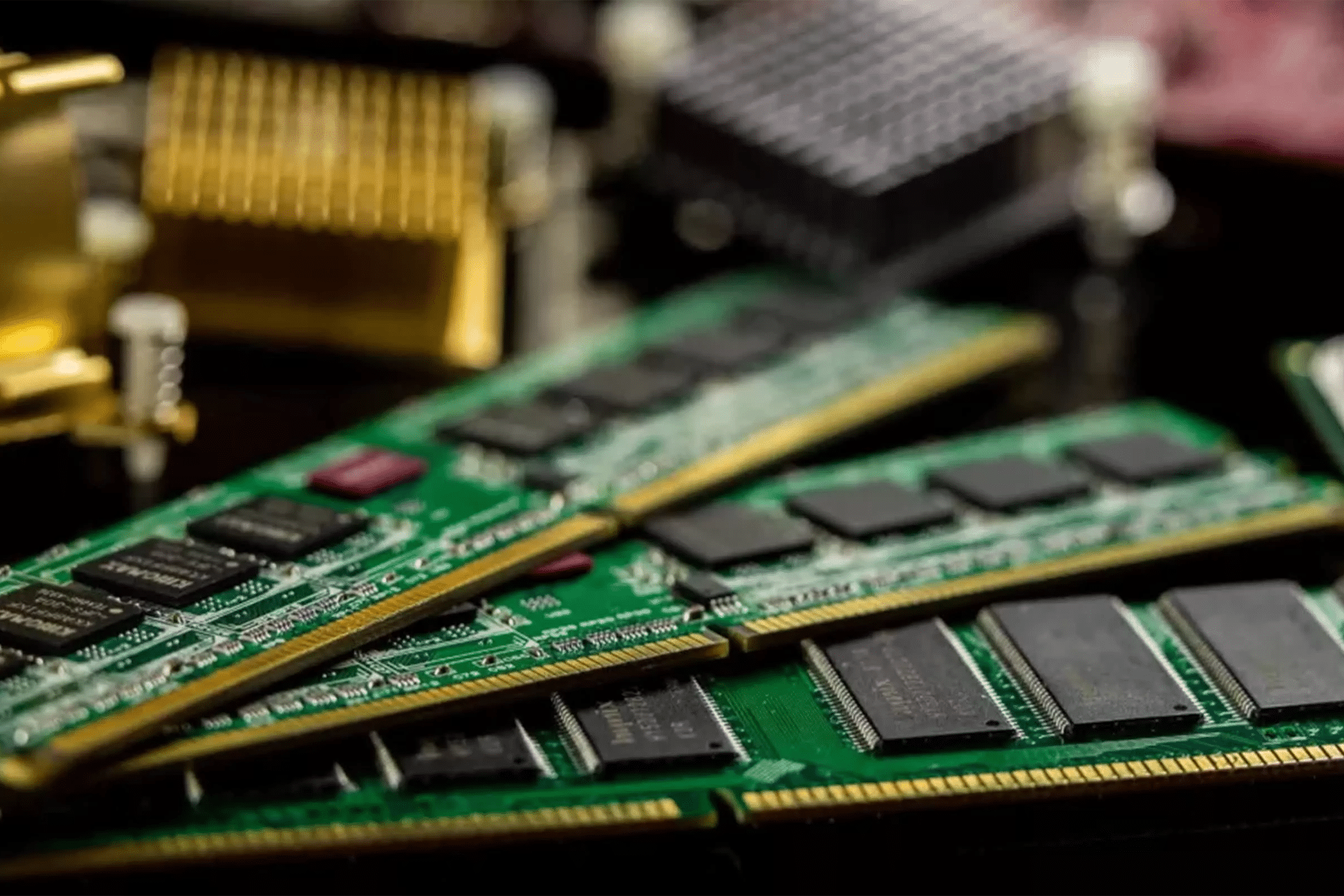

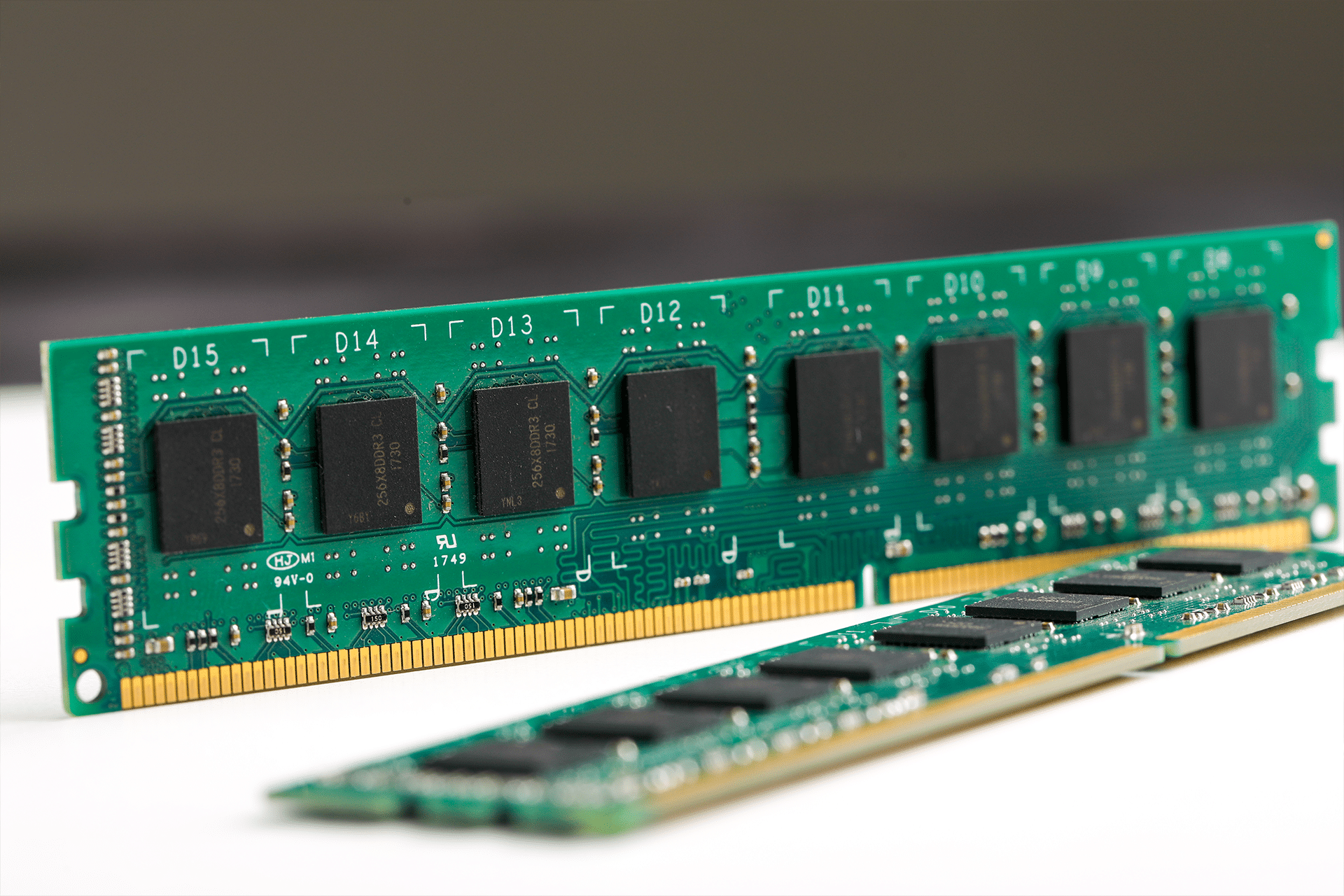

The cost of RAM has been climbing steadily as chipmakers adjust production and channel partners react to market demand. DDR5, now the standard for many new systems, carries higher manufacturing complexity than earlier generations. Combined with increased demand from AI-capable devices, servers and high-end consumer systems, the price shift affects nearly every corner of the hardware market.

Suppliers have also redirected more of their fabrication capacity toward products tied to data centers and advanced computing, where margins remain stronger. That leaves the consumer market with tighter availability, which influences the pricing seen in retail channels. The result is a landscape where memory once considered routine to upgrade now requires more planning and careful timing.

Why RAM Costs Are Rising Across the Market

Manufacturers are producing fewer lower-priced modules as they move deeper into next-generation memory lines. DDR5 continues to replace DDR4 in premium and mid-range PCs, and the global shift toward devices that run large models, local processing tasks and complex workloads increases the amount of memory needed in everyday machines.

This creates pressure across both ends of the market. Entry-level kits become harder to find at their usual price points, while higher-capacity modules remain in strong demand as developers and users adopt workflows that rely on heavier memory loads.

Another factor comes from supply chain adjustments. Fab operators have reorganized their production mix to emphasize components used in servers and AI infrastructure, where enterprise customers purchase at scale. Retail channels receive smaller allocations as a result, and the modules that do arrive often reflect pricing shaped by these upstream decisions.

How Users Can Navigate the Changing RAM Market

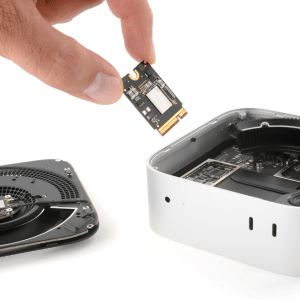

For many users, the rising cost of memory affects when and how they upgrade. Some choose to delay full system replacements and focus on smaller adjustments instead, especially if their tasks do not require immediate performance increases. Others reconsider capacity, opting for slightly lower configurations until prices stabilize.

