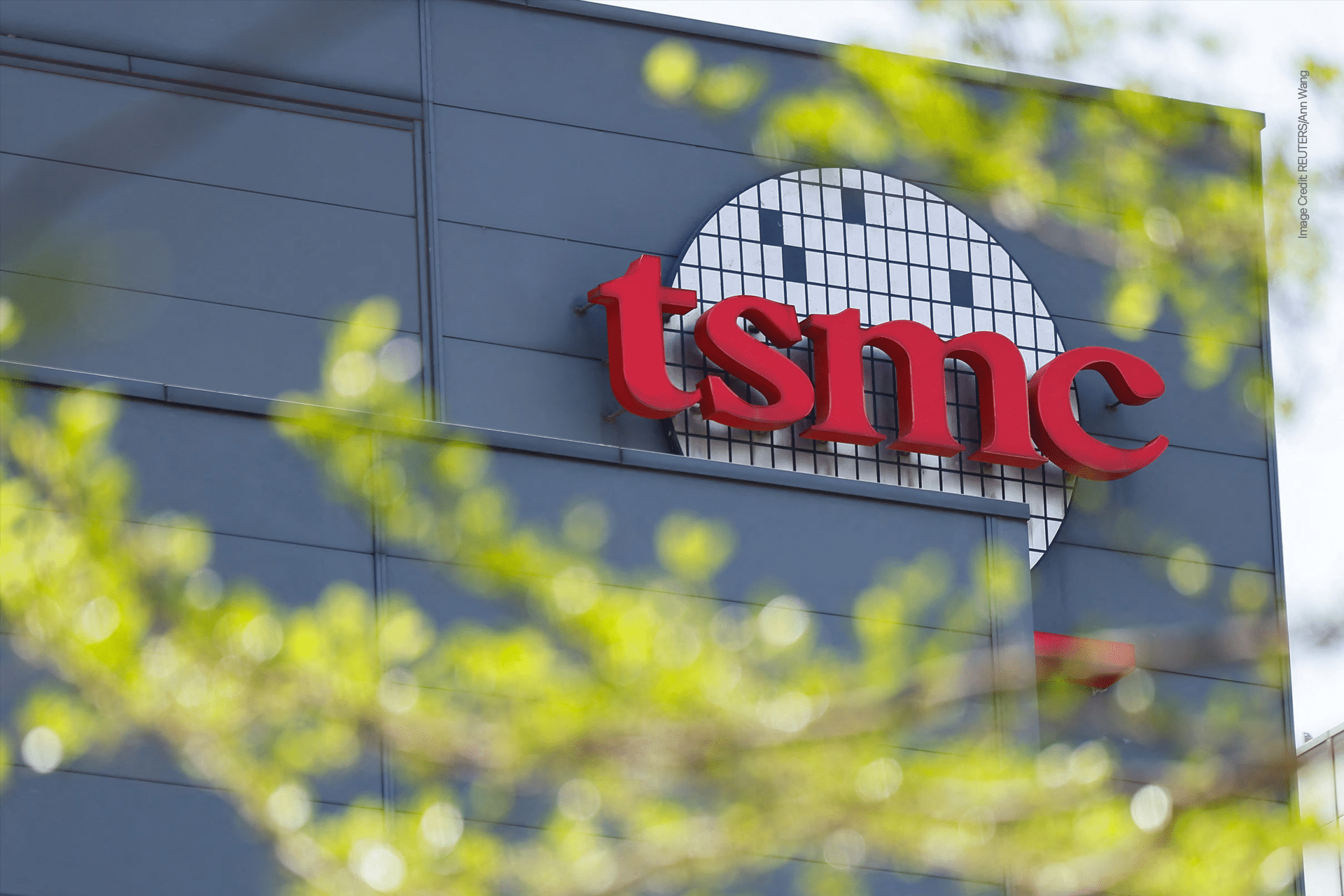

TSMC’s exemption is tied to its commitment to expand US-based production. The company has pledged over $165 billion to build three factories in Arizona, with an additional $100 billion investment announced earlier this year to further enhance its US operations. These facilities, while not yet producing Apple’s most advanced chips, are a cornerstone of the US effort to onshore semiconductor manufacturing, driven by the CHIPS and Science Act of 2022. The Arizona plants currently focus on larger process chips, suitable for older Apple devices, but represent a significant step toward reducing reliance on overseas production.

