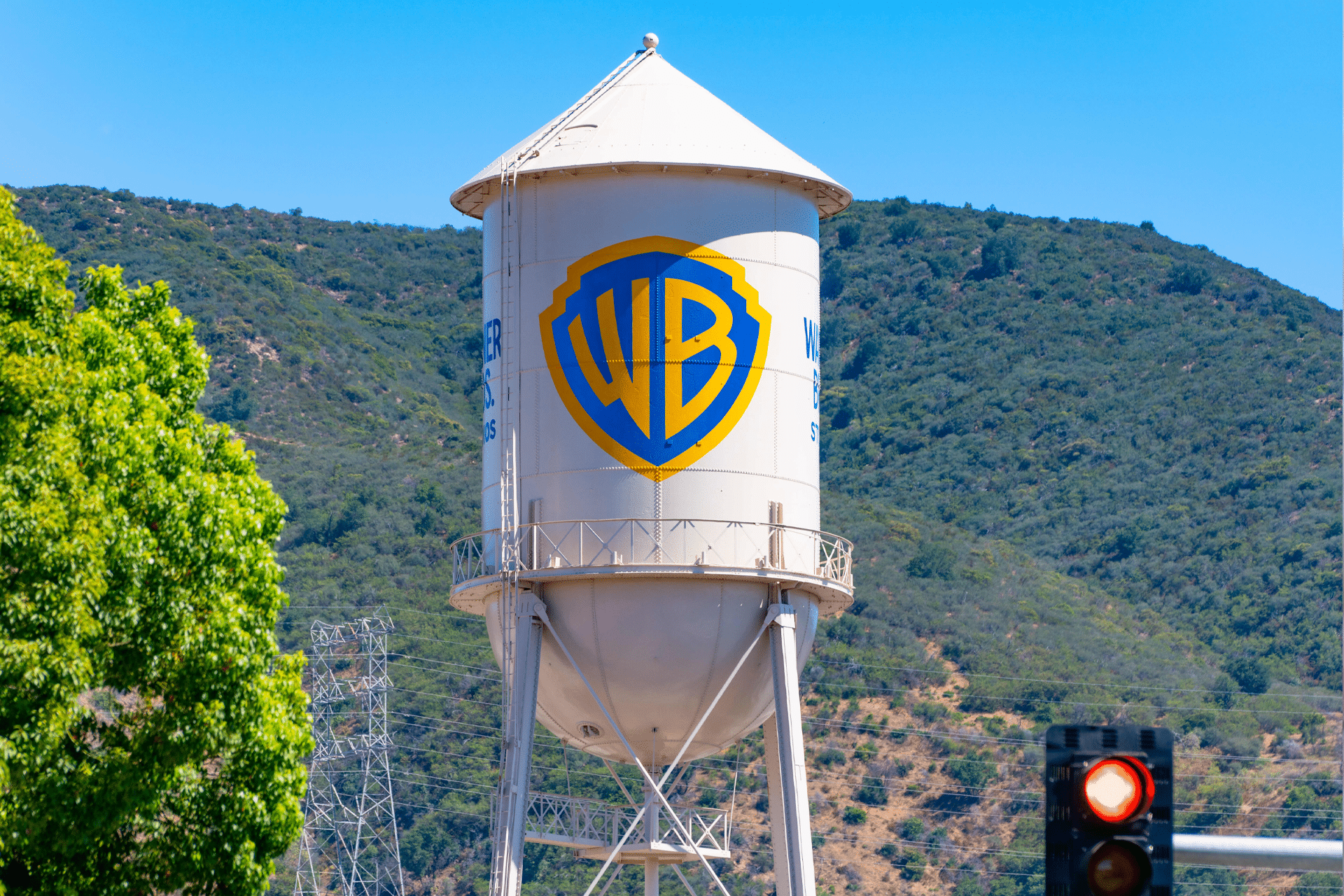

Hollywood consolidation battle intensified this week as Warner Bros. Discovery and Paramount became locked in a high-stakes corporate struggle that could redefine the future of major studios, content licensing and streaming distribution. The clash emerged after Warner Bros. Discovery reached an agreement to sell its film studio and streaming business to Netflix, a move that immediately triggered a hostile acquisition attempt from Paramount and its partner Skydance. The competing plans have placed the industry at a pivotal moment, with both sides working to secure control of some of the most influential entertainment assets in the world.

