Apple Pay is a mobile payment system that was introduced by Apple in September 2014. It allows customers to pay for goods and services using their iPhone, iPad, or Apple Watch. In this blog post, we will compare Apple Pay to other real money payment methods. When choosing a payment method, make sure you can use it in the best real money casino sites. You can find a list here of the best real-money casino sites. Let´s look at the pros and cons of each payment method to help you decide which one is right for you!

Apple Pay vs Paypal

Users can make purchases on the internet without having to log in or type in any payment information using Apple Pay payments on Safari. Users may quickly and safely fill out their payment, shipping, and contact information with Touch ID or double-click their Apple Watch to checkout.

PayPal is an e-commerce company that allows businesses and people to send money and accept payments without revealing any financial information.

Although Paypal is accepted on 1,666,959 websites from categories such as technology, lifestyle, entertainment, art, games, and 20 more categories. While Apple Pay is only accepted on 627,926 websites and hasn’t got a lead over PayPal in any websites category, having PayPal more than 1 million websites of advantage.

PayPal is the global leader in most nations, including the United States, United Kingdom, Germany, France, and 162 other countries. However, Apple Pay is present in 50 countries, including the United States, United Kingdom, Canada, Australia, and China.

Apple Pay offers similar features to PayPal but is limited to Apple devices.

When it comes to security, both payment methods use state-of-the-art encryption technology. However, Apple Pay may have an advantage because it uses Touch ID or Face ID which adds an extra layer of security.

Another difference between the two payment methods is that PayPal can be used for peer-to-peer payments while Apple Pay cannot.

Finally, when we compare the fees charged by each company, PayPal charges a fee of $0.30 plus % of the transaction while Apple Pay has no fee for debit card transactions and a 0.15% fee for credit card transactions.

