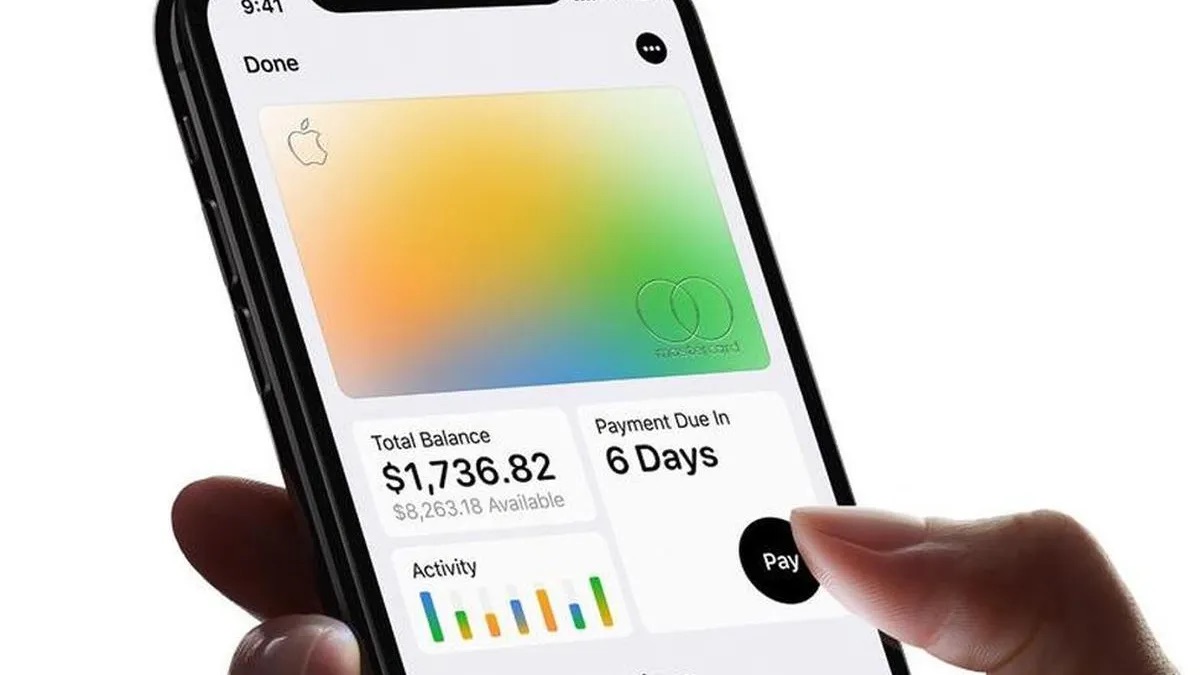

Since its launch, Apple Card has never behaved like a traditional credit card. It was conceived as a native extension of Apple Wallet, designed around clarity, privacy, and real-time control rather than paperwork, fees, or fine print. Now, with Chase announced as the new issuing bank, Chase Apple Card appears ready for its next chapter.

The change in issuer is more than a financial back-end decision. It signals an opportunity for Apple to rethink how Apple Card looks, feels, and evolves inside the broader Apple ecosystem.

A Foundation Built for Digital Wallets

Apple Card arrived with features that felt obvious only after Apple delivered them. Instant spending summaries. Daily Cash rewards. No card numbers printed on the physical card. Everything managed directly from iPhone.

That digital-first philosophy remains intact. What changes with Chase is scale, flexibility, and potential. As one of the largest financial institutions in the U.S., Chase brings infrastructure that can support broader features, partnerships, and expansion, while Apple continues to control the experience layer.

The result is likely a deeper blend of finance and software rather than a departure from Apple Card’s original principles.

What New Features Could Mean

With a new issuer, Apple Card can evolve beyond its current feature set. Expanded financing options, new rewards structures, or tighter integration with Apple Pay and Apple Wallet services become easier to implement.

There’s also room for Apple to rethink how Apple Card works across devices. Closer ties to iOS 26, Apple Intelligence, and Wallet automation could make budgeting, alerts, and insights feel even more contextual and proactive.

The focus is unlikely to be complexity. Apple Card has always favored simplicity. Any new features will likely appear quietly, embedded into daily use rather than presented as traditional banking upgrades.

A Design Opportunity Hiding in Plain Sight

Perhaps the most intriguing possibility lies in the physical card itself. Apple Card’s titanium design set a new standard when it launched. Minimal, weighty, and unmistakably Apple.

Now, with iOS 26 introducing the Liquid Glass design language, speculation naturally turns to whether Apple Card could follow the same visual philosophy. A flexible glass card, translucent or softly diffused, feels aligned with Apple’s current aesthetic direction.

Imagine a card with no printed numbers, just the Apple logo, the Chase logo, and a softly blurred name in white. A magnetic strip integrated seamlessly. A surface that feels more like an object of design than a piece of plastic or metal.

It would not be a gimmick. It would be Apple reinforcing that even physical objects can reflect digital values.

Matching Hardware to Software Philosophy

Apple has a long history of aligning hardware materials with software concepts. Aluminum, glass, and now Liquid Glass are not just visual choices, but metaphors for clarity and depth.

A redesigned Apple Card would extend that thinking into the wallet. The card becomes less about function and more about identity. A physical representation of a digital-first financial life.

With Chase handling issuance and Apple controlling experience and design, the partnership creates space for that kind of experimentation.

A Quiet but Meaningful Evolution

Apple Card has never chased loud updates. Its evolution has been subtle, guided by daily use rather than marketing beats. The transition to Chase fits that pattern.

Users may notice changes gradually. Smoother approvals. Expanded features. Possibly a redesigned card that feels unmistakably new, yet instantly familiar.

In a market crowded with fintech experiments, Apple Card continues to move differently. With Chase now part of the equation, Apple has the opportunity to push the concept further, blending finance, design, and software into something that still feels effortless.

If Apple does choose to reimagine the physical card, it won’t just be a redesign. It will be another reminder that, for Apple, even a credit card can be a piece of art.