Waymo vs Tesla robotaxi competition is often framed as a clash between two very different visions of autonomous driving. Waymo, backed by Alphabet, has spent more than a decade building a cautious, sensor-heavy approach to self-driving cars. Tesla, led by Elon Musk, has pushed a faster, software-first model, aiming to turn millions of cars already on the road into a robotaxi network through its Full Self-Driving (FSD) system.

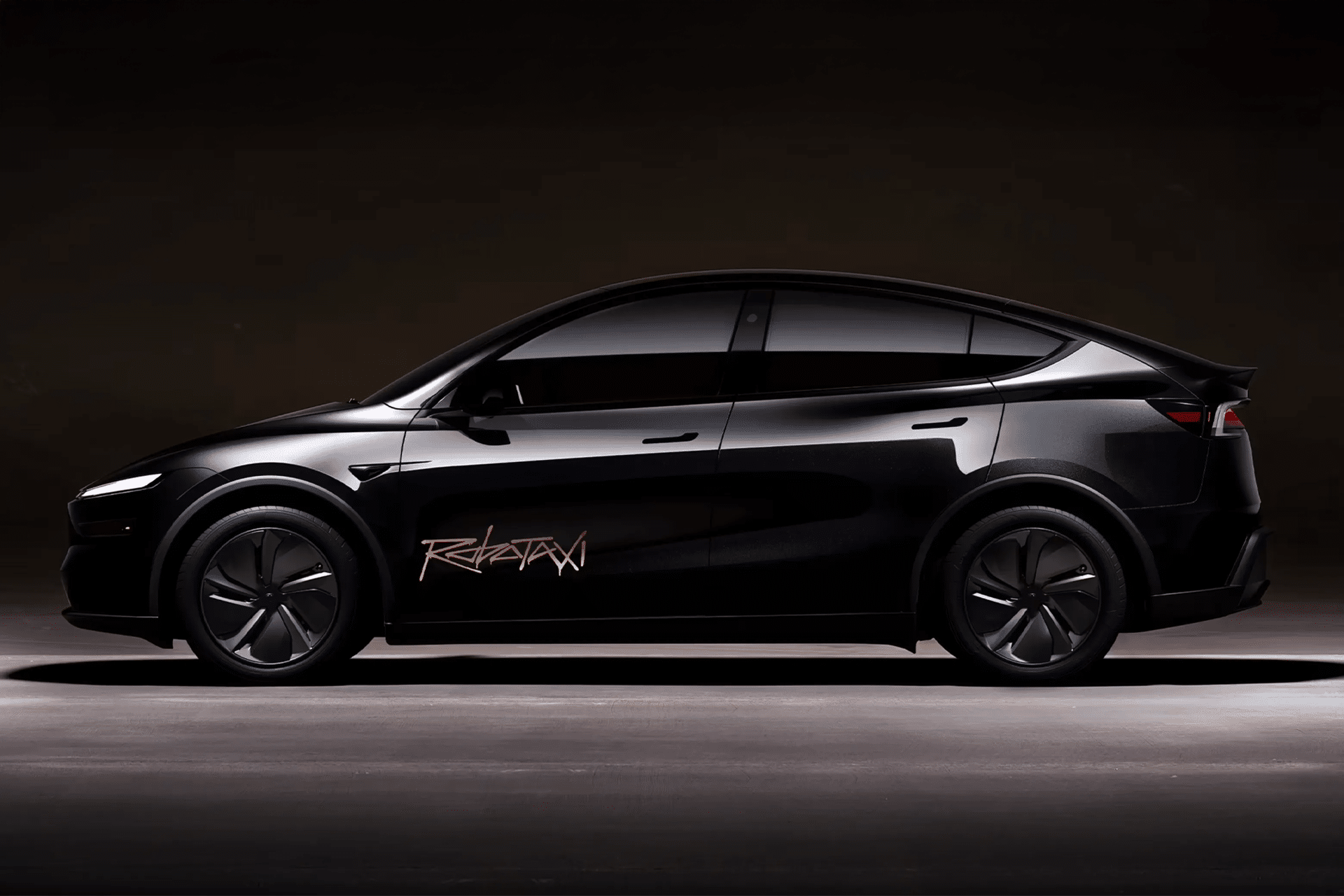

In 2025, the gap between the two has widened. Tesla is preparing to launch a dedicated robotaxi service as early as 2026, while Waymo remains restricted to limited pilot programs in Phoenix, San Francisco, and Los Angeles. The reasons for this divergence reveal both technological and strategic differences.

