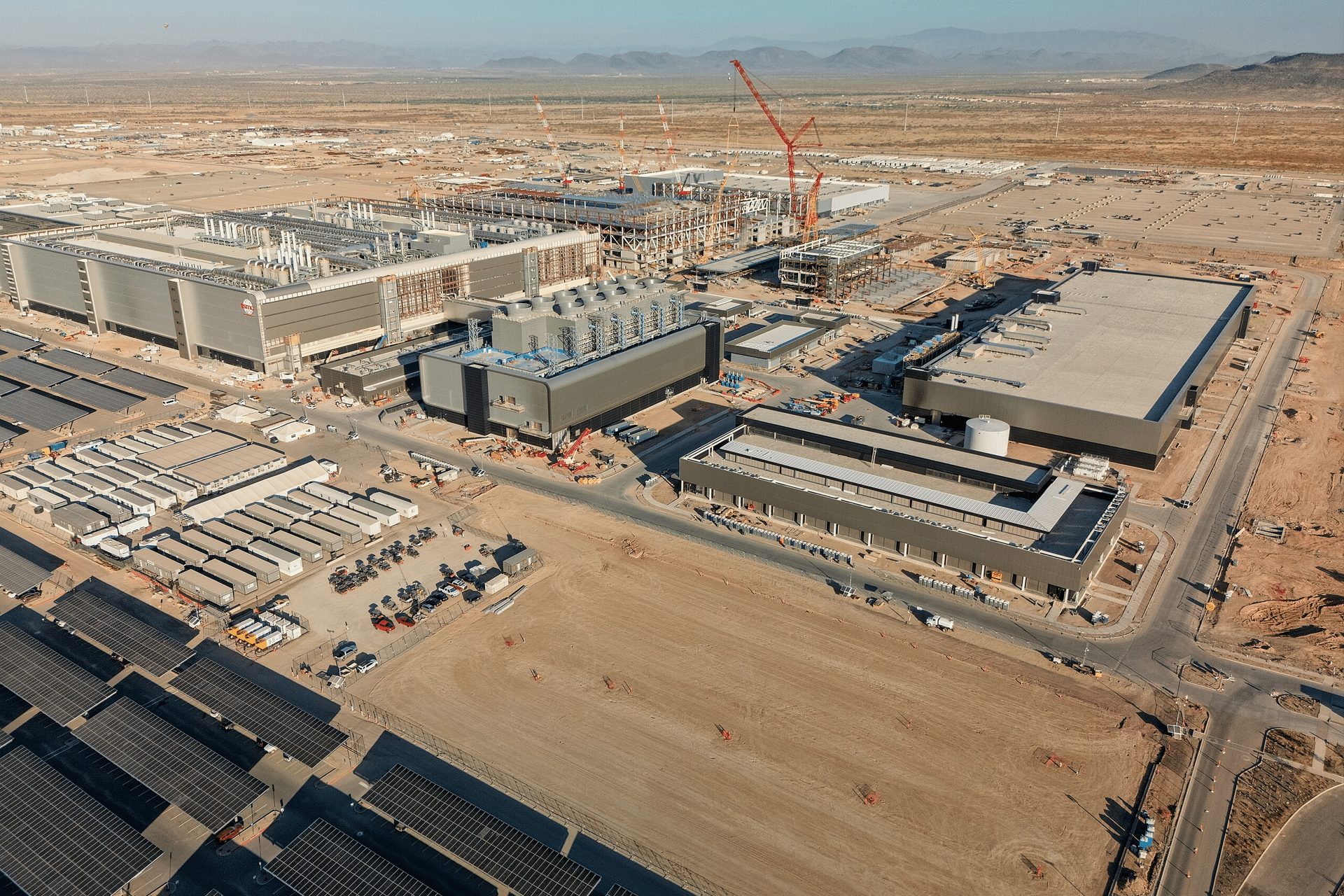

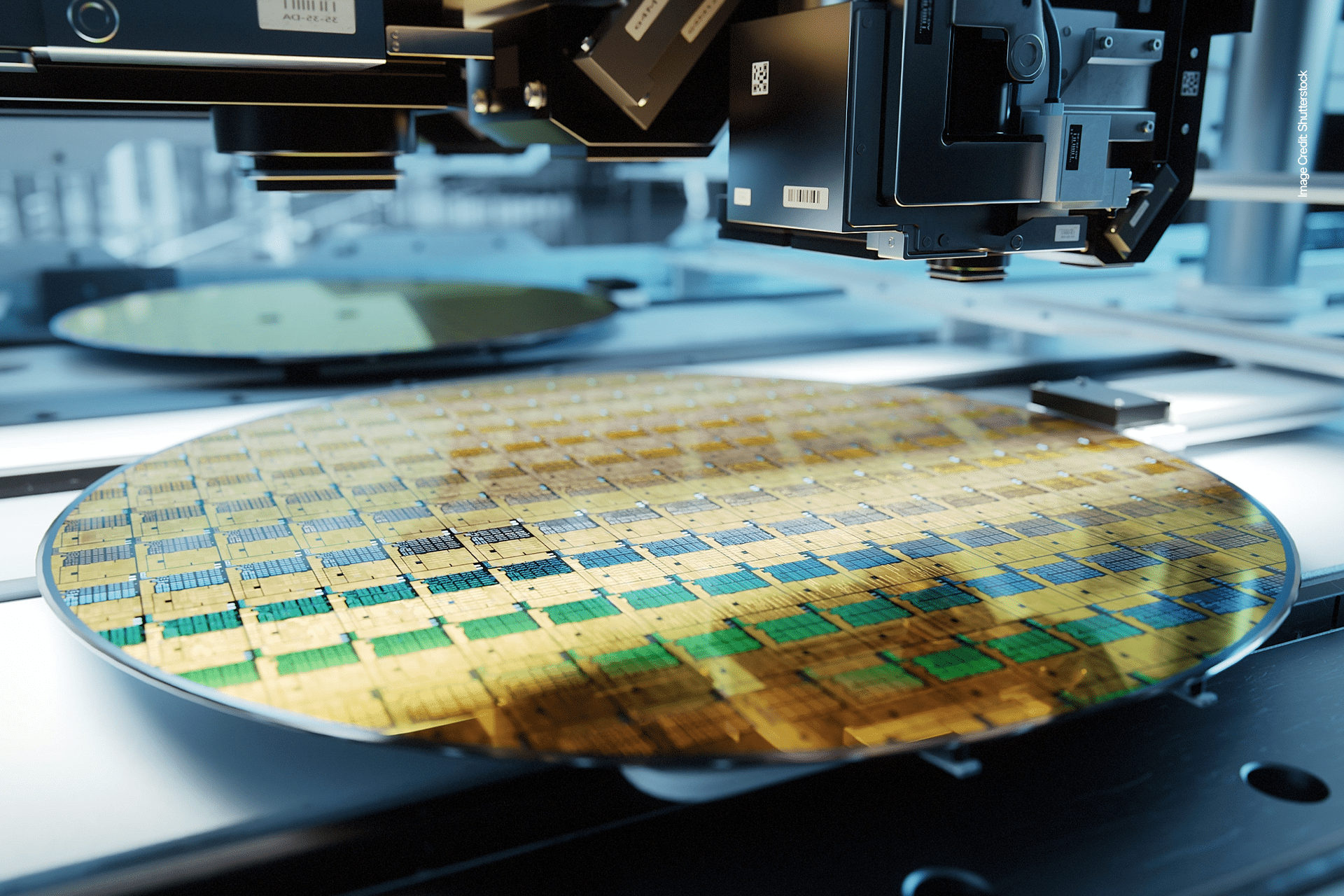

TSMC’s commitment to the U.S. includes a $12 billion initial investment in 2020, bolstered by a $6.6 billion subsidy from the CHIPS Act and a recent $100 billion pledge over four years. The funds are fueling the construction of three fabrication plants, two advanced packaging facilities, and an R&D center in Arizona. According to TSMC’s chairman and CEO, C.C. Wei, approximately 30% of the company’s 2-nanometer and more advanced chip capacity will be based in Arizona once these facilities are fully operational, creating a robust semiconductor hub in the U.S.

The accelerated timeline responds to strong demand from American customers, including Apple, Nvidia, and AMD. The second Arizona plant, set to produce 3-nanometer chips, is now expected to be operational by 2027, while the third, focused on 2-nanometer technology, could be ready by 2028. This progress aligns with national efforts to bolster domestic manufacturing, a priority echoed in political calls for increased U.S. production under the current administration.

Challenges and Limitations

Despite the optimism, TSMC’s U.S. facilities face hurdles. The Arizona plants currently produce older 4-nanometer chips, like the A16 used in the iPhone 14 Pro, while Taiwan’s factories are already manufacturing 2-nanometer chips for Apple’s latest devices. Even with faster construction, the U.S. remains behind Taiwan’s cutting-edge capabilities. Chips produced in Arizona must still be shipped to Taiwan or China for advanced packaging, though a new Amkor facility in Peoria, expected to open in 2027, aims to address this gap.

Labor shortages and cultural differences have also posed challenges. TSMC has flown in Taiwanese engineers to train local workers, sparking criticism from U.S. labor unions over insufficient local hiring efforts. Additionally, the higher cost of building and operating factories in the U.S., compared to Taiwan, may lead to increased chip prices, potentially impacting consumers. Posts on X reflect mixed sentiment, with some praising the move toward U.S. production while others question its economic viability given global supply chain dependencies.

