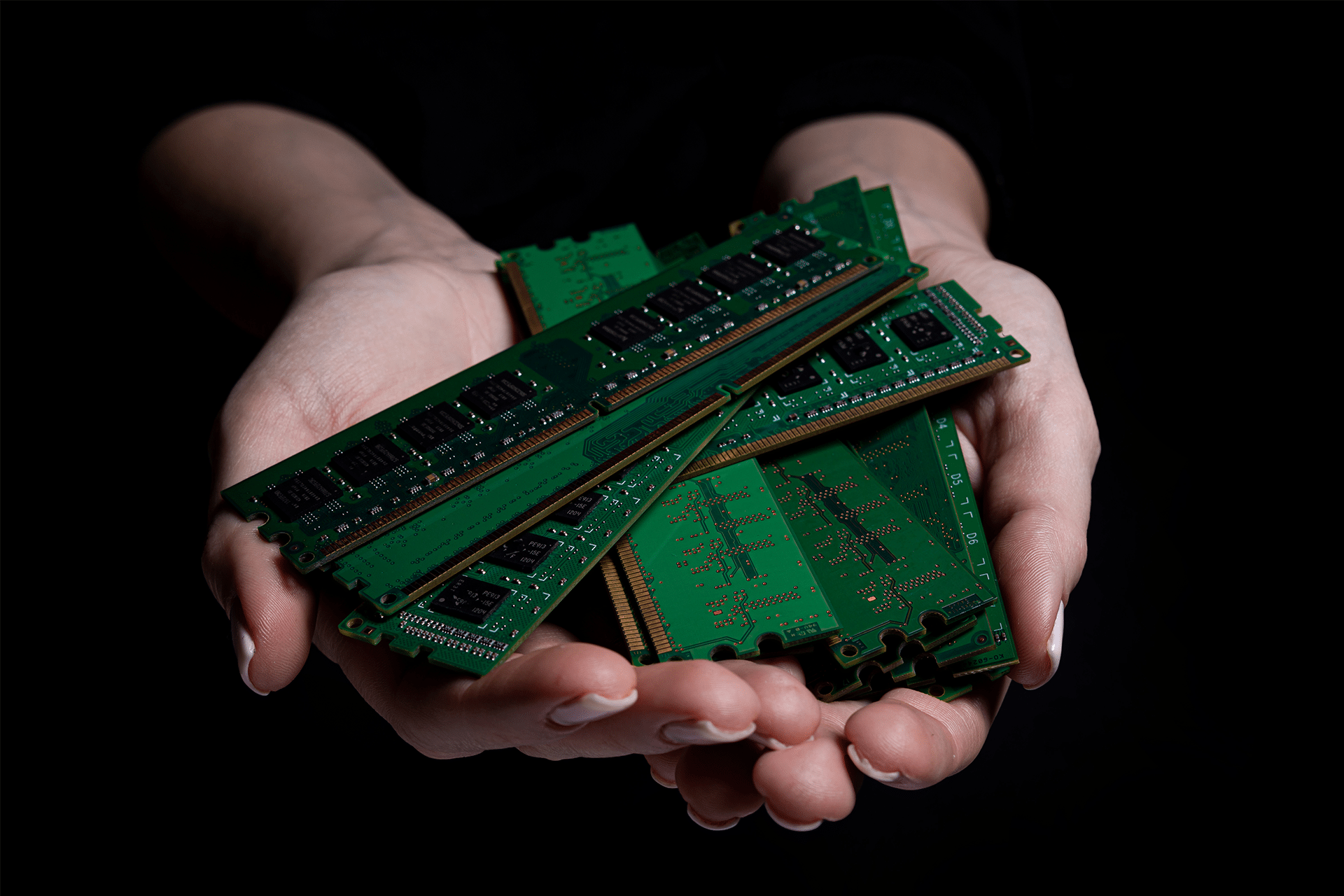

Global memory supply growth, including DRAM and NAND, is expected to slow significantly in 2026 as production capacity is increasingly directed toward high-bandwidth memory used in artificial intelligence infrastructures rather than consumer electronics. Market analysis firm IDC forecasts that DRAM supply growth may fall to around 16 % in 2026, well below historical norms, creating a bottleneck for device makers that rely on memory for smartphones, tablets, and laptops. This supply constraint is anticipated to drive up memory prices and influence device billing components, particularly for premium hardware.

Smartphone Market Impact and Price Pressures

Memory now represents a notable portion of the bill of materials for modern smartphones, and rising DRAM prices are expected to translate into higher average selling prices (ASPs) for devices in 2026. Counterpoint Research projects that memory prices could rise as much as 40 % in the first half of the year, contributing to an overall increase in smartphone ASPs by nearly 7 %, with some base models of premium phones — such as large-screen flagship models — potentially moving higher in price as manufacturers navigate memory cost pressures.

Data from IDC indicates that constrained memory supply, combined with strong demand, may also contribute to a modest contraction in global smartphone shipments in 2026. While large, diversified manufacturers such as Apple and Samsung are expected to be better positioned to absorb cost pressures, lower-end market segments may feel the impact more sharply due to tighter margins and limited ability to negotiate supply agreements.

PC and Notebook Market Effects

The PC and notebook markets are also seeing price pressures from rising memory costs. Memory shortages combined with other component constraints are influencing pricing strategies for consumer laptops and desktops. Analysts have warned that PC prices could rise as manufacturers seek to balance increased memory costs with overall production expenses, particularly as AI-ready PC configurations require larger memory capacities that further stretch constrained DRAM supply.