Different Philosophies: Hardware vs Data

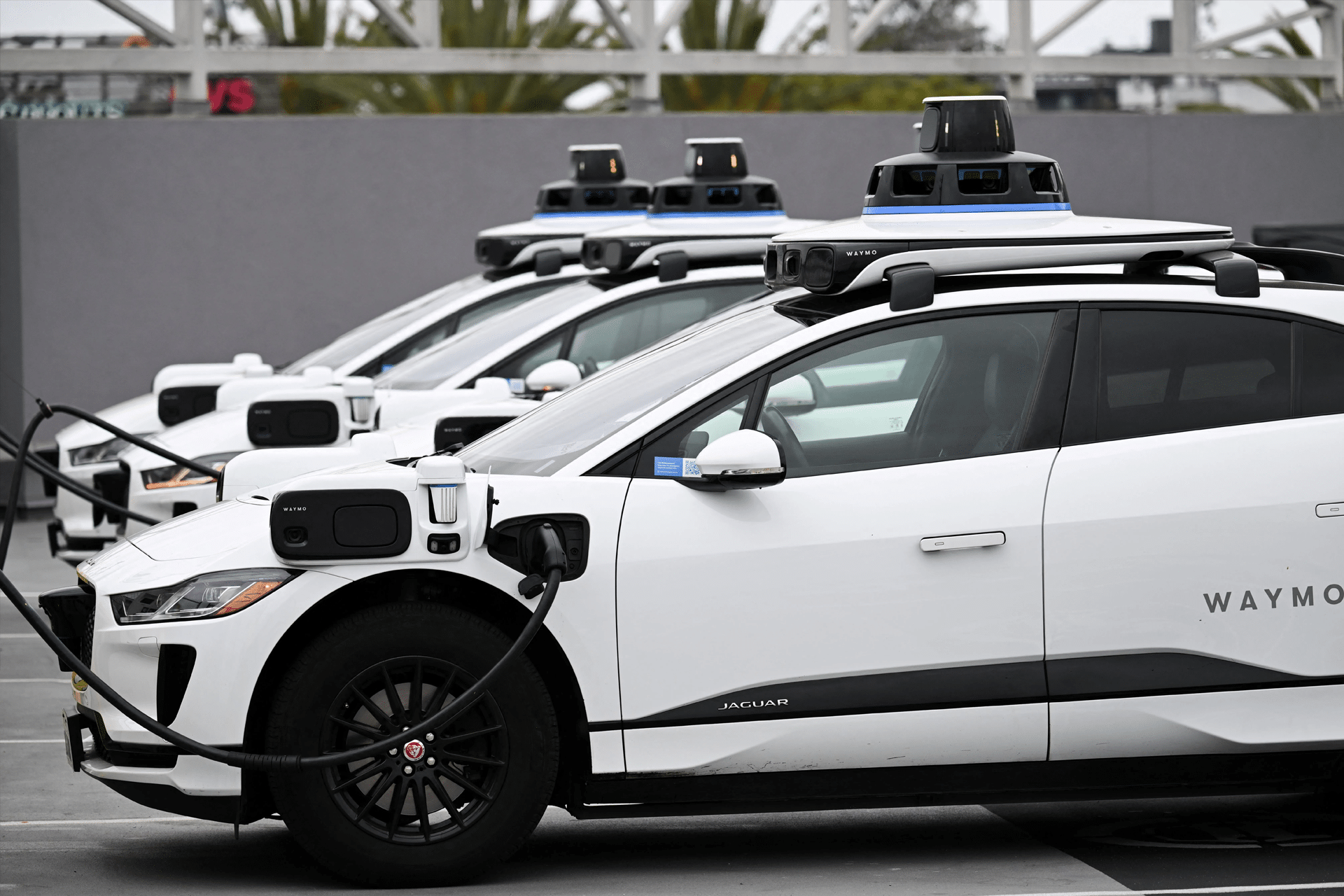

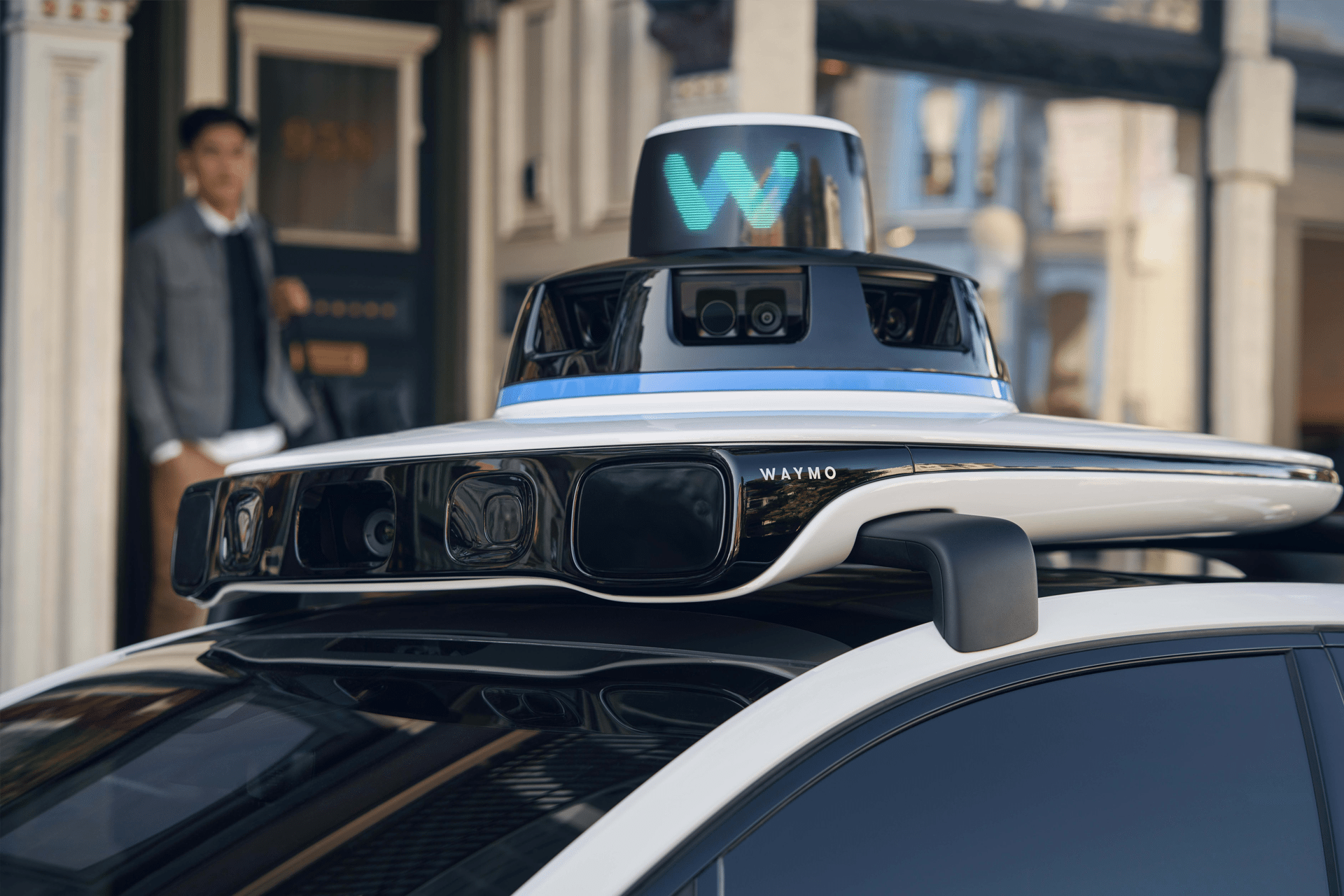

Waymo relies on an array of expensive sensors, including lidar, radar, and high-definition maps. Its cars operate in carefully geofenced areas where conditions are tightly controlled. While this approach produces safe, predictable driving, it limits scalability. Waymo has been slow to expand beyond its test cities because replicating its maps and validating routes city by city is labor-intensive.

Tesla, in contrast, uses a vision-based system that depends primarily on cameras, supported by neural networks trained on billions of miles of real-world driving data. Instead of restricting cars to mapped zones, Tesla pushes updates to its global fleet. Every Tesla with FSD capability becomes both a customer and a data generator, feeding back scenarios that improve the software. This constant stream of data has allowed Tesla to iterate faster than Waymo.

Speed vs Safety

Waymo’s cautious rollout has helped it avoid some of the controversies surrounding Tesla’s FSD. Its robotaxi service operates with safety drivers or in constrained environments where risk is minimized. But this caution has also slowed progress, making Waymo seem stuck in pilot mode.

Tesla, by contrast, has taken criticism for pushing “beta” software onto public roads. Regulators and safety advocates warn that Tesla’s approach risks accidents in the pursuit of speed. Yet Musk’s strategy of learning at scale means Tesla has gathered far more data than Waymo, helping it accelerate toward a viable robotaxi business.

Economics of Scaling

