The Q1 2025 figures, covering January through March, reflect a subscription boost tied to Severance’s return—a dystopian hit that’s become a flagship for Apple TV+. Yet, the 1% bump is more evolution than revolution. Amazon Prime Video and Netflix continue to dominate, holding 21% and 20% of the market, respectively, while Max and Disney+ trail at 13% and 12%. Hulu sits at 10%, with Apple TV+ now edging out Paramount+’s 7%. Smaller players like Peacock and Starz each hit 2%, rounding out the field.

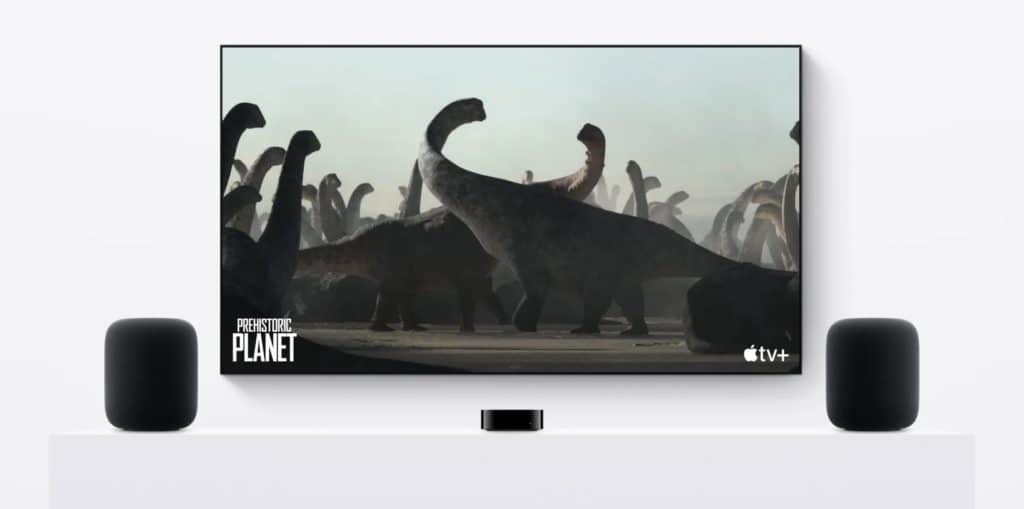

Apple’s uptick isn’t just about one show. The platform’s focus on prestige originals—think Ted Lasso or the Oscar-winning CODA—keeps it in the conversation, even if its library of 300+ titles pales next to competitors’ sprawling catalogs. Launched in 2019, Apple TV+ bets big on quality over quantity, a strategy that’s earned critical acclaim but hasn’t yet translated to massive market share. Still, 8% is a sign of traction, especially as the service reportedly nears 45 million global subscribers.

The Numbers Game

Behind the scenes, Apple TV+ remains a financial puzzle. A recent report pegs the platform as a $1 billion annual loss for Apple, despite hefty content investments—over $5 billion yearly, trimmed by $500 million in 2024. Compare that to traditional media giants, who’ve also bled billions building their streaming arms but are starting to see profits. Apple’s approach—curating a tight slate of originals rather than licensing older content—keeps its costs high and its reach narrower. Yet, the company seems unfazed, banking on long-term loyalty over short-term gains.

The Q1 boost suggests some payoff. Severance season two didn’t just draw viewers—it kept them, nudging subscriptions upward. But with Netflix and Amazon slugging it out for the top spots, Apple’s 8% feels more like a foothold than a leap. Peacock and Starz doubling their shares to 2% each also signal a crowded field where every percentage point matters.

Why It Matters

For users, Apple TV+’s growth means more reason to stick with—or try—the $6.99 monthly service (or snag it via an Apple One bundle). Its originals consistently punch above their weight, offering polished storytelling that rivals bigger platforms. The catch? A smaller library means less to binge, which might deter casual viewers hooked on Netflix’s endless scroll or Prime’s mix of old and new.

From a tech perspective, this is Apple flexing its ecosystem muscle. Bundling TV+ with hardware perks—like free trials for new device buyers—keeps it tied to the iPhone, iPad, and Mac universe. It’s not about overtaking Netflix overnight; it’s about embedding TV+ into daily life, one subscriber at a time. The 1% bump proves that strategy’s working, even if the pace is glacial.

What’s Next

Apple TV+ isn’t resting on its laurels. With new prestige series on the horizon—teased as “coming very soon” in the 9to5Mac report—the platform aims to keep the momentum rolling. Will it crack double digits in Q2? That might hinge on whether upcoming shows match Severance’s pull. For now, 8% is a solid base, a testament to Apple’s knack for carving out space in a cutthroat market without chasing every trend.

This isn’t a story of domination—it’s one of persistence. Apple TV+ may not lead the pack, but it’s proving it can hang with the big dogs, one carefully crafted season at a time.