Breaking down technological barriers, so that customers have access to goods and services quicker, has been one of the enhancements the digital revolution has brought to everyday life.

One sector in which the introduction of iOS apps, rather than having to fire up a website via a mobile browser, has really paid dividends, is in trading and investing.

In days gone by, the trading of stocks, foreign currencies, and other assets were considered to be a passive form of investment, i.e. you acquired the stock, waited a period of time, and then sold at (hopefully) a profit.

However, many contemporary trading strategies involve more active, hands-on investments, whether that’s in trading swings in the value of an asset or even scalping small, consistent profits throughout the day.

That was possible through a browser, however, the introduction of specific trading iOS apps like eToro has taken this mini-sector to the next level.

By the minute

The key for active traders is time.

They need access to the markets at the touch of a button, enabling them to open or close a position when the indicators – be they technical patterns found during analysis or breaking news stories – emerge.

The barrier to that used to be slow or intermittent internet connections, which would naturally hamper the individual’s ability to get in or out of the market on demand. Or, in some cases, simply firing up a laptop or desktop computer was a lengthy and time-consuming process.

But the power of iOS trading apps and software is that they afford the individual instant access to stock markets around the world, enabling investors to buy and sell at particular moments or set Take Profit and Stop/Loss orders to ensure they can manage their assets even when they are unable to manage their positions themselves.

Information is king

Of course, successful traders don’t just buy stocks and assets at random.

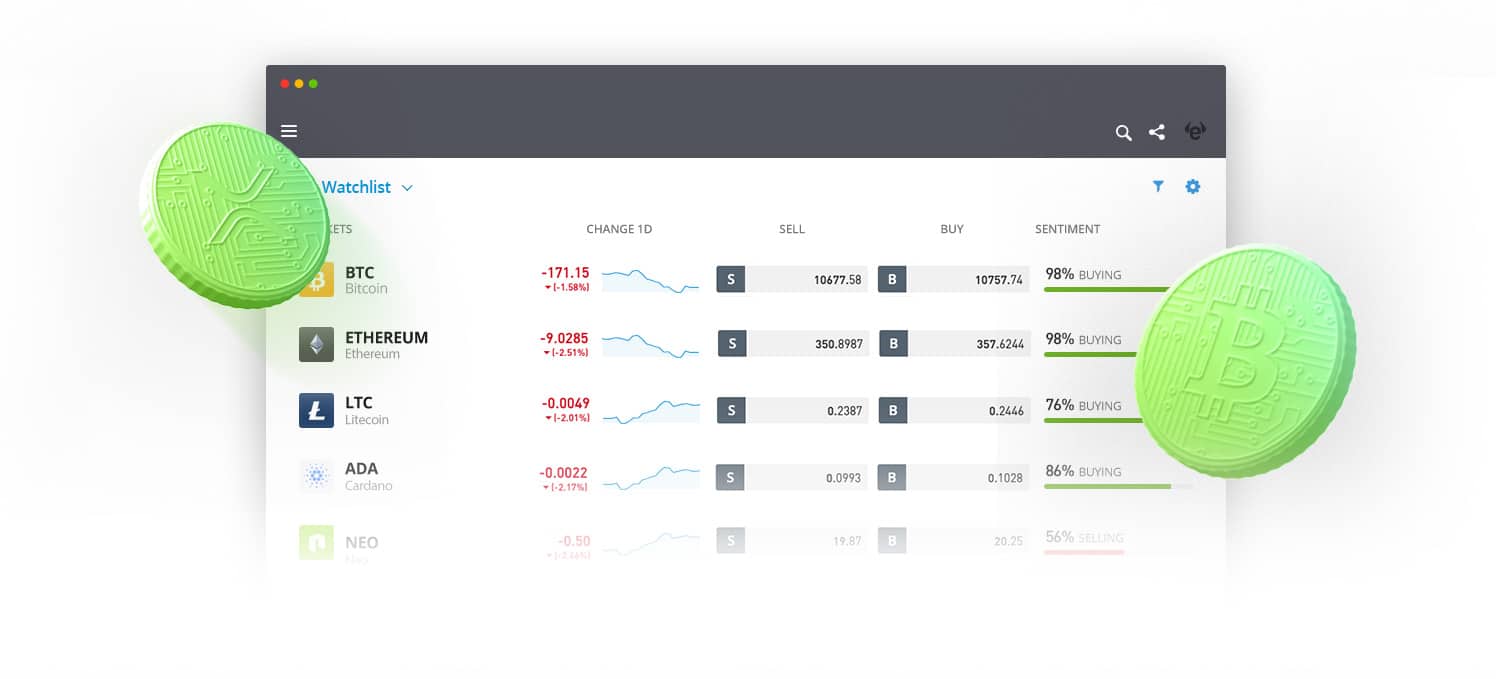

Instead, they utilize many different tools, indicators, and charts that display a wealth of information, particularly how an asset has performed over a given period of time using various mathematical formulae.

The leading iOS trading apps present this information to their users in easy-to-digest charts and graphs, and that has opened the door somewhat to beginners and casual traders to take their ‘game’ to the next level.

The price is right?

We live in a culture where it is an expectancy that apps will be free to download, with in-app purchases available if necessary.

This is true with trading apps like eToro, which are freely available from the App Store at the touch of a button.

Many offer zero commission on trades, which is an incredibly attractive proposition for investors operating on a smaller budget.

That’s not to say there aren’t fees to pay though. Some trading apps will charge you for holding an asset over the weekend, while the instant nature of app trading means that users won’t always get the best spread when it comes to closing out a position – meaning that some of your profits may be lost during the sale.

Is app-based trading too easy?

The fact that app-based investors are able to access the markets instantly is considered almost a universally positive thing…. almost being the key word.

However, there is a fear that, with no barriers to entry, more and more casual traders are entering the market.

No problem, you might think. But it’s worth remembering that real money is at stake, and bad decisions taken by those who perhaps haven’t finely tuned their trading strategy yet can have serious consequences.

It’s similar to betting on sports or spinning the roulette wheel…. without informed analysis and research, investments can go bad. And that typically means that hard-earned money is metaphorically flushed down the toilet.

However, stock trading, in particular, can have an addictive quality to it, and with more and more people giving investment apps a try during the Covid pandemic, there are fears that those uneducated in the harsh realities of trading could be in for a nasty shock.

Professor Gurdgiev, an economics teacher at Trinity College in Dublin, told the BBC that the ‘fear of missing out’ and the herd mentality can lead to bad decisions.

“Research shows that enhanced access to trading, and the perception of the lower cost that these platforms offer, leads to excessive risk-taking and over-trading by retail investors,” he added.

The democratization of investing has to be considered a good thing, and especially so where young people – with access to trading-based iOS apps – can think about their financial futures and look to enhance their wealth.

But, as ever, caution is advised – only invest what you can afford to lose.