Everyone finds budgeting difficult, but students find it to be particularly difficult. Money management is still a part of daily life, particularly if you are studying in a city and taking courses in architecture, civil engineering, medicine, or the sciences.

With little to no income, you must figure out how much money you’ll need for food, transportation, housing costs, and academic-related charges. Knowing how much money to spend and what to spend it on is crucial. Being able to handle your cash shows maturity and provides benefits. It is preferable to begin studying it young. Consider the following advice.

Manage your budget

Gaining awareness of your financial situation is a good place to start when creating a budget for college students. To better comprehend your spending patterns and where your money goes, keep track of your incoming cash and how you use it.

Your rent, internet service, and gym membership are examples of your fixed costs. Dining out, entertainment, tuition, and school materials are some of your variable costs. Understanding what you spend your money on is the key to figuring out how to adjust your budget.

Use the digital tools at your disposal to make tracking your finances simple. Most likely, your bank or credit card company provides an app with a financial calculator, or you might use an app that connects all of your accounts to assist you in tracking your spending and developing a budget.

Make financial goals

Your ability to build a budget is aided by setting reasonable financial goals. Whether it’s paying all of your bills on time each month or setting aside money for a trip, it’s critical to have a financial goal to strive for.

However, it’s equally crucial to ensure you’re aiming for attainable objectives so you don’t feel let down by falling short of targets beyond your reach. Consider the goals you wish to set for the long and near term.

Distinguish wants from needs

Some expenditures are largely fixed each day and rarely changed. Consider your everyday commute fare as an example; try to resist the urge to call a cab both to and from the university. Remain with public transportation.

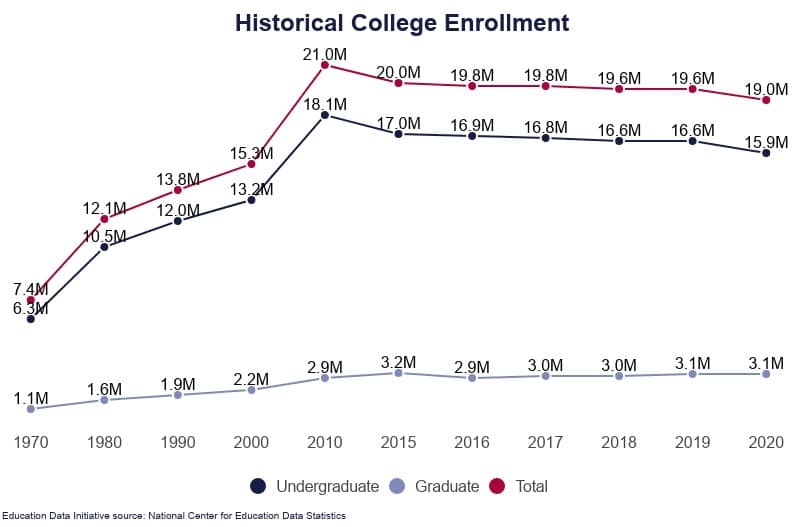

The majority of undergraduate students make one try to finish their college career, according to statistics on college enrolment, regardless of whether they graduate or leave school early.

Is that cup of expensive coffee truly necessary, or might you get by with instant coffee instead? You might easily save or lose a thousand dollars by making a conscious effort to forgo everyday coffee shop purchases!

Keeping track of your spending can help you learn to tell what you can live without and what you cannot. If you are still experiencing trouble, consider living off of a weekly allowance rather than a debit card to reduce your chance of going overboard.

Place your change in the market

With the advent of investment applications, saving change is now digital. Acorns round up your purchases to the closest dollar when you add your credit or debit card, giving you a spare chance to invest.

Your spare change is invested in stocks and bonds, which means that you are saving money and have the chance to increase it. The power of interest and the spare coin is something that doesn’t require a math major to understand.

Working along with roommates

To reduce housing costs, consider other options outside merely sharing a room. To ensure that all of your expenses are evenly distributed, set aside money for meals and household needs like toiletries and cleaning supplies. You may even think about setting up a joint account for household costs, to which everyone contributes monthly.

In this manner, a couple can share expenses like paying the mortgage and buying groceries. Managing roommates’ personalities is never easy, especially when money is involved, but establishing shared costs for the house in which everyone has a role can result in significant savings.

Don’t overestimate the success of your budget

Underestimating spending and failing to account for fluctuations are students’ most frequent mistakes when creating budgets.

A student will frequently make a strict budget that doesn’t account for monthly variances while deciding whether to live on or off campus. According to preliminary data, there were 16.2 million postsecondary students enrolled nationwide in Spring 2022, a 14.7% decrease from Fall 2020.

Students sometimes neglect to account for cost variations over the nine to twelve months they are budgeting for, whether it be an electric bill that will alter based on the season or gas to drive to and from school.

Source: https://educationdata.org/college-enrollment-statistics

For instance, while planning a grocery budget, they may live off of a batch of spaghetti that only costs a few dollars for a few days. While that may be the case, basing a shopping budget entirely on the lowest selections is neither practical nor healthful.

Review & correct

It’s important to review and modify your budget as expenditures and income fluctuate, as in the case of a rent increase from your landlord or a grant from your school to aid with tuition. Keeping this in mind will help you stay on course.

Now that you have greater control over your finances, you may be deliberate in how you spend and conserve money. It might be simpler to properly handle more complicated expenses after graduation if you develop the habit of setting and keeping a budget while you are still in college.

It’s crucial to adhere to your budget now that you’ve put effort into generating it. Following your budget while in college can assist you in paying off debt and graduating with sound financial practices that can assist you in achieving long-term life objectives. Establishing reminders to enter daily costs into your budget can help you stay on target.