Qualcomm’s latest court battle over chip licensing is sending ripples through the global smartphone industry, as manufacturers warn that the outcome could directly influence handset prices. According to GB News, the case could redefine how Qualcomm charges for the use of its cellular modem technology — the same chips that power nearly every major smartphone brand from Apple to Samsung.

At stake is not just corporate profit but the cost of the devices consumers buy. If Qualcomm wins, analysts say it could solidify its ability to maintain or even increase royalty rates. If it loses, the company might need to overhaul its licensing model entirely, a move that could reshape the economics of smartphone production worldwide.

The Heart of the Dispute

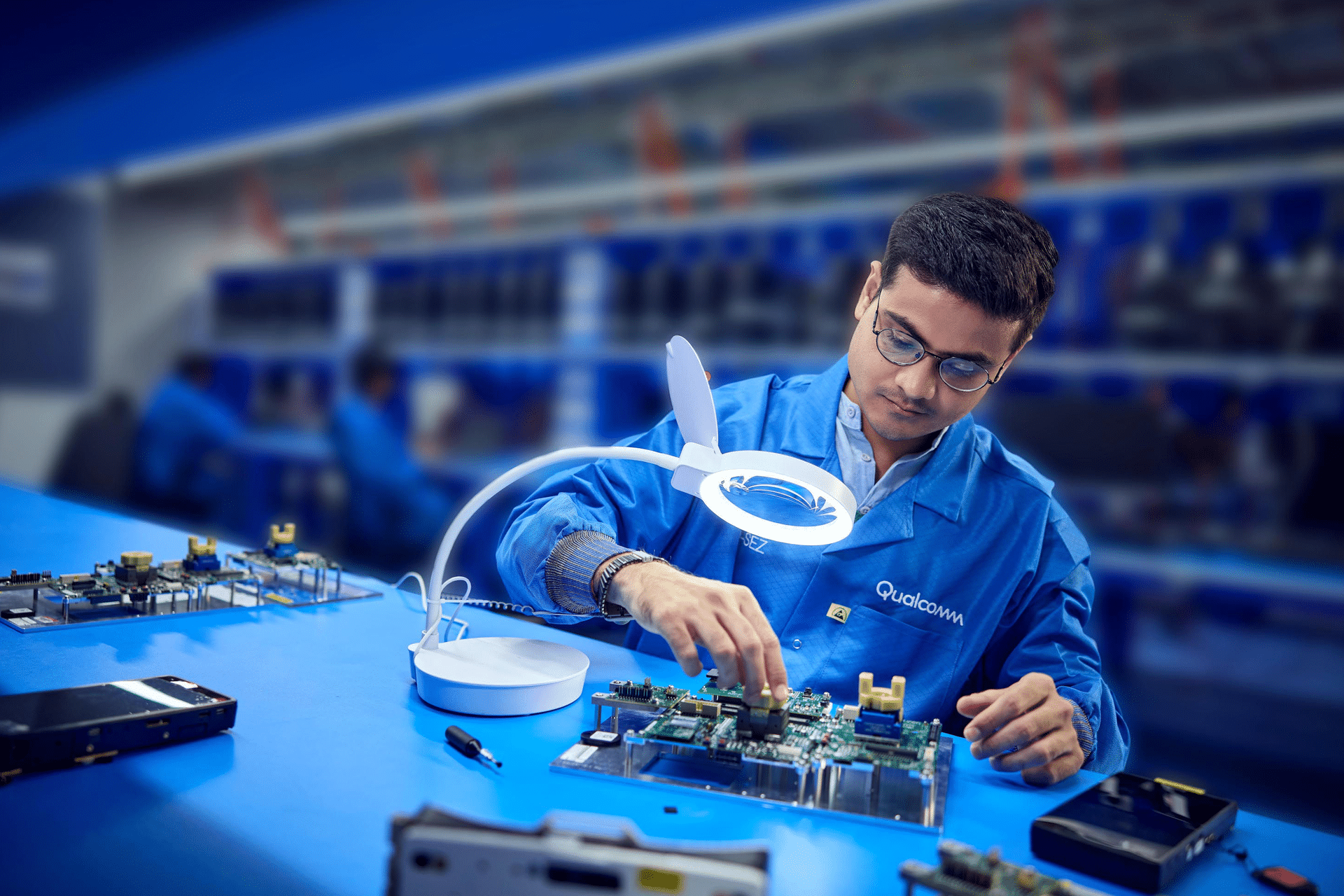

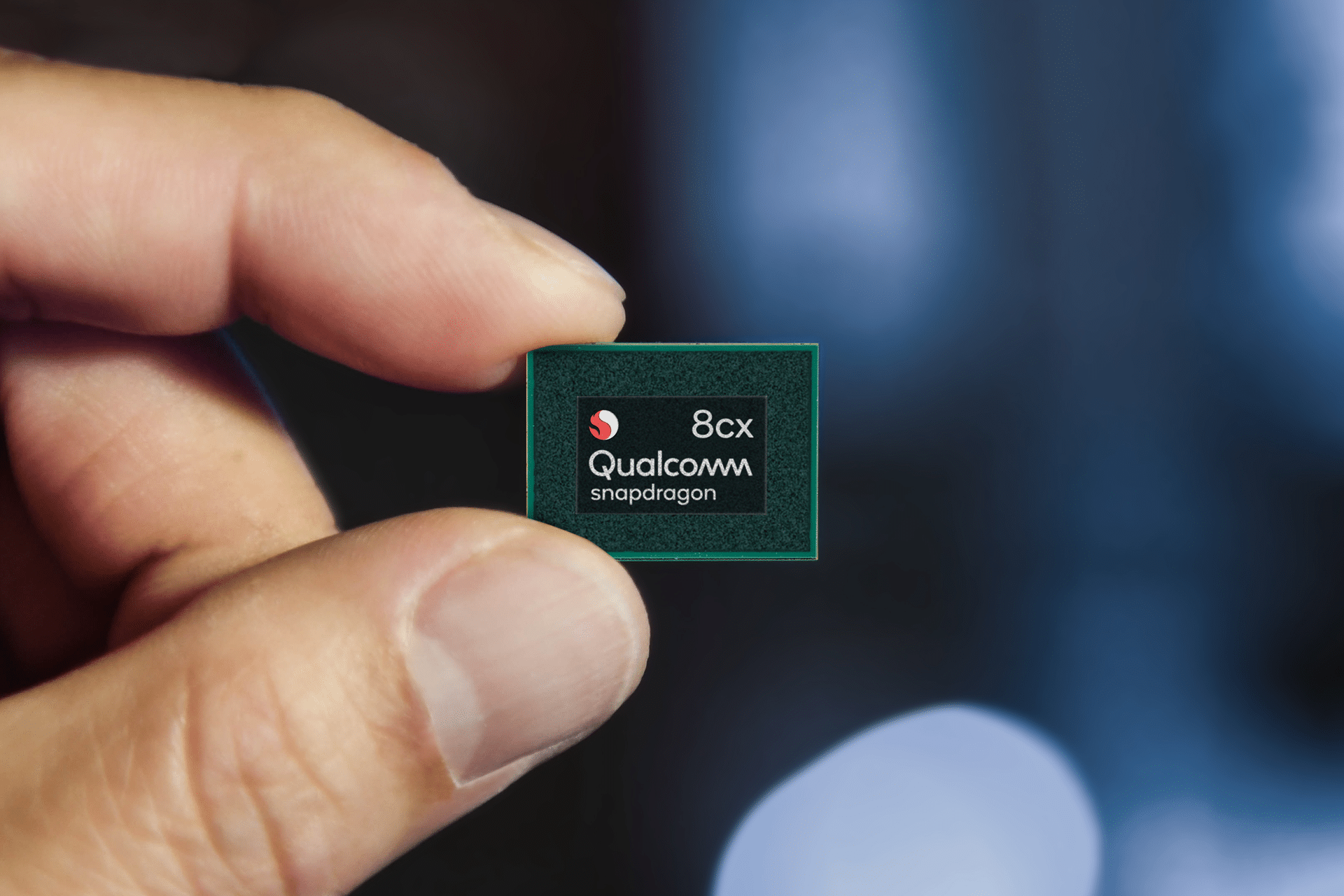

Qualcomm’s business model has always revolved around two key elements: selling physical chips and licensing the underlying patents that make wireless communication possible. Most manufacturers pay Qualcomm twice — once for the hardware and again for the right to use its patented connectivity technology.

This dual structure has faced scrutiny for more than a decade. Regulators in multiple countries, including the United States, the European Union, and South Korea, have accused Qualcomm of using its dominant market position to demand unfair royalties or restrict competitors.

The current case revisits many of those long-standing concerns. Smartphone makers argue that Qualcomm’s licensing terms effectively force them to pay excessive fees for essential technology, driving up production costs that eventually trickle down to consumers.

A Ripple Effect Through the Market

The potential impact of the case extends far beyond Qualcomm’s balance sheet. If the court sides with the chipmaker, smaller manufacturers could face tighter profit margins, making it harder to compete with tech giants that can absorb higher costs.

Conversely, if the ruling curtails Qualcomm’s licensing power, it could disrupt a supply chain that relies heavily on predictable pricing and standardized components. Analysts note that even modest shifts in royalty fees can add tens of dollars to a smartphone’s retail price — a significant change in a market where every dollar counts.

