So if you’re considering leaving your physical cards at home, hoping to make a purchase at your favorite coffee shop, or cop the new iPhone 16 when it launches, these are all you need to know about Apple Pay and Wallet.

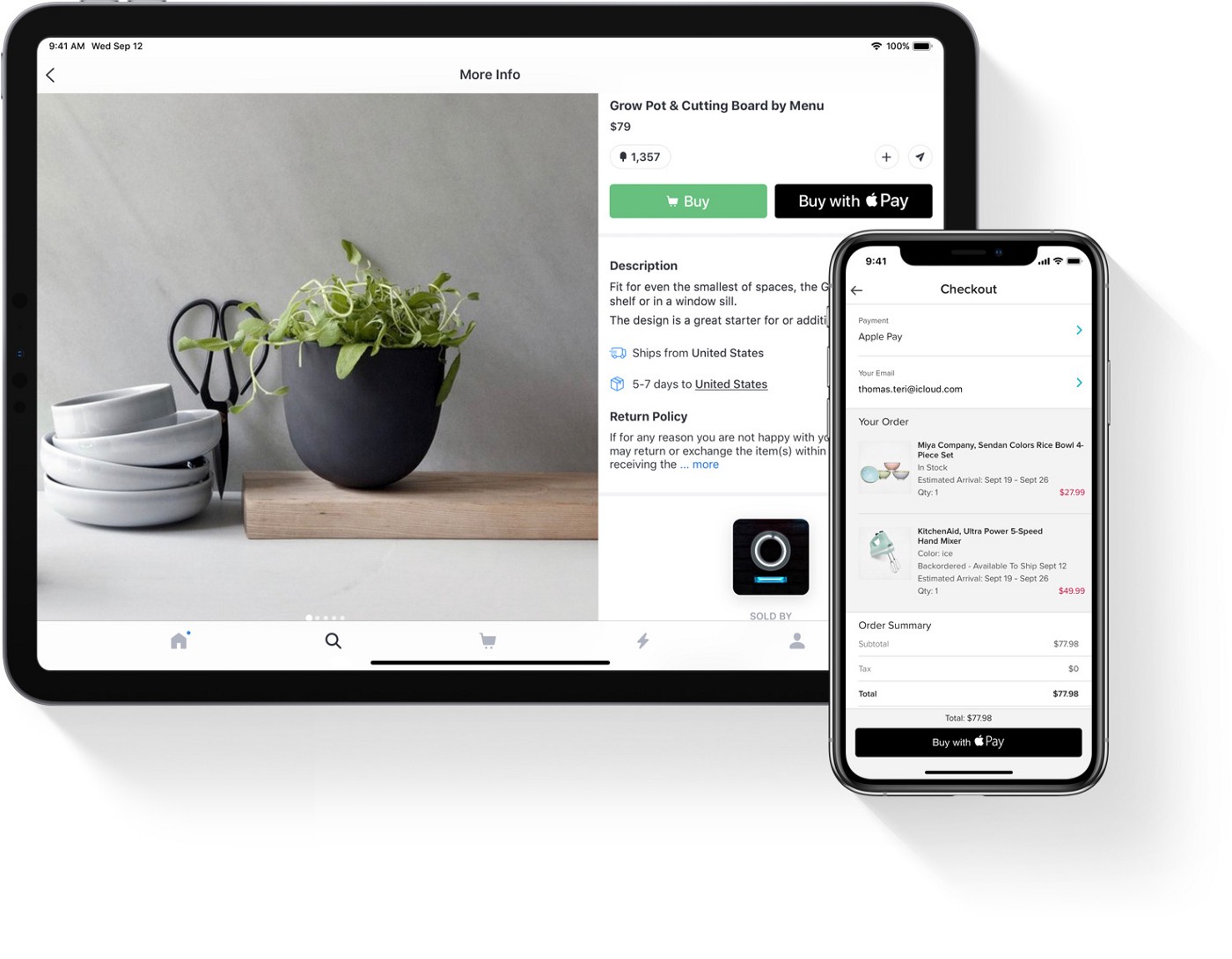

The easiest way to remember how they differ is to think about the words themselves: pay and wallet. Pay, as in other payment providers like Google PAY, Samsung Pay, and even PayPal, is a contactless payment method provided by Apple and available on all iPhone models with biometric technology, that is, Face ID or Touch ID, bar the iPhone 5S. It can also be accessed using an Apple Watch, iPad, or MacBook.

Apple Pay is significantly the most popular in this category, compared to Google Pay and Samsung Pay. Apple’s contactless payment method has over 60 million users, with customers choosing the service 48% of the time at physical/brick-and-mortar outlets or when shopping online. The security it affords users is the chief reason it is also popular for use at online outlets, with any online casino that accepts Apple Pay, a booking service, or an online store being the easy go-to for Apple users.

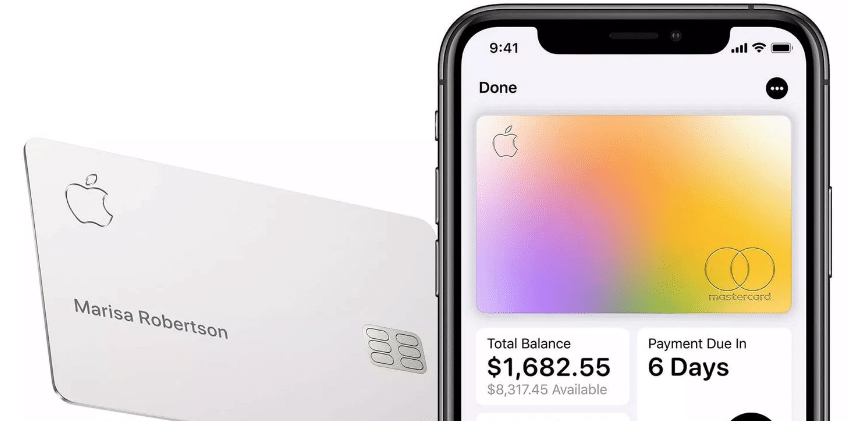

While Apple does have a credit card partnership with Goldman Sachs, it is not popular with most users. So, where exactly does Apple Pay draw your funds? This is where Apple Wallet makes its first impression.

When you think of Apple Wallet, just think of your physical wallet, but a digitalized, significantly safer version. You can store the same things you can store in your wallet in your Apple Wallet. Wallet, as it is more commonly called, can hold your business credentials, your government or student ID, event tickets, store cards, public transportation cards, coupons, resort and boarding passes, home and car keys, and, crucially, debit and credit cards for use on your Apple Pay.

Aside from the convenience of not having to walk around with a bulge in your pocket holding a wallet that barely holds enough, using the Apple Wallet also offers added safety. The iCloud encrypts your card data when it is accessed for payments online and in physical stores. It also keeps an encrypted copy on the Apple servers, so you’re sure your personal and financial information is safe, even during a brute-force hack.

Simply put, Apple Wallet is where you keep your cards and where Apple Pay accesses funds. This interconnectedness allows users to make payments faster and smoother than before and, crucially, safely. It is a testament to Apple’s insistence on a seamless customer experience and unwavering dedication to consumer protection.