DIY builders face particular challenges since RAM has traditionally been one of the more flexible components in a budgeting plan. Now, selecting compatible kits involves balancing capacity, speed and cost in a market where each variable shifts more quickly than before. Systems designed for creative work, gaming or development often require more memory, and buyers must evaluate how much performance they gain from stepping up to larger kits compared to waiting for better pricing.

Manufacturers and retailers note that prices can vary with seasonal demand and inventory cycles, creating short windows where certain kits become more accessible. Users planning upgrades often monitor these fluctuations, checking whether their systems allow enough headroom to adopt more efficient modules without reshaping the rest of the configuration.

Market Forces Continue to Shape RAM Availability

The broader hardware landscape influences these trends as well. As devices adopt AI-assisted features and handle more complex processes locally, system memory becomes a more prominent factor in overall performance. Manufacturers respond by prioritizing parts that support upcoming product cycles, and this shift shapes what appears on store shelves.

Economists following semiconductor supply note that memory pricing often responds sharply to even small changes in production volume. When fab operators adjust output in response to enterprise contracts, the retail market feels the effect quickly, especially if competing manufacturers make similar decisions.

As a result, users see a market where prices do not follow simple patterns and where availability can shift month to month. Builders planning new systems track these changes closely, looking for moments when supply balances with demand long enough to ease price pressure.

These developments show how a component once considered predictable now reflects broader trends in computing, manufacturing and user demand. RAM’s role has expanded beyond basic system performance, shaping how devices handle new workloads and how buyers plan upgrades throughout the year.