Is it the beginning or the end?

As 2013 hurtles to its conclusion, the debate on 2014 has just begun: Is the tech industry on the verge of a renaissance, or is the bubble about to burst? The glass-half-full types point to Twitter’s titillating IPO; the other half insist that’s when investors cashed in on social media’s hype.

The truth, as always, is somewhere in the middle. It’s indisputable Twitter’s public offering will usher in a wave of IPOs. But the payoffs may not match the froth of the microblogging service, forcing would-be IPO candidates to seek corporate suitors. Twitter shares are hovering near $65, up 44% from Nov. 6, its opening day of trading.

The social-media storm comes against a backdrop of wrenching changes. Tech’s old guard — Microsoft, Hewlett-Packard, Dell and Cisco Systems — continues to wrestle with the slowly dying PC market; smartphone sales, meanwhile, are expected to top 1 billion in 2014 — roughly three times the population of the USA. (By early October, there were more than 1.5 billion smartphones in use worldwide.)

The fertile mobile advertising market — expected to more than double from today to $25 billion in 2016 — is inflating the boom, creating the promise of profitable companies at warp speed. Venture capital firms will raise more money in 2014 than the $28 billion in 2007, according to Venture Economics.

“Consumers are spending much more, percentage-wise, on technology. It is evolving at a pace I have never seen in my 30 years in the field,” says Tom Kilroy, executive vice president of sales and marketing at Intel. “The ‘Internet of Things’ is what we used to call embedded technology — in cars, hotels, billboards.”

Boom II is different on several fronts, however. Incubators, angel investors and individuals are plowing cash into start-ups, sparing consumers from being burned. “Consumers got hurt the first time,” says Kevin Rose, general partner at Google Ventures and co-founder of several start-ups, including news aggregator Digg. “Now, some well-off people may lose a small chunk of change.”

This tech boom is fundamentally different from the one in the 1990s in another way. Established companies base their headquarters here instead of Silicon Valley, shifting the center of gravity farther north.

Last year, venture capital firm Benchmark Capital opened a satellite office close to the Tenderloin neighborhood. Spotify is there, with Twitter and Square in mid-Market Street.

Tech executives either live in San Francisco or maintain homes here. Yahoo CEO Marissa Mayer has a high-rise penthouse near Powell, and Facebook CEO Mark Zuckerberg bought a house, then adjoining lots, in San Francisco.

Divining 2014

It all made for one of the most tumultuous years in tech, and set the stage for riveting theater over the next 12 months. Several themes bear watching in 2014:

–Changing of tech guard?Behind an avalanche of products and ads that simply overwhelmed Apple and other consumer-electronics companies this year, Samsung Electronics has put itself on the precipice of supplanting Apple as Silicon Valley’s leading consumer-electronics brand.

In other industries, this would be considered a defining moment, akin to Pepsi overtaking Coca-Cola.

The moment has had an air of inevitability among some industry experts after months of watching the $288 billion Korean consumer-electronics behemoth “kill it” with a barrage of ads, the Gear smartwatch and a profusion of new smartphones and tablets in the U.S. More are expected at the CES tech show in Las Vegas next month. Analysts estimate Samsung will ship more than 350 million smartphones this year.

“Could Apple ever lose the cool, innovative tag to Samsung?” asks independent analyst Jonathan Yarmis. “It’s not out of the question. And it would be a cheaper alternative.”

Samsung lacks star power but is built on an intricate hierarchy, and slowly but surely intends to raise the profiles of executives.

“In 2013, our Galaxy S and Note series of smartphones achieved sales of 100 million units, and we expect to be No. 1 in both shipments and revenue for handsets and smartphones this year,” says J.K. Shin, head of IT and mobile communications at Samsung.

–Crisis of confidence? Two years after the death of Steve Jobs, Apple has quietly — and intentionally — distanced itself from its mythical co-founder.

The company is reluctant to comment on Jobs’ lingering impact, and officials are visibly uncomfortable when his name is uttered. The reasoning mirrors what Disney went through after the death of Walt Disney: It’s unfair to the current executive team, and it reminds the American public of the not-so-distant glory days.

Don’t cry for Apple, however. It not only has a mountain of cash (about $150 billion) and just signed a multiyear deal with China Mobile but enjoys a huge edge in design, user loyalty and perceived ingenuity. Marc Andreessen, who sits on the boards of HP and Facebook, has pointedly said Asian companies such as Samsung are hamstrung by a me-too business approach that favors the team over the flashy individual.

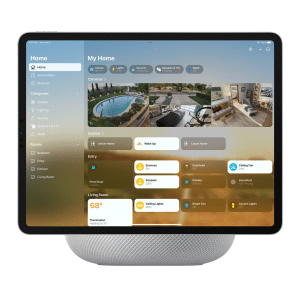

The countdown for the rumored Apple iWatch is on, too, with bets on a late 2014 release. Apple’s biggest product launch since iPad in 2010 could go a long way toward cementing its status among consumers if done right.

“Apple takes time to get things right — it redefines markets,” Rose says.

–The Next Big Things? Cryptocurrency and wearable computing devices captivated — and confounded — tech pundits and consumers.