Implications for Apple and Consumers

For Apple, TSMC’s Arizona expansion brings it closer to realizing CEO Tim Cook’s vision of chips “proudly stamped Made in America.” The A16 chips from Fab 21 are already being certified for use in Apple devices, with mass production expected soon. However, flagship devices like the iPhone 18 Pro, which will use 2-nanometer A20 chips, will continue to rely on Taiwan’s facilities until Arizona’s third plant is ready. This staggered progress means Apple’s most advanced products will remain dependent on overseas manufacturing for the near future.

For consumers, the shift could enhance supply chain resilience, reducing risks from geopolitical tensions or disruptions in Taiwan. However, higher production costs in the U.S. could translate to pricier devices. TSMC has indicated that Arizona-made chips may cost 3-5% more, a factor that could affect Apple’s pricing strategy for iPhones, iPads, and Macs.

A Step Toward Semiconductor Independence

TSMC’s Arizona plants represent a foundational step in rebuilding U.S. semiconductor capacity, but complete self-sufficiency remains elusive. The U.S. relies on global suppliers for critical components, such as ASML’s lithography machines from the Netherlands and materials from Japan and Germany. Taiwan’s “Silicon Shield”—its dominance in advanced chip production—continues to play a strategic role, with some Taiwanese officials expressing concern that expanding U.S. operations could weaken the island’s geopolitical leverage.

Nevertheless, TSMC’s efforts are reshaping the semiconductor landscape. The company’s Arizona facilities, supported by federal incentives and private investment, are creating high-skilled jobs and fostering innovation. As the U.S. narrows the gap with Taiwan, the promise of domestically produced chips for Apple’s ecosystem grows closer, offering a glimpse of a more resilient and competitive American tech industry.