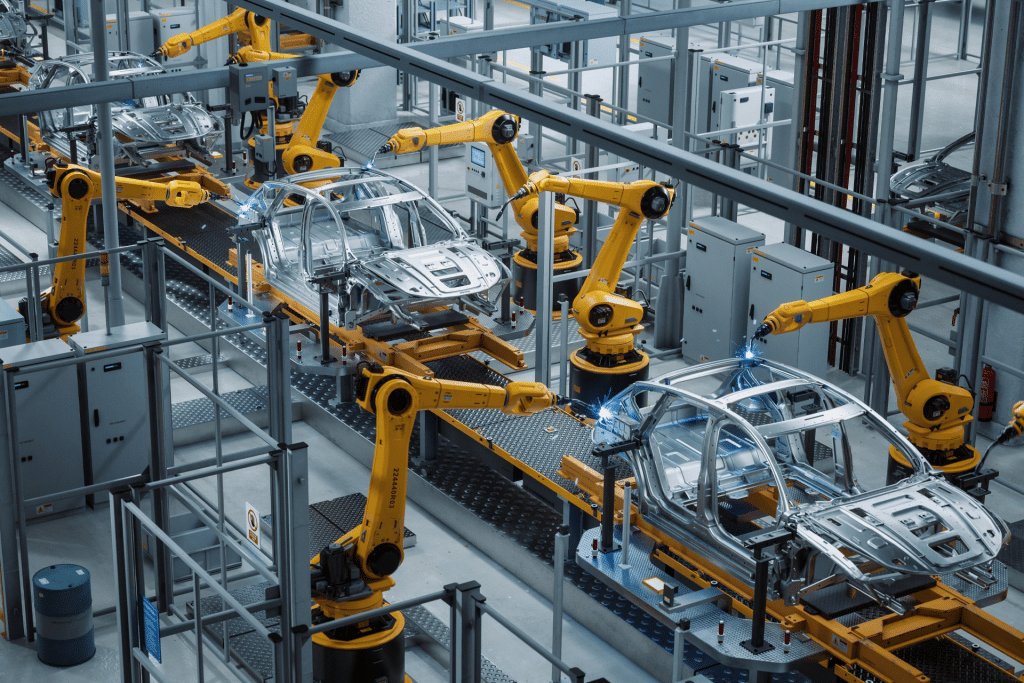

China’s rise as a manufacturing powerhouse has reached a new milestone: it now operates half of the world’s industrial robots. This dominance in automation underscores a dramatic shift in global industry — one where the balance of innovation, labor, and production efficiency is tilting unmistakably toward China, while the United States and Europe struggle to keep pace.Automation at Scale

Industrial robots have become the backbone of modern production, performing precision work in automotive, electronics, and heavy manufacturing sectors. China’s explosive adoption has transformed its industrial landscape in less than a decade. The International Federation of Robotics (IFR) reports that the country now accounts for roughly 52% of all active industrial robots worldwide, with more than 400,000 new units installed last year alone.

To put that in perspective, China now deploys more robots annually than the U.S., Japan, and South Korea combined. Entire manufacturing ecosystems — from car assembly lines in Guangzhou to electronics hubs in Shenzhen — now rely on autonomous systems designed to run continuously, often with minimal human oversight.

The Numbers Behind the Growth

China’s robot density — the number of robots per 10,000 manufacturing workers — has climbed at an extraordinary rate. In 2017, it was below 100; today, it exceeds 400, surpassing the global average and closing in on industrial leaders like Germany and South Korea.

Much of this rise stems from government strategy. The “Made in China 2025” initiative identified robotics and industrial automation as national priorities nearly a decade ago, driving billions in state-backed investment. Domestic manufacturers such as Siasun and Estun, supported by local subsidies, have matured quickly and now compete directly with Japanese and European robotics giants.

As production scales, China’s robotics industry is no longer reliant on foreign imports. It has developed the capability to design, build, and export its own automation systems — a sign of technological self-sufficiency that gives Beijing a powerful edge in shaping global manufacturing standards.

The U.S. Struggles to Catch Up

In contrast, the United States remains far behind in industrial automation. While American firms continue to lead in robotics research and design, deployment remains slow across most sectors. The IFR estimates that the U.S. represents less than 10% of the global industrial robot population, a fraction of China’s share.

Small- and mid-sized manufacturers in the U.S. face steep adoption barriers — high upfront costs, legacy equipment, and a shortage of skilled technicians capable of maintaining advanced robotic systems. Even as major players like Tesla and Amazon embrace full-scale automation, most American factories still operate with a limited number of robots compared to Chinese facilities of similar size.

The result is a widening productivity gap. As China automates at industrial scale, it continues to reduce per-unit manufacturing costs, even as domestic wages climb. The U.S., meanwhile, faces slower modernization and rising labor costs — an imbalance that could reshape global manufacturing competitiveness in the decade ahead.

Implications for the Global Market

China’s lead in robotics reflects more than industrial efficiency; it demonstrates the merging of automation, AI, and data-driven manufacturing into a cohesive national strategy. The rapid spread of robotics across Chinese factories signals a shift toward near-autonomous production lines, capable of adjusting processes in real time based on supply and demand.

That scale of integration gives China leverage over global supply chains. Countries dependent on Chinese components — from automotive parts to consumer electronics — will increasingly rely on factories run by Chinese-built robotic systems. As automation deepens, production becomes faster, cheaper, and less reliant on human labor, altering the calculus of where goods are made and how value is distributed.

What Comes Next

While the U.S. and Europe still lead in high-end robotics innovation, China’s ability to execute large-scale deployment has effectively redrawn the industrial map. The gap between research and application — long a strength of Western economies — is closing fast.

The next phase of the robotics race may hinge not on who invents the most advanced systems, but on who can integrate them across entire industries. For now, the country leading that transformation is already clear — and its factories are running day and night to prove it.