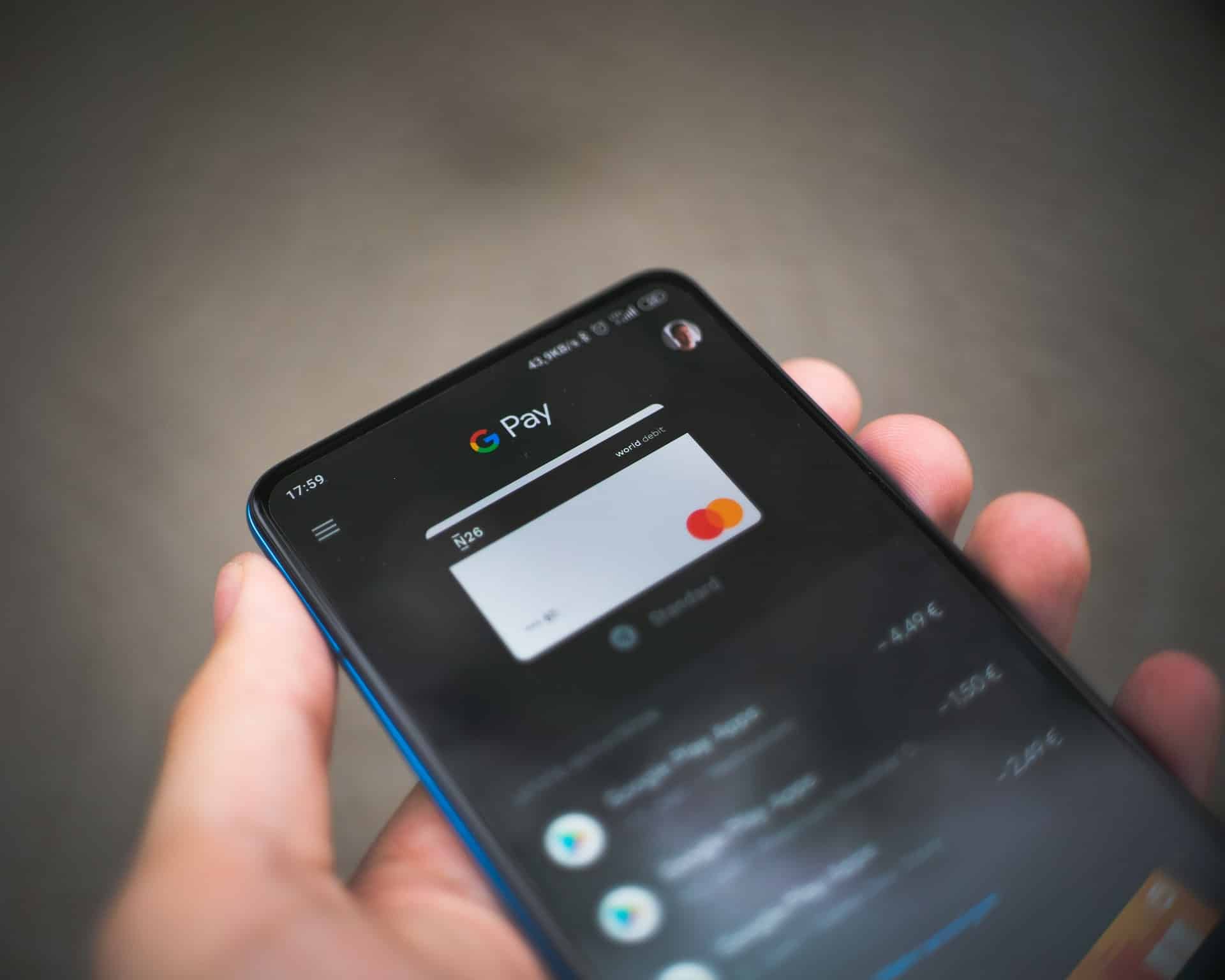

Google Pay

Both Apple Pay and Google Pay have widely accepted payment platforms. Apple Pay and Google Pay are pretty similar. Apple may be simpler to use, but Google offers good features. Both systems employ near-field communication (NFC) technology for contactless payment, yet their implementations are somewhat different.

Google serves as a go-between and keeps track of your payment data on its computers, whereas Apple has made it clear that it will not keep track of your transactions.

Apple Pay is available on all iPhone models with Face ID or Touch ID (except the 5s), iPad models with either Face ID or Touch ID, Apple Watch Series 1 and newer, and Mac computers with Touch Bar or built-in fingerprint sensor.

Instead of using a password, Google employs an old-school PIN system for authentication. This makes it compatible with less updated hardware.

If you use Google Pay or Apple Pay, making an online purchase is as simple as opening the App or website and verifying the transaction with your PIN or Touch ID.

Web Money

WebMoney Transfer is a global payment system that allows businesses to operate online. In this case, Apple Pay takes the leading in the market share, with 627,926 websites accepting the Apple payment option versus 30,446 accepting WebMoney transfers. In all categories, WebMoney is trailing significantly behind Apple Pay.

Regarding geography, In most countries, such as the United States, United Kingdom, Canada, Australia, and 160 other nations around the world, Apple Pay is ahead. While WebMoney takes the lead in Russia.

Speaking of security, both platforms offer state-of-the-art encryption technology. However, Apple Pay may have an advantage because it uses Touch ID or Face ID which adds an extra layer of security.

When it comes to fees, WebMoney has a 0.75% fee while Apple Pay has no fee for debit card transactions and a 0.15% fee for credit card transactions.

Finally, when we compare the two payment methods, we can see that they are quite different but both offer a secure way to make online payments. If you are looking for a simple and easy-to-use payment method, then Apple Pay is the better option.

So, what is the best real money payment method? It depends on your needs. If you are looking for a simple and easy-to-use payment method, then Apple Pay is the better option. However, if you need a payment method that is accepted in more countries and offers more features, then PayPal is the better choice. Whichever payment method you choose, make sure to do your research to ensure that it is the best fit for you.