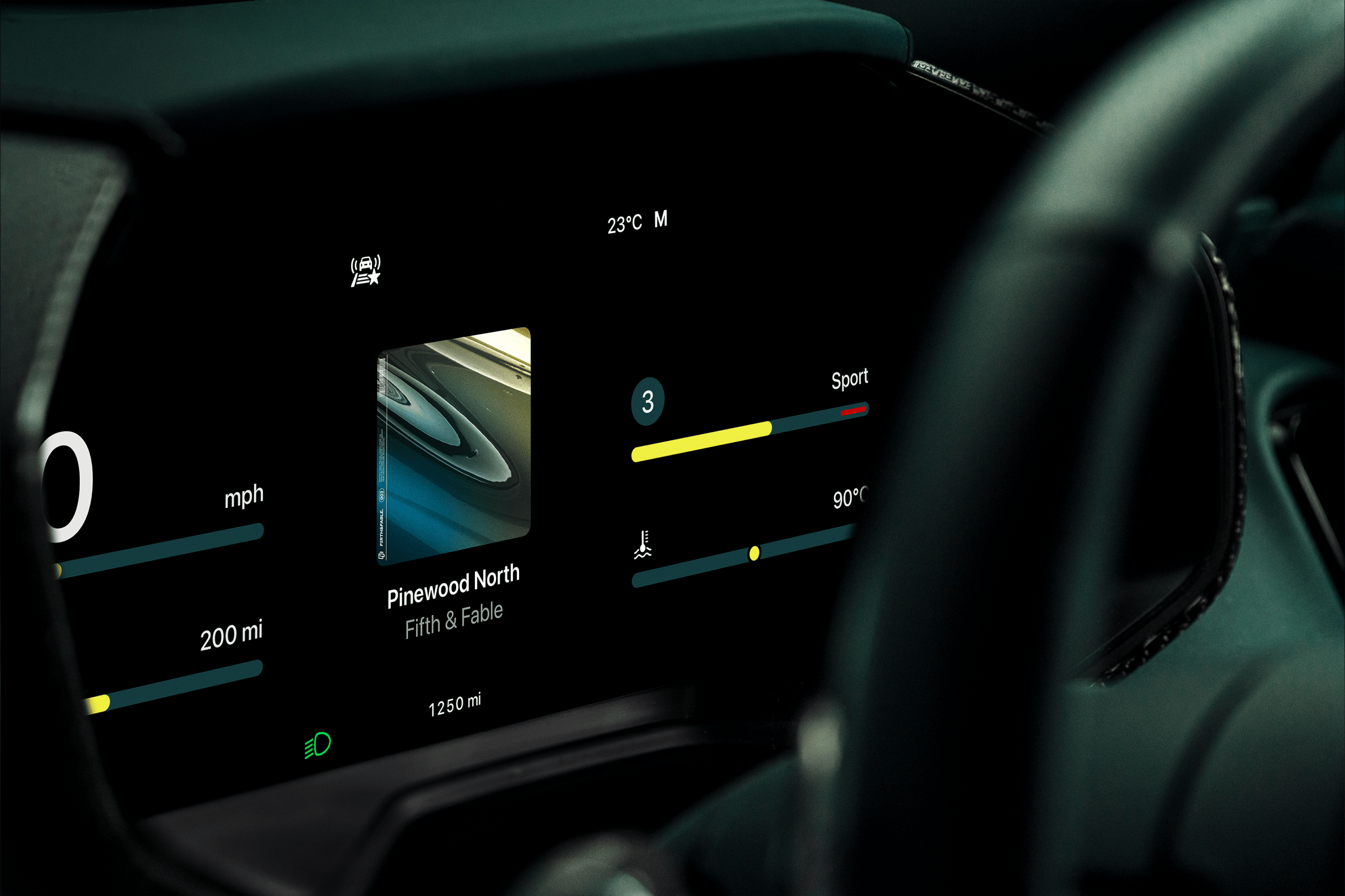

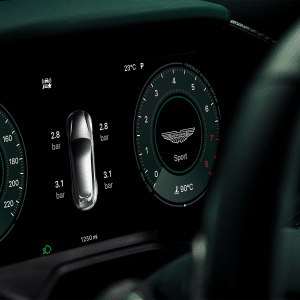

Several prominent brands have pledged support for CarPlay Ultra, signaling enthusiasm for Apple’s vision. Aston Martin led the charge, rolling out the system for new vehicle orders and offering software updates for existing models with next-generation infotainment systems. Hyundai, Kia, and Genesis joined as new partners in May 2025, expanding the platform’s reach to more affordable vehicles. Porsche also reaffirmed its commitment, promising future integration. These brands see value in CarPlay Ultra’s ability to blend iPhone features—like Maps, Messages, and Siri—with vehicle-specific controls, such as drive modes and climate settings, all accessible via onscreen controls, physical buttons, or voice commands. This collaboration allows automakers to craft custom themes, ensuring the interface aligns with their brand identity while offering drivers personalization options like color schemes and wallpapers.

Notable Holdouts and Concerns

Despite Apple’s strong partnerships, several major automakers have opted out of supporting CarPlay Ultra, citing concerns over software control and revenue streams from their proprietary systems. Audi, Mercedes-Benz, Polestar, Renault, and Volvo, initially listed as partners in 2022, have since backed away. Mercedes-Benz publicly announced its decision in April 2024, emphasizing the desire to maintain its in-house software experience. General Motors, having already phased out standard CarPlay in its electric vehicles, is also unlikely to adopt Ultra, favoring its Android Automotive-based systems. These holdouts reflect a broader tension: automakers are wary of ceding control of critical vehicle interfaces and data to Apple, especially as in-car subscriptions and services become lucrative. This resistance could limit CarPlay Ultra’s availability, particularly in premium and electric vehicle segments.

Implications for Drivers