Tariff Policy and Industry Impact

The proposed 100% tariff on chip imports, championed by President Donald Trump, aims to encourage domestic manufacturing by penalizing companies that produce abroad. However, exemptions for firms like TSMC, Samsung, and SK Hynix, which have committed to US-based facilities, reflect a pragmatic approach. Liu Chin-ching noted that Taiwan’s global leadership in chipmaking ensures its competitive edge, even as rivals face similar tariff pressures. The policy has sparked mixed reactions, with some analysts warning that smaller chipmakers without US investments could face higher costs, potentially raising prices for electronics like smartphones and cars.

Apple’s Role in the Exemption

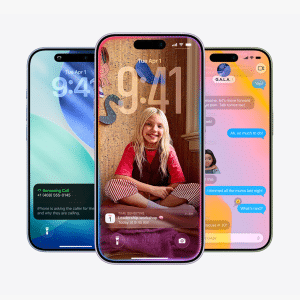

Apple, a major TSMC client, also secured a tariff exemption after committing an additional $100 billion to US manufacturing, bringing its total investment to $600 billion over four years. This pledge, highlighted during a meeting between Apple CEO Tim Cook and President Trump, underscores the tech giant’s influence in shaping tariff policy. The exemption ensures that Apple’s supply chain, heavily reliant on TSMC for A-series and M-series chips, remains cost-competitive, avoiding price hikes for iPhones, Macs, and other devices.

Challenges and Controversies

TSMC’s Arizona expansion has not been without hurdles. The first plant, initially slated for production in 2024, faced delays and is now expected to begin mass production later this year. Concerns over costs, with US-made chips potentially pricier than those from Taiwan, have raised questions about scalability. Additionally, TSMC faced criticism for allegedly favoring Taiwanese workers at its Arizona facilities, prompting a lawsuit claiming anti-American discrimination. Despite these challenges, TSMC’s investments align with US goals to strengthen domestic chip production, particularly for national security and economic resilience.

Global Supply Chain Implications

Taiwan produces over 60% of the world’s semiconductors, with TSMC leading the charge. The tariff exemptions for TSMC and other major chipmakers with US investments could shift global supply chains, encouraging further localization. However, analysts note that TSMC’s most advanced chipmaking remains in Taiwan, where research and development thrive due to a robust ecosystem. The US push for domestic production may reduce Taiwan’s global market share to 60% by 2027, while the US share rises to 17%, according to TrendForce. This shift could benefit American companies like Nvidia and AMD, which rely on TSMC’s manufacturing prowess.

A Win for Tech Giants

The tariff exemption is a significant win for TSMC and its clients, ensuring stability in the supply of critical components. For Apple, it means continued access to high-quality chips without the burden of doubled import costs, preserving affordability for consumers. As TSMC’s Arizona plants ramp up, they could produce more advanced chips in the future, further aligning with Apple’s “Made in America” ambitions. For now, the exemption underscores the strategic importance of domestic investment in navigating global trade policies.

Looking Forward

TSMC’s exemption from the 100% chip tariffs highlights the interplay between trade policy and industrial strategy. While the company’s Arizona investments secure its position in the US market, uncertainties remain about the broader impact on smaller chipmakers and the global supply chain. As the US continues to bolster its semiconductor industry, TSMC’s role as a key player ensures that tech giants like Apple can innovate without disruption, keeping consumer electronics competitive in a rapidly evolving market.