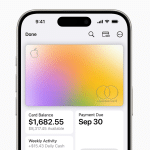

One of the standout features after 5 years of Apple Card is its Daily Cash program, offering instant cashback for every purchase. Unlike many rewards programs that require users to wait months to redeem points, Apple Card’s daily payout model aligns with consumer preferences for immediate benefits. Coupled with a clean and intuitive interface, users have clear insights into spending habits and financial goals.

Apple’s entry into the financial sector has pushed traditional credit card issuers to rethink their offerings. Features like zero fees, dynamic interest rate calculations, and simplified billing have raised the bar, forcing competitors to innovate and deliver more consumer-centric products.

Apple Card’s deep integration with the Wallet app and Apple Pay showcases how digital-first financial products can enhance convenience while prioritizing security. The 5 years of Apple Card reliance on digital payments has driven the adoption of mobile wallets and inspired other tech companies to explore financial services.

5 Years of Apple Card: Growth & Adoption

Despite initial skepticism, Apple Card has seen widespread adoption. Apple leveraged its loyal customer base to quickly scale the card’s reach. Today, it is a popular choice for iPhone users, particularly those who are already invested in Apple’s network and seek a seamless experience across devices.

The partnership between Apple and Goldman Sachs has been a key factor in the card’s growth. Goldman Sachs’ underwriting expertise combined with Apple’s technological prowess has resulted in a smooth user experience with a strong focus on financial wellness.

One of the primary criticisms of Apple Card is its limited accessibility. Only available in select markets, the card’s global reach remains restricted. Additionally, because the card is only accessible to iPhone users, it leaves out those who prefer other platforms.

While Apple Card aims to be consumer-friendly, there have been challenges regarding credit limits and approval processes. Some users have reported lower-than-expected credit limits, while others have faced difficulties during the application process due to Apple’s reliance on strict criteria for creditworthiness.

What’s Next for Apple Card?

As Apple continues to grow its financial services, expanding Apple Card into more regions remains a key priority. Increasing its availability across Europe and Asia would be a logical next step as Apple solidifies its presence in global markets.

Apple is likely to expand its financial services with new features, such as family sharing options, enhanced savings tools, and possibly even a subscription-based model for higher cashback rates. Additionally, as digital finance evolves, Apple might introduce more products like loans or investment tools.

We can expect even deeper integration between Apple Card and other Apple services, such as Health, Fitness, and Apple One. For instance, Apple could introduce rewards tied to health goals or exclusive perks for those subscribed to multiple Apple services.

The Broader Impact of Apple’s Financial Strategy

Apple’s foray into finance isn’t just about credit cards—it’s about reshaping how consumers interact with financial products. Apple’s emphasis on privacy, transparency, and ease of use sets a new standard that other financial institutions are beginning to adopt. With growing interest in digital wallets, contactless payments, and subscription-based financial tools, Apple Card is positioned at the center of this transformation.

One of Apple’s key advantages is its ability to leverage its network. The more users rely on their iPhones, Apple Watches, and other devices, the more likely they are to adopt Apple Card. This strategy not only drives adoption but also strengthens brand loyalty.

Five years in, Apple Card has made a significant impact on both the financial and tech industries. By focusing on simplicity, privacy, and transparency, Apple has built a product that resonates with its users while challenging traditional financial models. As Apple Card continues to evolve, it’s clear that Apple’s ambitions in the financial sector are only just beginning.