For drivers, CarPlay Ultra promises a unified, intuitive experience that blends the familiarity of an iPhone with vehicle-specific functionality. The system’s ability to display widgets for Calendar, Weather, or Reminders on the car’s screens, alongside critical driving data, enhances convenience and safety. However, its limited rollout—currently confined to high-end Aston Martin models—means most drivers won’t experience it soon. The lack of a clear timeline for Hyundai, Kia, Genesis, or Porsche implementations adds uncertainty. Meanwhile, Apple’s commitment to maintaining standard CarPlay ensures that millions of users won’t be left behind, with iOS 26 introducing features like widgets and a Liquid Glass design to keep the original system competitive. This dual-track approach suggests Apple is balancing premium innovation with broad accessibility.

The Road Ahead

The mixed response from automakers highlights a pivotal moment for CarPlay Ultra. While Apple’s collaboration with brands like Aston Martin showcases the system’s potential—described as “crisp, clean, and intuitive” by early reviewers—the reluctance of others underscores challenges in convincing manufacturers to integrate deeply with Apple’s ecosystem. Posts on X reflect this divide, with some praising Ultra’s features while others note automakers’ hesitation to relinquish software control. Apple’s ongoing investment in both CarPlay Ultra and standard CarPlay, including new iOS 26 features like video playback and Smart Display Zoom, signals a commitment to evolving the platform. Whether more automakers will embrace Ultra or double down on proprietary systems will shape its impact on the future of driving.

Balancing Innovation and Control

CarPlay Ultra’s success hinges on Apple’s ability to navigate automaker concerns while delivering a compelling experience for drivers. The system’s deep integration, from customizable gauge clusters to Siri-controlled climate settings, sets a new standard for in-car technology. Yet, the absence of brands like Audi and Mercedes-Benz could slow its adoption, particularly in competitive luxury markets. For now, drivers with compatible vehicles can enjoy a tailored, iPhone-driven experience, while others await broader availability. As Apple refines Ultra and expands its partnerships, the platform’s ability to coexist with standard CarPlay ensures it remains a key player in automotive connectivity, even as the industry grapples with the balance between innovation and autonomy.