Despite skepticism about its value, Bitcoin prices topped $1,000 in November amid signs it was breaking into mainstream use. Start-up Gyft, a mobile gift-card company backed by Google Ventures, recently joined the fray with a holiday reward program tied to more than 200 retailers, including Amazon.com’s Zappos and Gap.

“It’s a commodity now, but it will be a phenomenal currency soon,” says James Beshara, CEO of Crowdtilt, which has integrated Bitcoins in its mobile crowd-sourcing platform.

Bitcoin prices have cooled since, closing at above $670 on Monday.

“It is an interesting innovation, but we have not invested in it until there is regulatory clarity and until these companies find a stable bank partner,” says Alex Ferrara, a partner at Bessemer Venture Partners.

Meanwhile,Google’s head-mounted Glass computer may have been derided for its retro-nerd look, but keep in mind it is a long-term work in progress. By the time it reaches its final form in a few years, it could be contact lenses, film coated onto prescription glasses or glasses that interact with a wristband.

Eric Hippeau, managing director at Lerer Ventures, an angel fund specializing in tech start-ups, envisions an era of connected devices, in which most apps will be built with the same technology.

Cumbersome and expensive IT apps, for example, will be displaced, says Hippeau, who previously was CEO of The Huffington Postand a longtime Yahoo board member.

–Soaring to new heights? There seems to be no end to Google’s trajectory. Fifteen years after it was started by CEO Larry Page and Sergey Brin, the search behemoth appears as inventive and financially stout as ever. It topped $50 billion in sales for the first time this year, its stock eclipsed $1,000 a share, and it is rolling the dice on big ideas that Page calls “moon shots.” Projects range from Google Glass and driverless cars to robots, an anti-aging start-up and high-altitude balloons that provide Internet access to remote areas.

“The way Google runs is a sort of bizarre, bottoms-up innovation model, where people are encouraged to think outside the box,” Google Chairman Eric Schmidt told USA TODAY in an exclusive interview in September. “These ideas actually came from the bottom up.”

Added Sundar Pichai, senior vice president of Android, Chrome and apps at Google: “Our goals are ambitious — some would say crazy — but we believe big thinking and constant innovation can lead to transformative technology that can help change people’s lives for the better.”

Google alum Marissa Mayer oversaw a reclamation/rejuvenation project at Yahoo, with a slew of acquisitions, including Tumblr. She may just be warming up. “We’ll keep you guessing even better next year,” a smiling Mayer told USA TODAY, hinting at even more acquisitions, at a holiday party in December.

Shares at LinkedIn and Facebook, meanwhile, soared to records, a testament to strong financial results. Facebook, in particular, continued to refresh its product. The latest addition? Video ads, although CEO Zuckerberg admitted to USA TODAY that the company does a poor job of bracing its more than 1 billion members for change.

And then there was Jack.

Squaring off

Square CEO and Twitter co-founder Jack Dorsey was the poster boy for tech in 2013 — just look at the cover of any major publication, including this one. Both of his companies moved into snazzy new digs this year and, with Twitter stock performing well, expect a Square IPO in 2014. “I don’t think of (Silicon Valley’s current feverish climate) as a bubble or resurgence,” Dorsey said on a visit to USA TODAY’s New York bureau in September.

The business models of today, he said, are “more substantial in providing value.”

–Somewhere in between.While BlackBerry and Dell continued slides into irrelevance, PC juggernauts Microsoft and Hewlett-Packard soldiered on in a market increasingly dominated by smartphones and tablets.

The PC is far from dead — just walk into any office building in America and look at most cubicles — but both companies are betting heavily on mobile devices. Microsoft Surface 2 sales showed signs of life, and HP reported better-than-expected fourth-quarter net income of $2 billion on $29.1 billion in sales.

“We’re excited about things to come” with new HP tablets next year, HP CEO Meg Whitman said after the 74-year-old company announced strong quarterly financial results last month. “The innovation engine is alive and well here.”

BIG BROTHER, MEET BIG DATA

We interrupt this year in review to bring you Big Brother.

The National Security Agency’s staggering ability to eavesdrop and hack rich troves of data from the likes of Google, Microsoft, Facebook and Apple splashed cold water on the public’s trust in tech and its ability to secure private information such as bank and medical records.

The largest tech companies vowed to fight back, with a mix of enhanced computer security, lawsuits, calls for great legislative oversight and public relations spin. But it remains to be seen whether any of the efforts will thwart the government’s unquenchable thirst for national security in a post-9/11 world.

Speaking of tech gone wild, the website for the Affordable Care Act, HealthCare.gov, was a muddled mess that called into question the government’s ability to oversee its own legitimate online operation.

Hacking and online trickery reached a head this month, when Target admitted that credit and debit card numbers for some 40 million people who shopped at the retailer were stolen.

It was the latest in a string of high-profile breaches that underscored that modern-day crooks, like their predecessors, are “focused on (stealing) cash — and the easiest way of getting money in today’s world is stealing credit card records,” says Vince Steckler, CEO of anti-virus company Avast Software.