Globalstar is exploring a sale, with SpaceX among potential buyers in early discussions. The satellite operator, key to Apple’s iPhone emergency features since 2022, disclosed the review in late October 2025. Apple holds a 20% stake and committed $1.5 billion for network expansion, including new satellites and ground infrastructure.

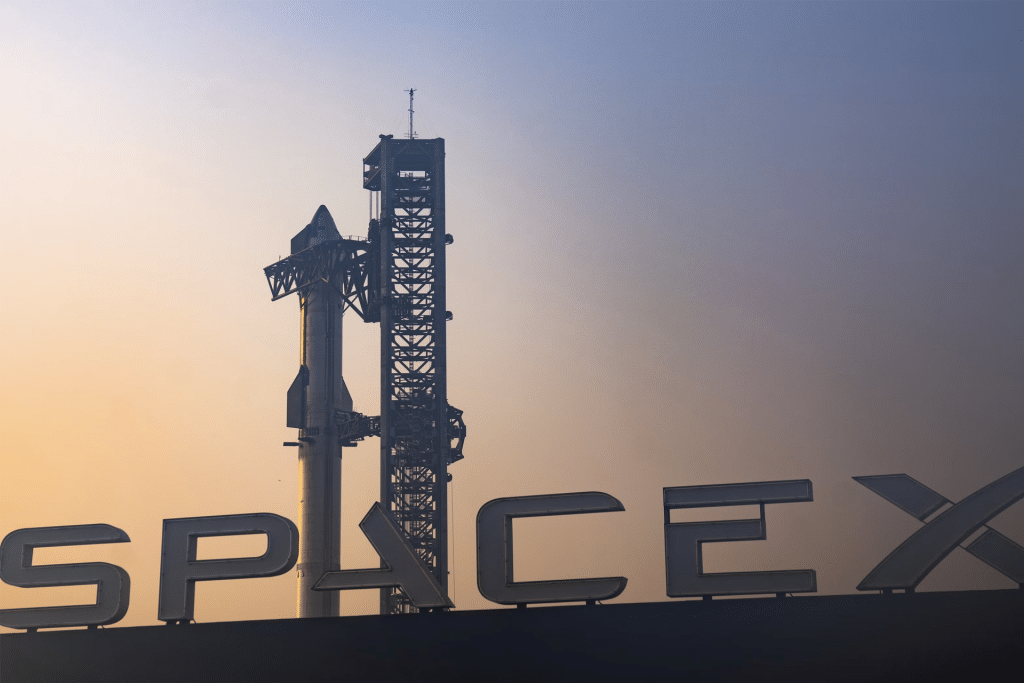

Reports from Bloomberg indicate Globalstar’s chair James Monroe discussed a valuation over $10 billion, above its $5.3 billion market cap. Microsoft declined similar terms in past bids, but SpaceX’s interest aligns with its Starlink upgrades. SpaceX added support for Apple’s satellite spectrum in recent designs, potentially enabling iPhone integration.

Apple’s partnership began with iPhone 14’s Emergency SOS, using Globalstar for messaging in cellular dead zones. The service expanded to iMessage and emojis, with 85% network capacity dedicated to Apple. Globalstar’s 31 satellites, plus 26 more launching via SpaceX, support these functions. Apple’s $1.1 billion cash and $400 million equity stake fund upgrades, including debt reduction.

Satellite Market Dynamics

The direct-to-device sector grows with players like SpaceX’s Starlink, AST SpaceMobile, and Iridium.

SpaceX’s T-Mobile partnership offers texting and data, including Apple apps, upgrading to LTE speeds via EchoStar spectrum acquisition. Globalstar’s sale could consolidate options, affecting iPhone users reliant on its network for safety.

Apple’s investment secures capacity through 2025, but a SpaceX deal might shift spectrum use. Musk pitched Apple in 2022 for Starlink partnership, offering alternatives to Globalstar. Recent FCC approvals allow Starlink emergency texts, competing directly.

Globalstar earned $74.2 million from Apple in 2023, boosting revenue 50%. The RM200M IoT module launch on October 21 adds revenue streams. A sale could value upgrades, but antitrust concerns arise from SpaceX’s dominance, with 60% of active satellites as Starlink.

iPhone Satellite Implications

For iPhone users, Globalstar powers core satellite texting, free until 2025. A SpaceX acquisition might integrate Starlink, upgrading to voice and data, but requires Apple approval. Current features use L-band spectrum, which SpaceX now supports.

Apple’s Advanced Data Protection enhances privacy, but satellite requests follow U.S. CLOUD Act. Users in remote areas benefit from options like Verizon’s Skylo or AT&T’s AST partnerships.

Globalstar’s independence remains possible, focusing on IoT and upgrades.