The CIRP report peels back the curtain on who buys the iPhone SE and why. A striking 45% of SE owners previously wielded “number” iPhones—like the 12 or 14—before opting for the cheaper SE. Only 26% upgraded from an older SE model, meaning most aren’t hooked on a legacy form factor or nostalgic design. They’re downgrading deliberately, prioritizing affordability over the latest bells and whistles. At $170 more than the SE, the iPhone 16e asks these users to pay up for features they’ve already shown they can live without.

Breaking Down the Numbers

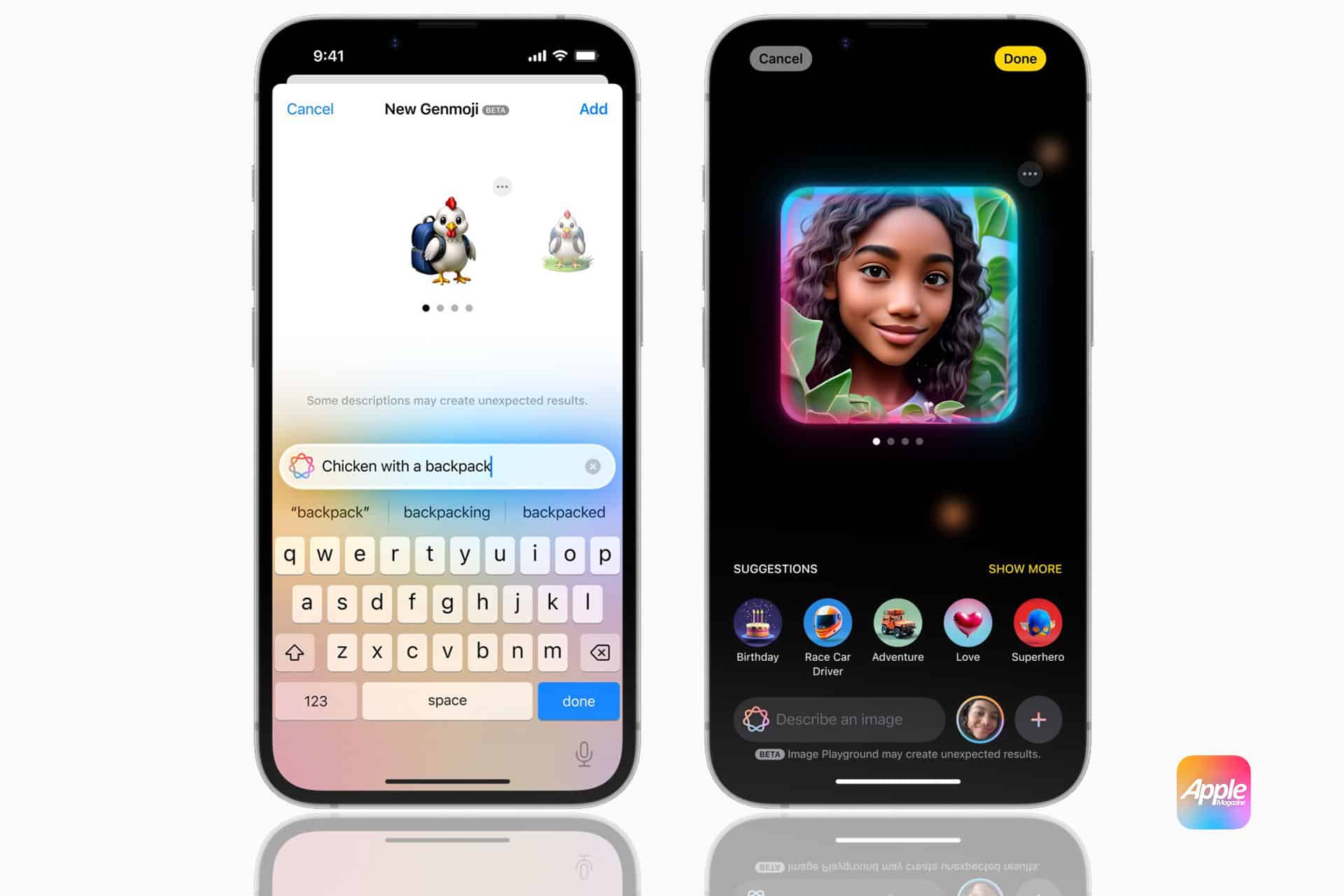

The survey paints a vivid picture: SE buyers are a pragmatic bunch. Many pair their phones with budget carriers or prepaid plans, skipping the trade-in discounts big networks offer. Apple’s betting the 16e’s modern edge—5G via the C1 modem, a vibrant OLED display, and AI tools—will tempt them. But if nearly half of SE owners are stepping down from pricier models, the $599 sticker could feel like a step too far. For comparison, the SE launched at $429 in 2022, a price that hit the sweet spot for thrifty tech users. The 16e’s upgrades are real, but they might not resonate with a crowd that values savings over speed.

Apple’s not wrong to innovate. The A18 chip, shared with the iPhone 16 lineup, delivers snappy performance and efficiency—think faster app loads and longer battery life. The 48MP camera, a leap from the SE’s 12MP lens, promises sharper shots, while Apple Intelligence brings AI-driven perks like smarter Siri responses. For casual users upgrading from an iPhone 11 or older, the 16e could be a compelling deal. Yet, the CIRP data suggests SE loyalists aren’t typical upgraders—they’re a niche that Apple risks misreading.

The Stakes for Apple’s Ecosystem

Why does this matter? iPhone sales fuel over 50% of Apple’s revenue, per Bloomberg’s latest estimates, and the SE has been a quiet workhorse. It’s the entry point for budget buyers who might later splurge on AirPods, an Apple Watch, or app subscriptions. Lose them, and the ecosystem takes a hit. The 16e’s higher price could shrink that gateway, especially if Android rivals swoop in. TechCrunch points to the Google Pixel 8a, priced at $499 with 5G, a strong camera, and years of updates. Samsung’s Galaxy A54, hovering around $450, offers similar value. Both undercut the 16e while meeting basic needs—needs the SE crowd already deems sufficient.

Apple’s February 18 press release called the 16e a “powerful, more affordable option” in its lineup. It’s powerful, no doubt—benchmarks shared by The Verge show the A18 outpacing mid-range Android chips by 20-30% in multi-core tasks. But “more affordable” is relative. At $599, it’s cheaper than the $799 iPhone 16, yet it’s a far cry from the SE’s bargain appeal. The company seems to assume budget buyers will stretch their wallets for a taste of premium tech. The survey hints they won’t.

Can Apple Pull It Off?

This isn’t Apple’s first pricing gamble. The iPhone XR, launched at $749 in 2018, eventually found its footing after a slow start, proving the brand can sway hesitant buyers. The 16e might follow suit if early adopters rave about its battery life or AI perks—features that could trickle into reviews and sway the fence-sitters. But the SE’s success wasn’t about hype; it was about accessibility. ZDNET notes that SE sales spiked among small businesses and students, groups that don’t always have $599 to spare.

The 16e’s fate hangs on execution. If Apple can’t convince its budget base that the extra $170 buys meaningful value—not just specs for spec’s sake—it risks losing a loyal slice of its audience. Android’s mid-range game is stronger than ever, and the CIRP survey is a flashing warning: price still reigns supreme for the SE crowd. As sales data rolls in, we’ll see if Apple’s bold pivot pays off—or if it’s a rare misstep for a company that usually nails the landing.