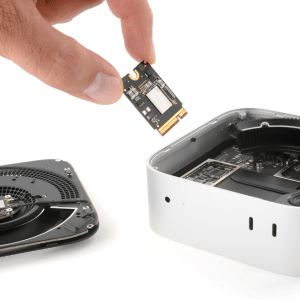

Shifting Memory Allocations and Hardware Trade-Offs

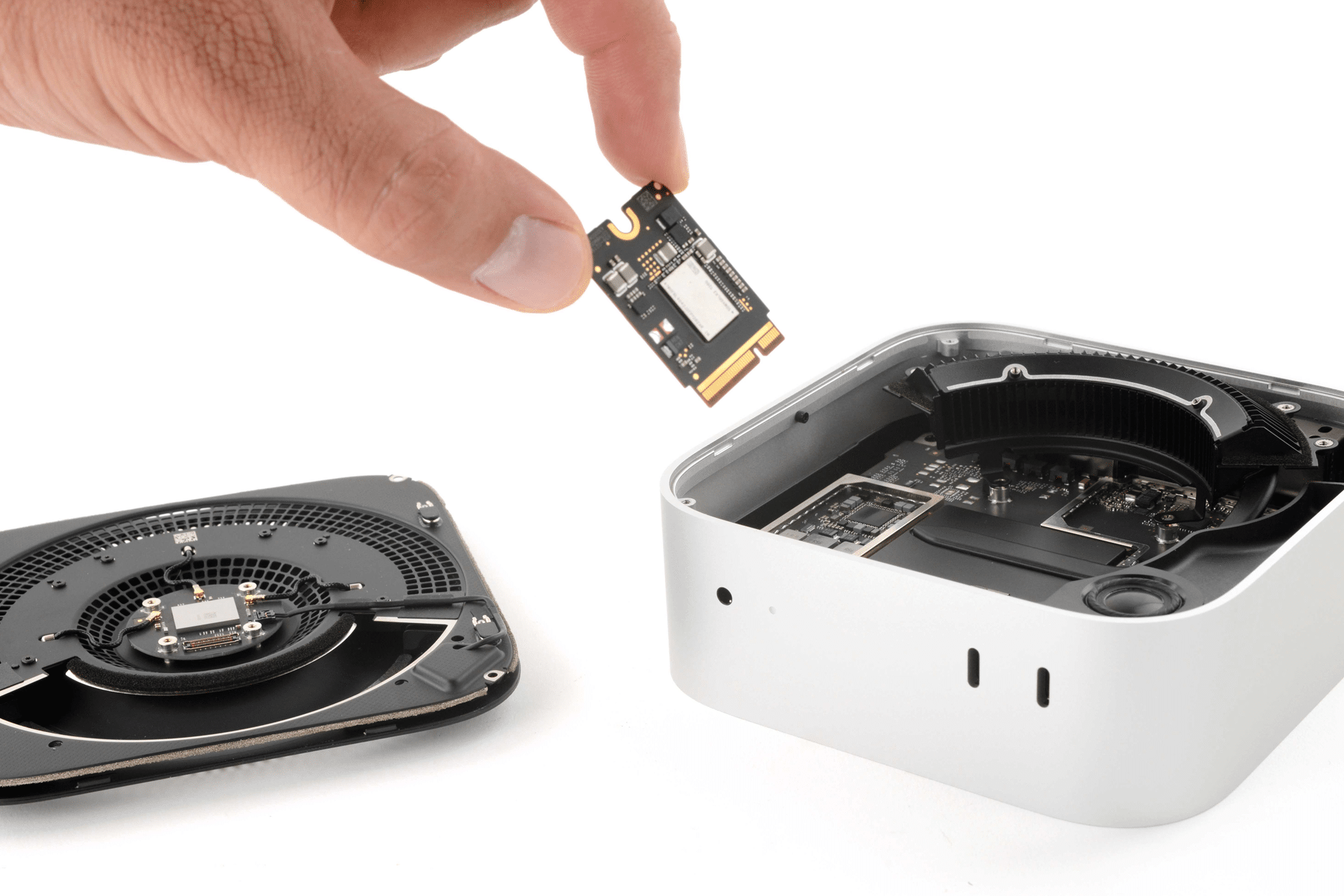

Under present trends, memory suppliers are prioritizing production of high-bandwidth memory and server-grade solutions for enterprise and AI data centers, leaving less capacity for the DRAM used in everyday devices. This has the effect of elevating prices for mobile memory formats (such as LPDDR variants) and making negotiation for long-term supply agreements more critical for companies building consumer hardware. Samsung’s pricing actions — including reports of contract price increases for memory chips of 30 % to 60 % amid tightening supplies — underscore how suppliers are leveraging the current imbalance between supply and demand.

For device manufacturers like Apple, which historically secures significant memory capacity through long-term partnerships with suppliers, rising memory costs remain a strategic concern. While Apple’s supply chain advantages help insulate it from short-term volatility, ongoing memory cost rises could influence future contract negotiations and device cost structures, especially as legacy contracts approach renegotiation periods.

Long-Term Memory Price Outlook

The memory market is anticipated to remain tight through much of 2026 — and possibly into 2027 — as new DRAM production capacity required to alleviate shortages takes time to come online. Major memory producers such as Samsung, SK Hynix, and Micron are balancing legacy memory production against escalated enterprise and AI demands, with industry sources suggesting that memory pricing pressure will persist until expanded capacity can meet both consumer and enterprise needs.

As a result, consumers may face higher device prices or adjustments in hardware configurations, while manufacturers work to maintain feature sets, margins, and competitive positioning in an industry increasingly shaped by memory supply constraints.