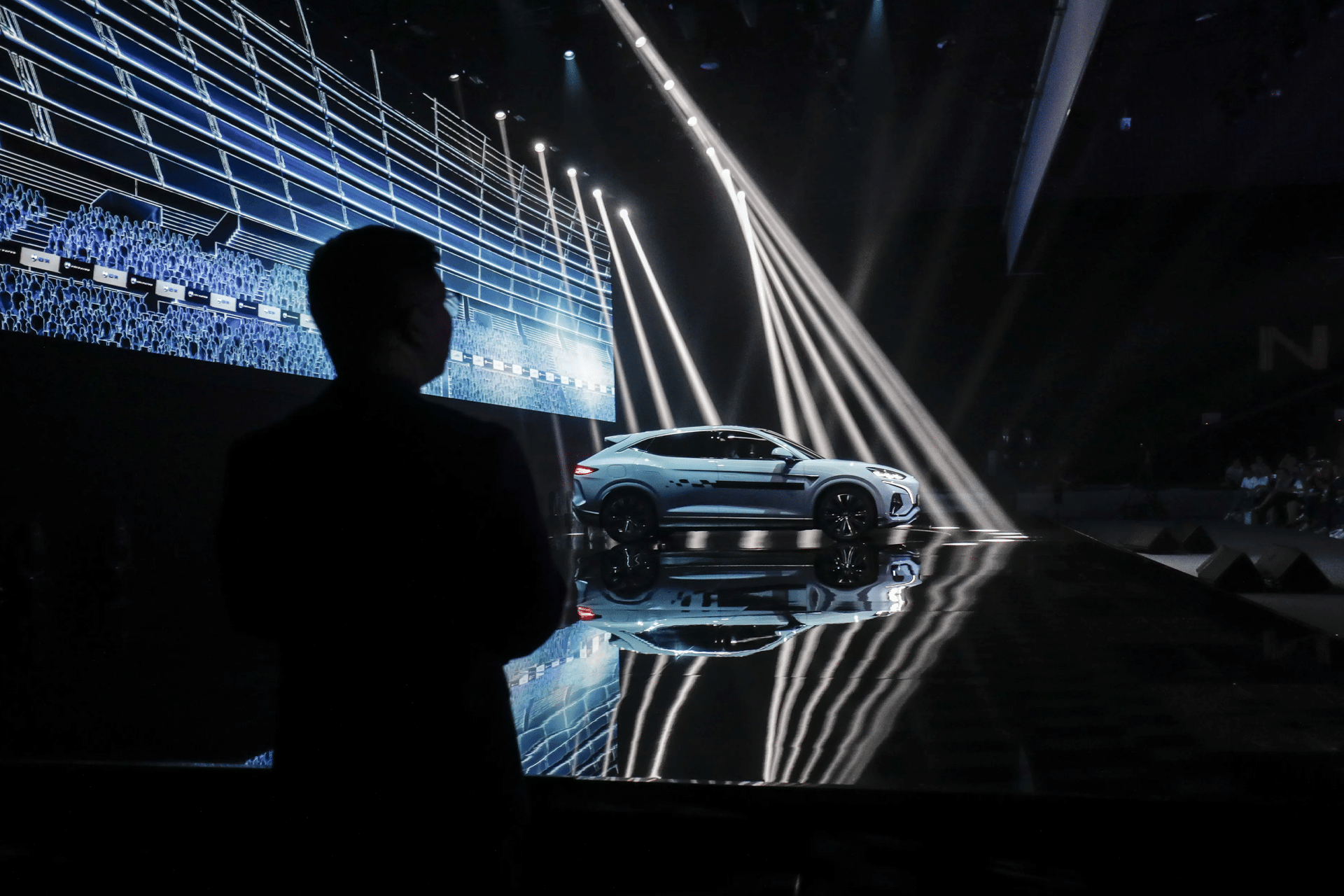

Industry researchers say the balance of power in the global EV sector is not fixed, despite China’s lead in battery production scale, price efficiency and vehicle export volume. While Chinese manufacturers hold advantages in cost structure and supply-chain depth, Western brands retain strengths in design, software integration and regulatory alignment with emerging clean-transport mandates across Europe and North America. Analysts describe a landscape in which Western automakers can regain ground by targeting segments where quality, trust and long-term service infrastructure drive consumer decisions.

