A warning about Apple Pay scams has been issued by the Lincoln County Sheriff’s Office, cautioning iPhone users to remain vigilant against a growing wave of fraud targeting digital wallet services. The announcement underscores how scammers are exploiting the popularity of Apple Pay to trick people into authorizing fraudulent payments.

According to the Sheriff’s Office, scammers have been contacting individuals under the guise of banks, credit card companies, or even Apple itself. Victims are pressured to provide authentication codes, approve fake transactions, or click malicious links that mimic legitimate Apple Pay notifications. Once access is granted, funds can be stolen in minutes.

How the Scams Work

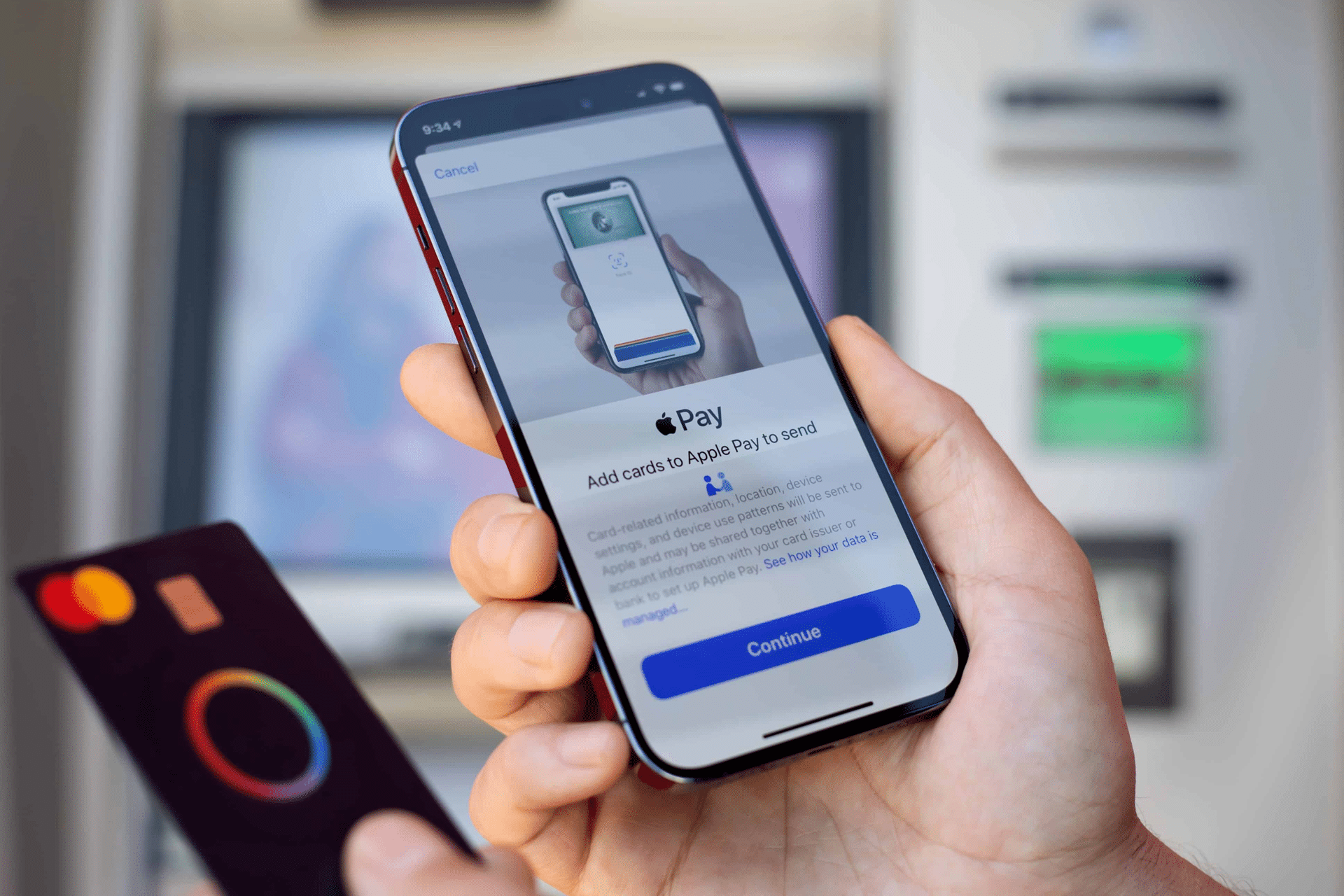

The fraudulent activity often begins with a phone call, text message, or email claiming to flag “suspicious activity” on an Apple Pay account. Users are then urged to confirm their identity or secure their account. In reality, they are handing sensitive information directly to the scammer.

Officials stress that Apple and banks will never ask for Apple Pay passcodes or two-factor authentication codes via text or phone call. If you receive such a request, it should be treated as a red flag.

Rising Digital Wallet Fraud

Digital wallets like Apple Pay and Google Wallet have become increasingly common for everyday purchases, but their growth has also drawn the attention of scammers. Law enforcement agencies nationwide have reported an uptick in fraud cases tied to mobile payments, with schemes evolving quickly as consumers adopt new technologies.

Sheriff’s Office Advice

The Lincoln County Sheriff’s Office recommends users take a few key precautions:

-

Never share Apple ID, passcodes, or verification codes with anyone.

-

Confirm suspicious activity directly with your bank or Apple through official channels.

-

Enable strong device passcodes and use Face ID or Touch ID to secure transactions.

-

Regularly review recent transactions for signs of unauthorized activity.

What to Do If You’re Targeted

If you suspect you’ve been targeted by an Apple Pay scam, officials urge you to immediately report the attempt to Apple and your financial institution. Victims of fraud should also file a report with local law enforcement to help track trends and prevent further crimes.

A Growing Concern

The Sheriff’s Office notes that scams are becoming more sophisticated, often designed to exploit the trust users place in official-looking texts and emails. Public awareness, they say, is the strongest line of defense.