Unveiled last month, the system aims to dominate vehicle dashboards with deep integration, but carmakers are backing away, eyeing their own subscription-based services to boost profits.

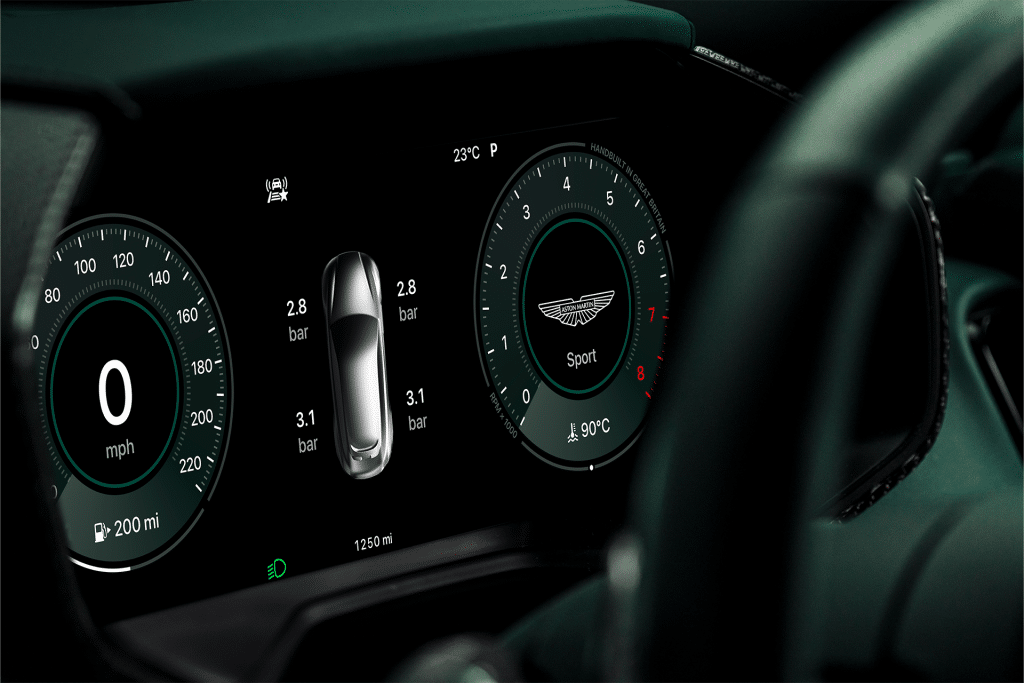

CarPlay Ultra, officially announced in May 2025, expands on the standard CarPlay by controlling all driver screens, including instrument clusters, with real-time data like speed and fuel levels. Unlike its predecessor, which mirrors iPhone apps on a car’s infotainment system, Ultra embeds itself into the vehicle’s core, blending Apple’s interface with the automaker’s design for a tailored, customizable experience. Aston Martin was the launch partner, and Porsche has committed to adopting it, but other brands are pulling back.

Apple initially touted “many other automakers” as future supporters, including Mercedes-Benz, Audi, Volvo Cars, Polestar, and Renault. However, a Financial Times report reveals these companies have no plans to integrate CarPlay Ultra. Mercedes-Benz publicly withdrew support in April 2024 via a podcast, while Audi quietly reversed course. Renault reportedly told Apple, “Don’t try to invade our own systems,” signaling a firm stance against ceding control.

Revenue Over Integration

The rejections stem from automakers’ desire to protect lucrative revenue streams. With global car sales plateauing, premium brands are turning to subscription services—think monthly fees for navigation, heated seats, or performance upgrades—to drive growth. “Western carmakers are trying to figure out how to find growth in a world at or near its peak in terms of car sales,” said Simon Middleton, a McKinsey partner, in the Financial Times. Handing over dashboard control to Apple risks losing these monetization opportunities, as CarPlay Ultra could prioritize Apple’s services like Maps or Music.

Premium brands also see their in-house infotainment systems as a way to stand out in a cutthroat market. Proprietary interfaces allow Audi, Mercedes, and others to showcase unique designs and features, reinforcing brand identity. Allowing Apple to dominate the driver experience could dilute this differentiation, a critical factor in the luxury segment.

While CarPlay Ultra struggles, standard CarPlay remains a non-negotiable for many buyers. Surveys consistently show that seamless iPhone integration ranks high on car shoppers’ must-have lists, ensuring Apple retains leverage. Automakers may resist Ultra’s deep integration but are unlikely to abandon the lighter, app-mirroring CarPlay, which doesn’t threaten their revenue models.

Why It Matters

For tech users, CarPlay Ultra promised a slick, unified driving experience, blending iPhone familiarity with car-specific data. Its rejection means drivers may face a patchwork of proprietary systems, varying in quality and ease of use. For Apple, the snub is a setback in its push to expand beyond devices into automotive ecosystems. Meanwhile, automakers are betting that their own software can compete with Apple’s polish while unlocking new income streams. The tug-of-war between tech giants and carmakers will shape the future of the connected car, with consumers caught in the middle.