts during the 618 shopping festival.

The broader PC market is also evolving, with AI PCs gaining traction. However, IDC reports that only 3% of PCs shipped in 2025 are optimized for generative AI tasks, indicating that consumer interest in AI features, including Apple Intelligence, has yet to fully materialize. Apple’s ability to integrate AI seamlessly into macOS could drive future upgrades, particularly as enterprises prioritize AI-capable hardware.

Looking Ahead

Apple’s Mac lineup is poised for continued growth, bolstered by its silicon advancements and enterprise appeal. Yet, challenges like tariff-driven price hikes and inventory overhangs loom large. As the PC market stabilizes post-pandemic, Apple’s ability to balance innovation with affordability will determine whether it can sustain its momentum. For now, its 21.4% global shipment growth underscores a brand that continues to outshine rivals in a competitive landscape.