The dispute began when Warner Bros. Discovery confirmed its intention to divest core studio operations and shift toward a new strategic structure built around two separate companies. Soon after, Paramount launched an unsolicited bid to acquire the entire Warner Bros. Discovery organization, including film and television production, networks and historically significant intellectual property. The offer, which has been raised multiple times, introduced a public and unusually personal contest between the companies as they attempt to persuade shareholders and regulators. Reports from insiders quoted representatives of each side describing the other as either overly reactive or unwilling to reconsider a missed opportunity, signaling growing tension surrounding the negotiations.

What’s at Stake as Two Hollywood Giants Compete for Control

The assets under discussion include iconic movie studios, deep content libraries, globally recognized franchises and distribution networks that reach hundreds of millions of viewers. These properties influence not only film and television production but also licensing, merchandising, streaming development and long-term audience strategy. Because ownership determines which platforms control tentpole franchises and back catalogs, the outcome could shape creative decisions across the industry for years.

Warner Bros. Discovery’s plan to split into two businesses aims to preserve certain divisions while selling others to Netflix, potentially reducing regulatory pressure and creating clearer financial pathways for remaining segments. Paramount, by contrast, is seeking to consolidate all assets under a single umbrella through its takeover bid. This has raised broader questions about how much consolidation the entertainment sector can absorb before regulatory bodies intervene. Analysts warn that combining large swaths of Hollywood into a single conglomerate could reduce competition and limit creative diversity, while the alternative — a sale to a dominant streaming platform — carries its own implications for distribution models and market leverage.

Regulators and shareholders now face a complex landscape. The size of the proposed deals, combined with the cultural and economic importance of the studios involved, means any decision will undergo significant scrutiny. The future structure of the companies will influence where major productions are financed, how streaming libraries are built and who gains access to the intellectual property that underpins much of the entertainment marketplace.

How the Conflict Reflects the State of Modern Entertainment Economics

The struggle between Warner Bros. Discovery and Paramount underscores the shifting economics of Hollywood. As streaming platforms continue to reshape audience behavior, studios are under increasing pressure to stabilize revenue, streamline operations and secure scale advantages. The costly nature of content production has pushed traditional studios to consider mergers, divestitures and restructuring plans that were unthinkable just a decade ago.

At the same time, global streaming services seek exclusive libraries and recognizable brands that can anchor subscription growth. Netflix’s interest in acquiring studio assets from Warner Bros. Discovery reflects its ambition to expand beyond licensed titles and build deeper vertical integration. Paramount’s competing bid shows that legacy studios are unwilling to cede territory without exploring aggressive options of their own.

Partners remain focused on developments, as each decision could alter green-light authority, budgeting processes and platform availability. Employees across both companies are also watching closely, given that mergers and split-offs often lead to organizational changes that affect staffing, leadership roles and long-term project planning.

Paramount may continue adjusting its bid to gain support, while Warner Bros. Discovery will weigh whether its split-and-sale strategy delivers the most stable outcome. Meanwhile, global regulators may begin preliminary evaluations to assess how the proposals would affect competition within the entertainment sector and adjacent markets such as streaming technology and international distribution.

With the future of multiple studios, streaming businesses and decades of intellectual property in play, Hollywood’s current power struggle represents one of the most consequential turning points in its modern history. The final structure that emerges from the confrontation will influence how stories are financed, who controls major franchises and how audiences worldwide experience film and television in the years ahead.