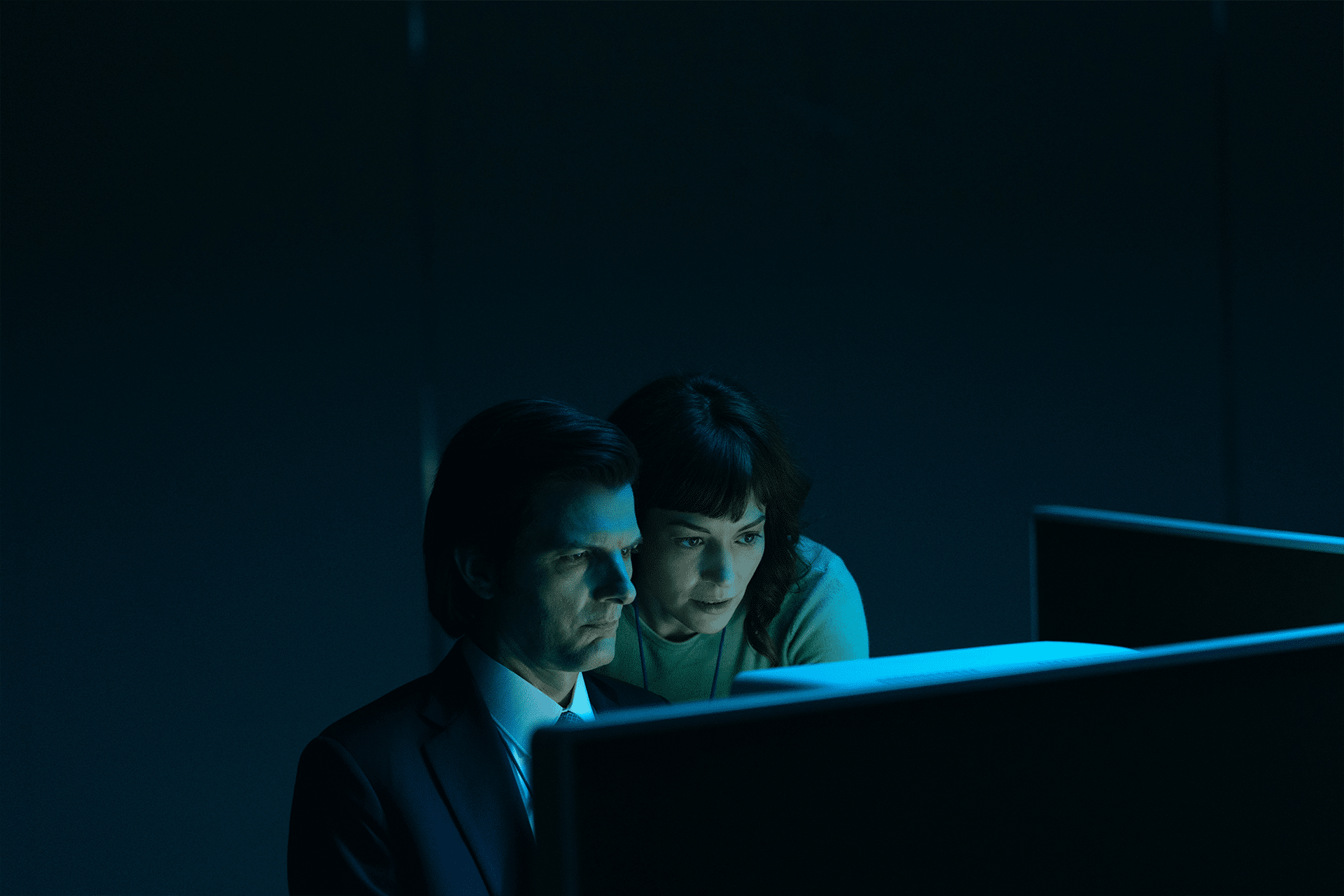

Apple has poured significant resources into its streaming venture, spending upwards of $5 billion per year on original programming at its peak. Hits like Ted Lasso, The Morning Show, and Severance have garnered critical acclaim and awards, but they come with hefty price tags. For instance, Severance reportedly cost $20 million per episode—a steep investment that reflects Apple’s aim to compete with heavyweights like Netflix, which plans to spend $18 billion on content in 2025. Even with a budget trim to about $4.5 billion last year, Apple TV+ remains a costly endeavor.

Yet, these losses align with Apple’s initial projections. The company anticipated spending between $15 billion and $20 billion over the first decade of Apple TV+ to establish its foothold in the streaming market. Unlike Netflix or Disney+, which prioritize subscriber volume (301 million and 124.6 million, respectively), Apple’s service sits at around 45 million subscribers—a modest figure that underscores its niche approach.

The Loss-Leader Strategy

Apple TV+ isn’t meant to stand alone as a profit center. It’s a cog in a much larger machine. Apple’s services division, which includes iCloud, Apple Music, and the App Store, raked in $96 billion in fiscal 2024, with gross margins exceeding 75%. Hardware, by contrast, offers margins closer to 40%. Within this portfolio, Apple TV+ serves a dual purpose: it enhances the appeal of Apple devices and keeps users locked into the ecosystem. The hope? A subscriber drawn in by Severance might stick around for an iPhone upgrade or an iCloud subscription.

This approach mirrors a classic loss-leader tactic—think printers sold cheaply to sell ink at a premium. Apple’s leadership, including SVP of Services Eddy Cue, initially shielded TV+ executives from intense budget scrutiny, betting on intangible benefits like brand prestige and customer loyalty. Shows like CODA, which won an Oscar for Best Picture, reinforce Apple’s reputation for quality, even if the financial returns lag.

Scrutiny Ramps Up

That said, the free rein may be tightening. Since 2022, CEO Tim Cook has reportedly taken a closer look at Apple TV+’s finances. Extravagances—like private jet travel for stars costing hundreds of thousands per flight—have come under fire, prompting negotiations for better deals with charter companies. This shift follows broader industry trends, with streaming giants like Netflix and Disney trimming budgets after years of unchecked spending. Apple’s response, however, remains measured; its deep pockets—$391 billion in 2024 revenue—mean it can absorb TV+ losses without breaking a sweat.

Still, the numbers tell a stark story. Apple TV+ accounts for just 0.2% of U.S. TV viewing, per Nielsen, dwarfed by Netflix’s 8% daily share. High-profile films like Killers of the Flower Moon have found streaming audiences, but others, such as Napoleon and Argylle, flopped at the box office. The service’s monthly viewership reportedly trails Netflix’s daily figures—a gap that highlights its struggle to scale.

Why It Matters to Users

For tech users, Apple TV+’s losses translate to a mixed bag. On one hand, the service delivers premium content that enhances the Apple experience—think seamless integration with your iPhone or Mac. A single episode of Severance might justify keeping that Apple One subscription active. On the other hand, if budget cuts deepen, the pace of new releases or the polish of productions could suffer. Shows like The Morning Show, with stars like Reese Witherspoon and Jennifer Aniston reportedly earning $2 million per episode in season four, underscore the high stakes.

The Bigger Picture

Apple’s not sweating the $1 billion annual hit—at least not yet. Compared to its trillion-dollar valuation, it’s a rounding error. The real test will come as the streaming wars evolve. If Apple TV+ can’t grow its subscriber base or boost viewership, the justification for these losses might wear thin. For now, though, it’s business as usual: spend big, lose big, and bet on the long game. As one industry observer put it, “Apple’s playing chess while others play checkers.” Whether that strategy pays off remains to be seen.