Cost is another factor. Waymo’s vehicles rely on lidar and radar units that cost thousands of dollars each, making widespread deployment expensive. Tesla’s reliance on mass-produced hardware — cameras and in-house AI chips — makes scaling more feasible. Tesla argues that a dedicated robotaxi vehicle, designed without steering wheels or pedals, will cut costs even further, creating a service that can be priced competitively with Uber or Lyft.

Waymo’s model is harder to scale profitably. Even with Alphabet’s backing, expanding beyond pilot projects requires massive infrastructure investments. Tesla, with millions of vehicles already deployed, can flip the switch on a global service much faster.

Public Perception and Market Position

Waymo built an early reputation as the leader in self-driving technology, but its low visibility outside test markets has eroded that image. Tesla, on the other hand, has made autonomy central to its brand. Musk’s promises of a robotaxi future, combined with over-the-air updates that let users see progress firsthand, keep Tesla in the public spotlight.

This difference matters. Investors and consumers perceive Tesla as pushing toward autonomy at scale, while Waymo appears stuck in experimentation. That perception helps Tesla attract both capital and developer talent, widening the gap further.

The Road Ahead

Waymo is still a serious player in autonomous driving, with advanced technology and a track record of safe operations. But Tesla’s willingness to push software aggressively, combined with its data advantage, has given it momentum. The coming years will determine whether Waymo’s slower, safety-first approach ultimately proves more sustainable — or whether Tesla’s riskier strategy secures dominance in the robotaxi market.

What is clear is that the once-clear leader in self-driving cars has lost ground. The race to turn autonomy into a viable business may now belong more to Tesla than Waymo.