The timing couldn’t be more critical. With smartphone sales flattening globally and consumers holding onto devices longer, any increase in production costs could push retail prices upward, further slowing upgrades.

Qualcomm’s Defense

Qualcomm maintains that its licensing structure is both legal and essential to innovation. The company argues that its technology — which underpins 3G, 4G, and 5G networks — is foundational to the entire mobile ecosystem.

Executives insist that royalties fund the research and development that keeps wireless standards advancing. Without that revenue, Qualcomm warns, the pace of innovation could slow, particularly as 6G research ramps up.

Supporters of the company point out that its chips remain among the most efficient and reliable in the industry, forming the backbone of premium smartphones, including those in the iPhone 17 series and Samsung’s latest Galaxy models.

Global Stakes

The outcome of this court case could reverberate across continents. Qualcomm’s technology is licensed to nearly every major smartphone maker, meaning any ruling on how it can charge for its patents would affect pricing structures worldwide.

If regulators or the courts impose tighter controls, it might level the playing field for emerging chipmakers like MediaTek, but could also introduce uncertainty in the market. Companies dependent on Qualcomm’s chips — particularly those without in-house alternatives — might face delays or compatibility challenges during any transition period.

Industry Watching Closely

Both investors and industry insiders are treating this case as a bellwether for the future of mobile hardware economics. Some see it as an overdue reckoning for a company long accused of monopolistic behavior; others view it as a test of whether regulators can adapt to the complexities of the modern semiconductor landscape.

Whatever the verdict, it’s likely to reshape how smartphones are priced and how much control any one company can exert over global communication standards. For consumers, that may mean a choice between paying slightly more for their next device — or facing a wave of hardware disruptions as the industry recalibrates.