The EV race increasingly reflects differences in industrial policy and supply-chain maturity. China’s ecosystem benefits from vertically integrated battery production, aggressive domestic competition and a dense network of suppliers. This has allowed Chinese manufacturers to produce lower-cost EVs and expand into global markets. Western automakers, meanwhile, face higher production expenses tied to labor, materials and battery sourcing. However, these challenges are seen as addressable through coordinated policy incentives, expanded domestic battery gigafactories and strengthened mineral-sourcing partnerships.

Why Western Carmakers Still Have Strategic Options

Analysts point out that Western brands hold strong positions in premium and performance segments, where engineering quality, long-distance reliability and service footprints matter more than lowest price.

Regulatory initiatives across Europe and the United States—such as clean-energy credits, local-content requirements and domestic manufacturing incentives—can accelerate rebalancing of battery supply chains.

Established automakers possess long-standing brand equity, dealership networks and customer-care systems, which continue to influence purchase decisions for higher-priced vehicles.

Some reports highlight that while Chinese EV adoption surged due to strong domestic competition and supportive policy structures, Western consumers continue to value crash-safety benchmarks, software update reliability and predictable long-term support. These factors can shape purchasing decisions as EV penetration expands in markets with diverse regulatory requirements.

Shifts in Market Structure and Consumer Behavior

In Europe and North America, the premium EV segment remains an area where Western automakers maintain brand leverage. High-range models, performance variants and vehicles with advanced driver-assistance systems tend to draw buyers who prioritize consistency and long-term service.

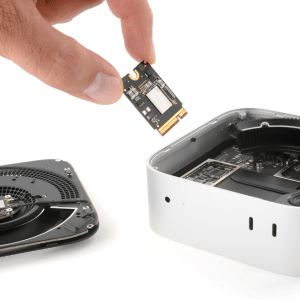

Battery-cell production capacity is expanding across Western markets through new joint ventures and government-backed projects designed to reduce reliance on imported cells.

Consumers in mature markets display higher sensitivity to data privacy, cybersecurity and software-update transparency, areas where Western regulatory frameworks often set stricter standards. This dynamic can influence how global EV brands align with local expectations.

Industry observers also note that while Chinese EV makers have gained momentum in price-sensitive regions, they face hurdles when entering markets with distinct certification requirements, dealer-liability rules and environmental standards. These barriers do not halt competition but can slow the pace at which Chinese models gain share in higher-regulation regions.

Policy, Supply Chain and Industry Coordination

Western automakers and governments are investing in battery-material partnerships, refining facilities and domestic assembly plants aimed at closing cost gaps. Rare-earth diversification and long-term lithium contracts remain central to these efforts.

Expanding local gigafactory capacity reduces logistic dependencies and aligns vehicles with incentive structures that reward domestic content.

Policy frameworks continue to evolve around tariffs, import scrutiny and supply-chain disclosure, influencing how quickly Chinese EVs can expand into Western markets.

Analysts say the global EV race is shifting from pure manufacturing scale toward a combination of cost efficiency, regulatory advantage and software-driven differentiation. While Chinese automakers maintain cost leadership, Western brands can leverage policy support and technology platforms to compete in segments where durability, safety and service structure dominate decision-making.

As EV markets mature, many expect a multipolar industry rather than a single-region dominance. Western automakers face significant challenges, but analysts argue they retain meaningful opportunities to expand their share if supply-chain reforms, battery investments and product strategies continue to align with evolving consumer expectations.